1. Inauguration day: Donald Trump is set to be sworn in as the 45th president of the United States on Friday. Trump will take the oath of office around noon.

Since his election, he has shown an uncanny ability to move markets. Investors have pushed U.S. and global stock markets higher in response to his pro-business rhetoric.

The Dow Jones industrial average has surged 7.6% since the election and even traded near 20,000 points before easing back down. The S&P 500 jumped 5.8% while the Nasdaq added 6.7% over the same period.

But the Republican has also introduced a heavy dose of uncertainty to markets. Trump has made a habit of targeting and calling out specific companies on Twitter.

He's criticized Boeing (BA), Lockheed Martin (LMT), United Technologies (UTX), GM (GM) and Ford (F) -- as well as foreign car companies Toyota (TM) and BMW (BMWYY). He has also threatened tariffs on companies building their products in Mexico instead of the U.S. and slammed China's trade policies.

Related: Watch the inauguration of Donald Trump

2. Global market overview: U.S. stock markets hit record highs earlier this year and they're not far from those levels right now.

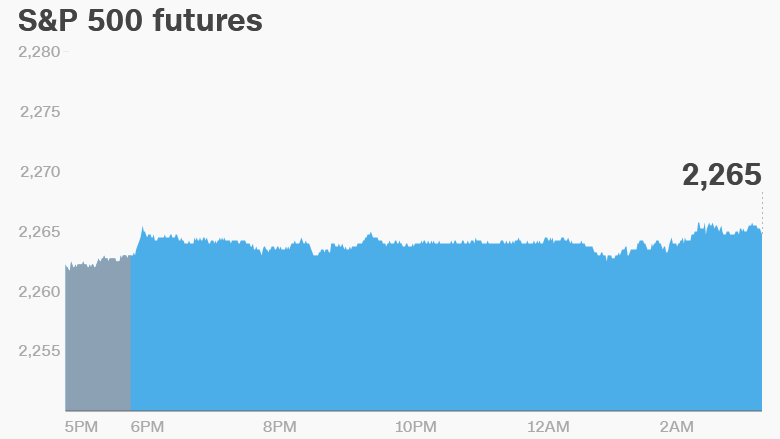

But U.S. stock futures suggest investors want more detail from Trump before they're ready to push shares even higher. The major indexes are holding steady right now.

"Investors [will be] hoping that his speech comprehensively outlines his policy plans for the next four years in a scripted rather than lively off-the-cuff affair," said Mike van Dulken, a market analyst at Accendo Markets.

European markets are mostly edging up in early trading, though the gains are modest.

Asian markets ended the day with mixed results.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

3. Earnings: A number of blue-chip companies are reporting quarterly results this morning, including General Electric (GE) and Procter & Gamble (PG).

4. Drug wars -- Bristol-Myers Squibb vs Merck: Shares in Bristol-Myers Squibb (BMY) are falling by about 5% premarket after the firm announced it wouldn't pursue "an accelerated regulatory pathway" for a lung cancer treatment it had been developing.

This has helped shares in competitor Merck (MRK) pop by about 5% premarket. The company announced earlier this month that the U.S. Food and Drug Administration had begun reviewing a license for its lung cancer treatment, Keytruda. It's going through the fast track approval process.

Download CNN MoneyStream for up-to-the-minute market data and news

5. Coming this week:

Friday - Inauguration day for President-elect Donald Trump