|

Going broke at a record

|

|

March 19, 1997: 9:23 a.m. ET

Total bankruptcy filings in the U.S. hit the 1 million mark for first time

From Correspondent John Defterios

|

NEW YORK (CNNfn) - The United States reported that total bankruptcies for the nation rose 27 percent in 1996, topping the 1 million mark for the first time ever in a calendar year.

Only 4.5 percent of those were business related. The rest were filed by individuals.

While there may be temptation to try to unload debt by filing for bankruptcy, experts caution it should always be taken as a last resort.

The costs can be emotional as well as financial, Karen Gross, a bankruptcy professor at New York Law School explained. "It's stressful. It's embarrassing."

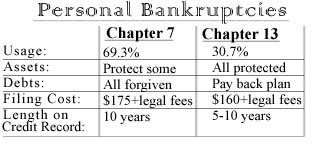

There are two types of personal bankruptcies: Chapter 7 and Chapter 13.

About 70 percent of filers choose Chapter 7 in which a court-appointed trustee determines what assets can be protected and sells what's left to partially repay creditors. The rest of the debts are wiped out.

Under Chapter 13, the person who files pays off the debts by following a three to five year payment plan while their assets are protected.

Chapter 7 costs $175 to file, while Chapter 13 costs $160. Most people hire bankruptcy lawyers, who may charge between $300 and $1,000 up front.

Chapter 7 is usually more damaging to the person's credit record. Either way, bankruptcy sticks with the filer for up to 10 years.

Gross said that bankruptcy may not only deny a person future credit, but other things as well. (143K WAV) or (143K AIFF)

Despite a healthy economy, personal bankruptcies have skyrocketed and are pursued by people from all economic brackets.

The most common reason is an unexpected drop of income triggered by a layoff or divorce. Other issues cited for the rise include greater awareness of bankruptcy as an option and easy access to credit cards.

The courts play a part, too, since they approve more than 90 percent of bankruptcy applications.

"We feel that the bankruptcy system is fundamentally flawed," said Thomas Layman, chief economist at credit card issuer Visa USA. "We have found that many people are declaring bankruptcy that really don't deserve to be able to get bankruptcy protection."

Alternatives are available, including negotiating directly with creditors or working with groups such as the Consumer Credit Counseling Service, a non-profit organization that charges a minimal fee to set up debt repayment plans.

|

|

|

|

|

|

|