|

Real estate posts rebound

|

|

March 31, 1997: 10:42 a.m. ET

Commercial market's plummet seems distant as vacancy rates drop

From Correspondent Bill Tucker

|

NEW YORK (CNNfn) - Construction is growing, rents are rising and tenants are happy.

The commercial real estate market is back, and the early 1990s, when the bottom fell out of the market, are a distant memory. Particularly after real estate investment trusts yielded a return of 35.75 percent last year.

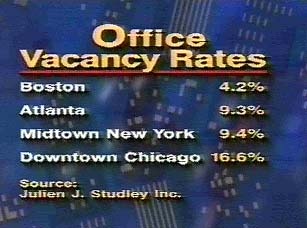

In the past 12 months, vacancy rates have fallen in most major cities. In Boston, the office vacancy rate is down to 4 percent, while markets in Atlanta, New York and Chicago are showing strong improvement.

Atlanta is building 3.5 million square feet of office space under construction -- which is about one-quarter of all new office space under construction in the whole country.

"I think that a boom in economy goes with a boom in real estate both in an investment perspective as well as new construction [and] new activity," said Michael Etling, managing director of Cushman & Wakefield.

People want new buildings that fit their needs, "and I think Atlanta is just one indication of how things are going across the country," Etling said.

A tighter real estate market generally means higher rents, and the types of deals tenants have wrangled out of landlords are not as sweet as those five years ago.

But real estate specialists accept the tradeoff, calling today's market more balanced.

"We're in a healthy climate right now, somewhat akin to inflation," said Richard Schlesinger, managing partner of Schlesinger & Co. "It's moderate, and I think that's particularly healthy." (419K WAV or 419K AIF)

Moderate or not, the flip side of a tighter real estate market might be the prospect of higher inflation -- and thus more reason to believe the Fed will raise interest rates even more in the future.

There's one notable exception about the general trend in commercial real estate: Los Angeles.

"There was a tremendous amount of development downtown, and the appeal downtown wasn't totally there," said Julien Studley, chief executive officer of Studley Inc. "The appeal was more in Burbank, where the entertainment area is."

But analysts say it's only a matter of time before the rents in the region rise -- giving businesses a new reason to discover downtown Los Angeles.

|

|

|

|

|

|

|