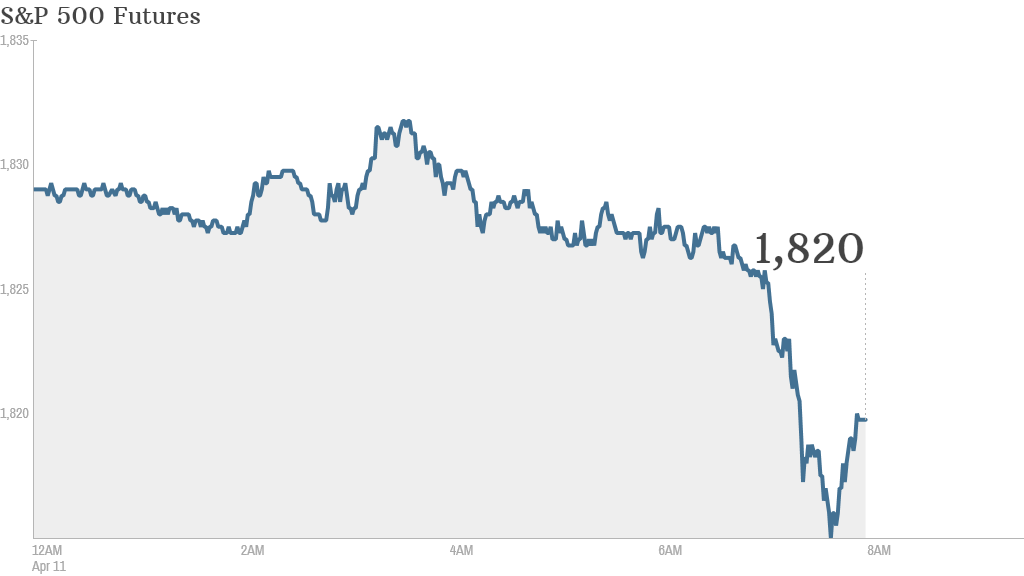

Markets could be in for another rough session Friday after disappointing earnings from JPMorgan.

U.S. stock futures dropped significantly after JPMorgan Chase (JPM) earnings missed forecasts. Investors didn't share the "growing confidence" that Chief Executive Officer Jamie Dimon talked about in his earnings statements.

The news was a bit rosier for Wells Fargo (WFC), which reported a double-digit gain for net profit in the first quarter. Shares role in premarket trading.

Earnings reports from big banks for the first quarter are dominating investor sentiment. Given yesterday's tech selloff, investor queasiness could easily spread into other corners of the market.

"With earnings season in the U.S. under way, tech company earnings will be under intense scrutiny with investors likely to dump their tech stocks on even the faintest sign of bad news out of a company," wrote Ishaq Siddiqi, market strategist for ETX Capital in London, in a report.

Related: Fear & Greed Index still gripped by fear

In economic news, the U.S. government will publish the monthly producer price index at 8:30 a.m. ET and the Michigan Consumer Sentiment Index will come out at 9:55 a.m. ET.

Shares of H&R Block (HRB) jumped in premarket trading after the company said it will sell its bank to Bofl Federal Bank. Shares of retailer GAP (GPS) slid when the company said sales fell in March.

Related: Tech stock rout continues in Asia

U.S. stocks took a beating Thursday. The Nasdaq took the hardest hit, closing down 3.1%. The Dow finished down 1.6%, and had its third biggest point loss of the year. The S&P 500 slid 2%.

A tech rout that started in the U.S. continued in Asia, with Tencent plunging 6.8%. Samsung fell, as did leading Japanese tech brands. The Nikkei index plunged 2.38%, taking its loss for the week to 7.3%.

European markets were also caught up in the fallout from Wall Street's slump. Germany's DAX led the way lower with a loss of about 2%.