It's back-to-school time in the U.S. and Canada.

And back to the desk for traders after the Labor Day holiday.

Here are the five things you need to know before the opening bell rings in New York:

1. Takeover talk: Shares in Monsanto (MON) are set to surge at the open after Germany's Bayer (BAYRY) sweetened its bid to buy the world's largest seed seller.

Bayer said it is now willing to pay $127.50 per Monsanto share, about $20 above Friday's closing price. That values the offer at $55.8 billion. Including Monsanto's debt, the deal would be worth $65 billion.

Monsanto said it is considering the offer "as well as proposals from other parties and other strategic alternatives."

Meanwhile, Softbank (SFTBY) has completed its $32.5 billion purchase of ARM Holdings (ARMH), a British company that designs the chips used in cellphones and electronic gadgets around the world.

The heads of both firms issued a statement Tuesday saying: "It is business as usual -- only better."

2. Tech turbulence: British Airways is getting back to normal after struggling for hours with a major computer system failure that affected passengers at multiple airports, including some in the U.S.

In a statement Tuesday, it said: "We are checking in customers as normal at Heathrow and Gatwick this morning."

Shares in British Airways' parent company International Consolidated Airlines (ICAGY) are cruising along and showing no signs of trouble. They're up slightly since the start of trading.

3. Global market overview -- Oil and stocks: Oil prices remain in focus after some major volatility on Monday.

Traders got excited after Saudi Arabia and Russia signed an agreement aimed at stabilizing the oil market.

Oil prices gained 3% early Monday but a lack of detail in the announcement saw the rally fade later in the day.

Crude oil futures are now trading around $45 per barrel, up about 1.3% over the past few hours.

"Although there have been talks that the cooperation marks a 'new era' which would have a 'critical significance,' it still does not change the current [oil] oversupply woes," noted research analyst Lukman Otunuga from FXTM.

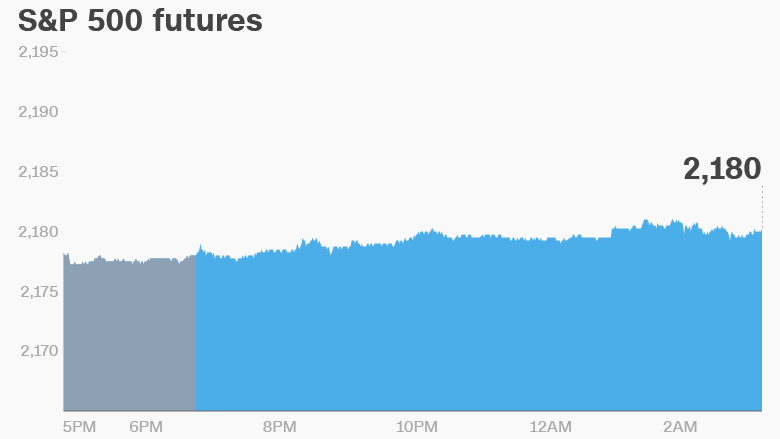

Moving to the stock market, U.S. futures are relatively steady. European markets are little changed in early trading.

Asian stock markets mostly closed the day with positive results.

4. Earnings: It's a relatively light day for earnings. Semiconductor firm Marvell (MRVL) will report quarterly results ahead of the open. Dave & Buster's (PLAY) and Casey's General Store (CASY) will report after the close.

5. Friday market recap: U.S. stock markets were relatively perky ahead of the Labor Day weekend. The Dow Jones industrial average, S&P 500 and Nasdaq each gained 0.4% on Friday.