1. Saudi arrests rattle markets: Saudi billionaire Prince Alwaleed bin Talal has been arrested as part of an anti-corruption sweep in the kingdom.

The businessman is one of at least 17 Saudi princes and top officials that have been detained, according to a list obtained by CNN and cited by a senior royal court official.

Alwaleed owns stakes in companies including Apple (AAPL), Twitter (TWTR) and Citigroup (C).

Saudi Arabia's All-Share index dropped by about 1.5% on Monday.

Crude oil spiked to $56 per barrel -- the highest level in over two years -- as investors worried about increased political uncertainty in Saudi. But the international impact may be limited.

"There is little cause for international markets to react," said Paul Donovan, global chief economist at UBS Wealth Management. "The moves would be relevant only if they were seen as creating instability and threatening the oil price (unlikely) or if they were seen as prompting capital flight from Saudi (possible, but unlikely)."

2. Gun stocks: Shares in gun makers Sturm Ruger (RGR) and American Outdoor Brands (AOBC), the company formerly known as Smith & Wesson, will be closely watched on Monday following a shooting at a church in Sutherland Springs, Texas. At least 26 people were killed.

In the past, U.S. consumers who worried about stricter gun control measures purchased more guns in the wake of mass shootings.

3. Trump's tax bill goes under the microscope: The U.S. House Ways and Means Committee will begin its markup of the GOP tax plan on Monday.

As it stands now, the Tax Cuts and Jobs Act would permanently lower the corporate tax rate to 20%, increase the standard deduction for individuals and households and eventually repeal the estate tax.

President Trump promised that a tax reform bill would be completed by Christmas.

Before the Bell newsletter: Key market news. In your inbox. Subscribe now!

4. Takeover talk -- Qualcomm, Broadcom, Sprint, T-Mobile, Cathay Pacific: Broadcom (AVGO), a semiconductor device supplier, has announced a $130 billion offer to takeover Qualcomm (QCOM).

Broadcom intends to finance the takeover with cash and stock, paying $70 per share. It announced plans last week to switch its legal headquarters back to the United States from Singapore.

Sprint (S) and T-Mobile (TMUS) have abandoned discussions about a potential merger after weeks of speculation. Japan's SoftBank (SFTBF) -- which already has an 83% stake in Sprint -- said Monday that it will buy more of the stock following the collapse.

Shares in Cathay Pacific (CPCAY) dipped in Hong Kong after Qatar Airways announced a deal to buy about 9.6% of the airline. Air China already holds a 30% stake in Cathay.

5. Earnings: CVS Health (CVS), Michael Kors (KORS) and Booz Allen Hamilton (BAH) are set to release earnings before the open.

AMC Entertainment (AMC), Etsy (ETSY), GoDaddy (GDDY), Red Robin Gourmet (RRGB), TripAdvisor (TRIP), Priceline (PCLN) and Weight Watchers (WTW) will follow after the close.

CVS executives could be grilled based on reports that the firm is considering buying Aetna (AET).

Etsy shareholders will want to hear how the company plans to fend off competition from Amazon (AMZN), which recently said it would add a handcrafted gift section to its site.

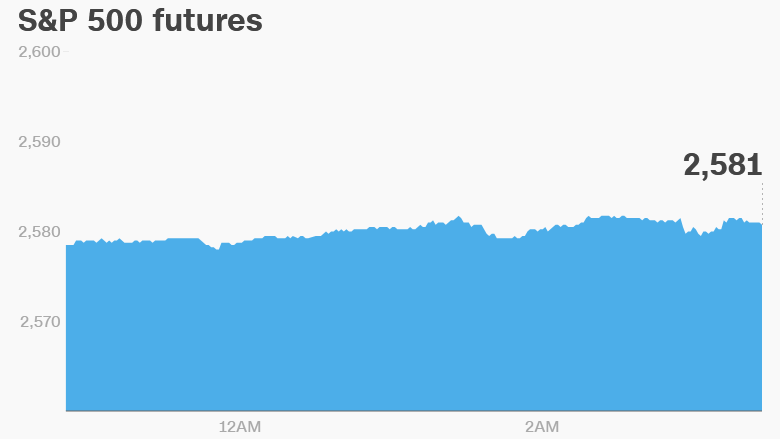

6. Global market overview: U.S. stock futures were in negative territory.

Most European markets dipped in early trading, while Asian markets ended the day mixed.

Download CNN MoneyStream for up-to-the-minute market data and news

7. Coming this week:

Monday -- Ways and Means Committee begins markup of tax bill; CVS (CVS), Etsy (ETSY) and Weight Watchers (WTW) report earnings

Tuesday -- Snap (SNAP) earnings;

Wednesday -- First anniversary of the 2016 presidential election

Thursday -- Nordstrom (JWN), Macy's (M), Disney (DIS) and News Corp (NWS) earnings

Friday -- Consumer confidence survey released