Hold onto your hat!

Global stock markets are making some wild swings Tuesday as oil prices gyrate.

Here are the five things you need to know before the opening bell rings in New York:

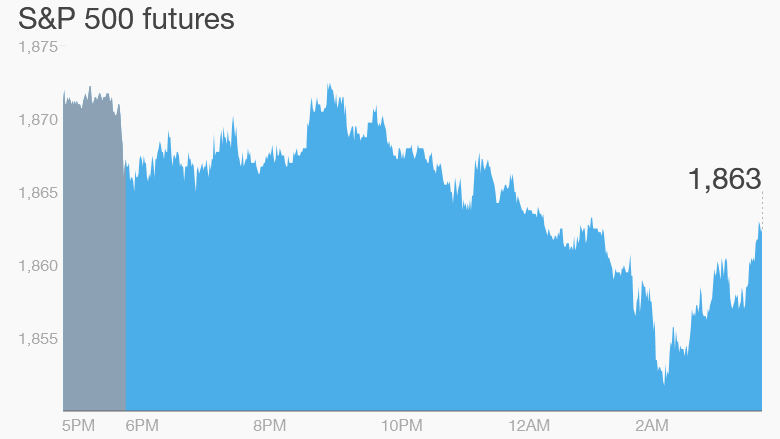

1. Tricky Tuesday: U.S. stock futures are stabilizing after being deep in the red earlier this morning.

Global markets had been in sell-off mode earlier, with negative sentiment taking hold as concerns rose about the falling price of oil.

After crude oil futures had fallen dramatically earlier in the month, prices are stabilizing around $30.50 per barrel. That has calmed investors' nerves.

European markets are now mixed in afternoon trading.

But Chinese stocks took a big hit. The main Shanghai Composite index dropped 6.4% and the Shenzhen index plunged 7.1%.

Related: Why China is pumping huge sums into its financial system

Simon Smith, chief economist at FxPro in London, said the downward spiral may have further to run.

"Volatility has been rising throughout the year so far, but we're still some way off the big spike in the Vix -- the volatility index or 'fear gauge' -- last August and so there's potential for moves in markets to get even more dramatic," he said.

2. Earnings: Many U.S. companies are releasing quarterly earnings this morning.

Johnson & Johnson (JNJ), Procter & Gamble (PG), Lockheed Martin (LMT), Sprint (S), 3M (MMM) and Coach (COH) are among the firms due to report before the bell.

After the close, Wall Street will hear from Apple (AAPL), AT&T (T) and Capital One (COF).

Wall Street analysts expect Apple will report an astounding $18.2 billion in profit in the past quarter. That would be a record, not just for Apple, but for any U.S. company -- ever. But the market will also be paying close attention to iPhone sales.

Related: Why Apple is giving investors a heart attack

3. Economics: There are some important economic reports coming out Tuesday.

The Case-Shiller home price index will come out at 9 a.m. ET, giving investors insight into the current state of the U.S. housing market.

Then the U.S. Conference Board will issue its January Consumer Confidence Index at 10 a.m.

4. Stock market mover -- Siemens: Shares in German industrial conglomerate Siemens (SIEGY) are rising by an impressive 7.5% in Europe as investors cheer the company's latest quarterly results.

5. Monday market recap: It seems like Wall Street woke up on the wrong side of the bed on Monday. The Dow Jones industrial average dropped 1.3% and the S&P 500 and Nasdaq shed 1.6%.