Do not go gentle into that good weekend.

Even though it's Friday, there's still a lot going on, including big moves in currency markets.

Here are the five things you need to know before the opening bell rings in New York:

1. Euro takes a tumble: The European currency took a swift, sharp fall on Friday as the head of the European Central Bank -- Mario Draghi -- said the bank was ready to "do what we must to raise inflation as quickly as possible." The euro fell by about 0.5% versus the U.S. dollar before recovering a bit. It's down by about 5% over the past three months.

Investors are readying themselves for the ECB to print more money or make other policy moves to get inflation back up to about 2%.

Draghi's remarks come against a picture of weak growth and almost zero inflation in the eurozone.

European markets also dipped into the red in early trading but some key indexes have now bounced back.

Related: Why Europe will cut rates just as the Fed hikes

2. Attack on Radisson Blu hotel in Mali: Gunmen have taken 170 people hostage inside the Radisson Blu hotel in Bamako, the capital of the former French colony in west Africa. The hotel chain said two armed men have locked in 140 guests and 30 employees.

"Our safety and security teams, and our corporate team are in constant contact with the local authorities in order [to] offer any support possible to re-instate safety and security at the hotel. At this point we do not have further information and continue to closely monitor the situation," hotel operator Rezidor Hotel Group said in a statement.

3. Market movers -- Nike, Pfizer, ABN Amro: Shares in Nike (NKE) are surging by about 5% premarket after the company announced a range of investor-friendly moves. It's set to hike its dividend, buy back another $12 billion in shares and split its stock in a two-for-one move.

Shares in pharma giant Pfizer (PFE) are also inching up by about 1% premarket after the U.S. Treasury announced new measures that could deter the company from pursuing a massive takeover deal with Irish-based Allergan (AGN). Treasury has been vocal about its opposition to U.S. companies that pursue foreign takeovers to avoid U.S. taxes.

Shares in the Dutch bank ABN Amro are rising slightly after the company returned to public markets Friday after seven years of state ownership.

"Much water has flow[ed] under the bridge since the mayhem of 2008 and 2009, and it is a strong financial institution returning to public markets," said Peter Garnry, head of equity strategy at Saxo Bank. "We see a lot of value in ABN Amro."

4. Earnings: Retail chains Foot Locker (FL) and Abercrombie & Fitch (ANF) are among a small group of companies reporting ahead of the open.

There are no companies reporting later in the day.

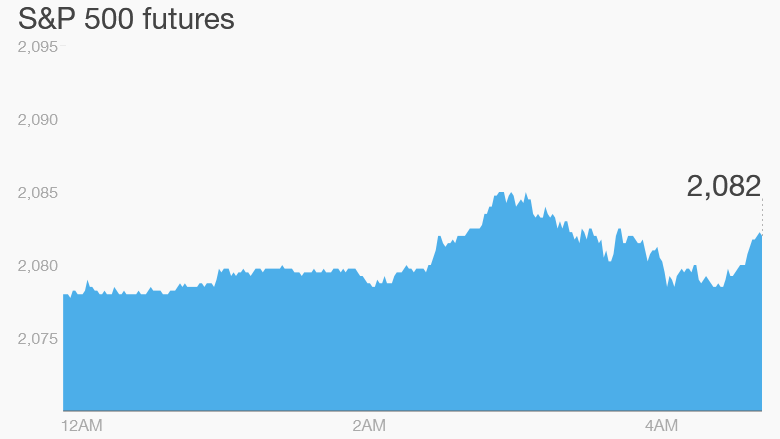

5. U.S. market overview: U.S. stock futures are holding around the levels where they closed on Thursday.

Over the previous trading sessions, stock markets were pretty quiet. The Dow Jones industrial average and the Nasdaq stayed even, while the S&P 500 dipped 0.1%.