1. Fed focus: Economists and investors are gearing up for the U.S. Federal Reserve.

The central bank will announce its latest interest rate decision at 2 p.m. ET, followed by a press conference at 2:30 p.m.

Wall Street expects Fed chair Janet Yellen to outline plans for the vast stock of Treasuries and other securities purchased by the central bank since the global financial crisis.

2. Deadly quake: Investors will be tracking markets in Mexico following a massive earthquake that killed over 200 people.

The Mexican peso is holding steady following the 7.1-magnitude quake.

3. Market movers: Shares in Adobe Systems (ADBE) and Bed Bath & Beyond (BBBY) are set to drop at the open after the companies reported disappointing results.

Talk of a merger between Sprint (S) and T-Mobile (TMUS) has investors calling their brokers. Shares in the companies boomed on Tuesday following reports that they are in active talks, and the upward momentum could continue on Wednesday.

SoftBank -- which has a controlling interest in Sprint -- has made no secret of its plans for the wireless carrier. SoftBank CEO Masayoshi Son, an ambitious deal-maker, said in May that the "door is open" for potential deals involving Sprint.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Gun shares shoot up: Gun stocks could be on the move following a news report that said President Trump plans to ease firearm export regulations.

Shares in Sturm Ruger (RGR) rose by 13.7% on Tuesday. American Outdoor Brands (AOBC), previously Smith & Wesson, also saw a jump of more than 10%.

Reuters reported that the Trump administration is planning to shift oversight of non-military firearms sales in a way that would make it easier for U.S. gun makers to sell small arms, including assault rifles and ammunition, overseas.

5. Big steel deal: Europe is set to get a new steel giant after two of the industry's biggest players agreed to team up.

Germany's Thyssenkrupp (TKAMY) and India's Tata Steel announced plans to merge their European operations on Wednesday to create a new force in an industry that is under intense pressure from cheap Chinese exports.

The companies said their planned joint venture will be Europe's second-largest steel producer with annual revenues of almost $18 billion. It will be headquartered in Amsterdam with more than 40,000 employees. Some 4,000 jobs are expected to be cut.

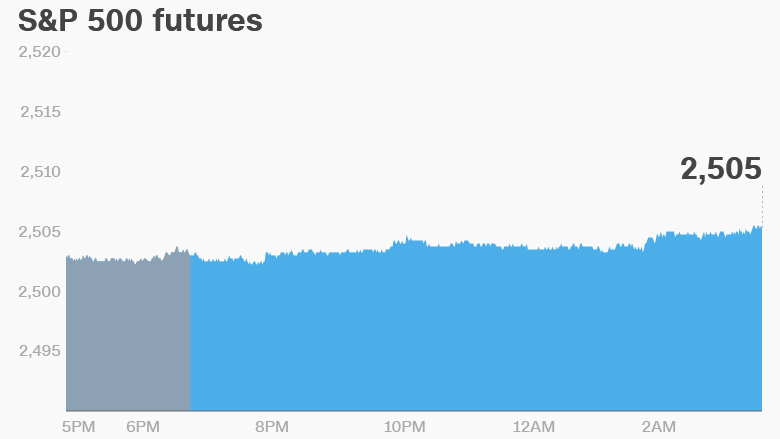

6. Stock market overview: U.S. stock futures are stuck in neutral after all three key indexes hit new records on Tuesday.

European market moves were muted in early trading. Asian markets ended the day with mixed results.

Download CNN MoneyStream for up-to-the-minute market data and news

7. Coming this week:

Wednesday -- General Mills (GIS) earnings; Federal Reserve interest rate decision and press conference

Thursday -- Manchester United (MANU) earnings

Friday -- OPEC and non-OPEC oil ministers meet in Vienna