|

A fund for the Millennium

|

|

February 24, 1998: 3:49 p.m. ET

The Year 2000 bug may cost billions, but can you make money off of it?

|

NEW YORK (CNNfn) - Doomsayers warn that the Year 2000 computer bug could shake international markets, trigger a global recession and cost $600 billion to fix worldwide.

So, you probably want to know if you can make a buck off of it.

Emerald Advisers Inc. of Lancaster, Pa. thinks it has an answer: a mutual fund that invests in companies that may profit from the so-called "Y2K" bug.

"We felt this problem was so momentous it deserved specialization," said Ken Mertz, president of Emerald Advisers. "This whole problem has life after the year 2000. All of the problems won't be solved once the Millennium comes."

The "problem" is that some computer developers in the 1960s didn't plan ahead for the Millennium. They left only two digits for the date, so computers left unfixed will blink "00" and assume it's 1900, rather than 2000. That could throw off bank records, inventories and factory assembly lines, among countless other computerized systems across the planet.

And it won't be cheap to fix, analysts warn. A typical small U.S. company will spend an average of $10 million, while a Blue Chip could spend $250 million, said Lou Marcoccio, Year 2000 Research Director at the Gartner Group, an information technology consultant based in Stamford, Conn.

Globally, Gartner has estimated the repair cost at $200 billion to $600 billion.

"I don't believe in the 'gloom and doom' we're hearing that planes will fall out of the sky," Marcoccio said. "But there's going to be a significant impact."

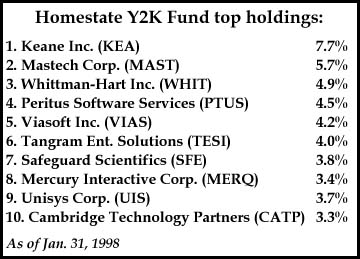

Emerald's HomeState Y2K Fund, the first of its kind, invests 65 percent of its assets in companies that are developing technologies the address the Year 2000 bug. To sweeten the pot, it will short-sell overvalued Y2K firms and companies that will suffer from the problem.

The fund has risen 14.2 percent since Oct. 31, compared with 12.6 percent for the S&P 500. With $4.5 million in assets, it's a tiny blip in the mutual fund universe.

Emerald offers two other funds, the HomeState Pennsylvania Growth Fund (HSPGX), and the HomeState Select Opportunities Fund (HSSAX).

The Pennsylvania Growth Fund received a four-star rating from Morningstar Inc., a mutual fund tracker in Chicago, for its five-year performance. Emerald introduced the Select Opportunities Fund in February 1997. Since its inception that fund is up 37.4 percent.

Joe Besecker, founder of Emerald, said he's identified nearly 100 companies that will drive some or all of their business from the Millennium bug. More companies may be forming Y2K divisions, he said.

But not everyone on Wall Street is sold on the idea of a Y2K fund. The financial community is rife with doubters who think a Millennium fund is too limited and trendy to make money.

"It's the flavor of the month," said Russ Kinnel, head of equity fund research at Morningstar. "It's an overly narrow, gimmicky thing."

Robert Natale, chief investment officer at Standard & Poor's in New York, said Emerald tends to choose smaller, more volatile companies, making it a risky investment.

"It's very aggressive," Natale said. "The fund has done better than the market, but at what risk?"

Besecker acknowledges the fund isn't for investors who love safety. But he thinks the fund will survive past 2000 because companies working on the bug will generate other business.

For example, Keane Inc., the fund's top holding, added about 2,000 new employees in 1997. Keane, a Boston-based information technology services firm, has booked $500 million in Y2K business from 263 clients. Of those 263 clients, more than half are new customers.

In the fourth quarter of 1997, for every $1 Keane earned for year 2000 business, it took in $1.74 for unrelated services.

Gartner Group's Marcoccio thinks the Y2K Fund did a "pretty good job" of picking companies. But some of those companies are software vendors who will suffer a different setback as 2000 approaches: while their clients are fixing the Y2K bug, they won't be buying new software.

"Some of them (Y2K Fund companies) will do well, some won't…but none will be big losers," Marcoccio said. He declined to comment on specific companies in the fund's portfolio.

Some Wall Street analysts said that investors who want to capitalize on the Year 2000 bug would be better off buying one or two technology stocks instead of a fund.

Bob Finch, an investment manager at Aeltus Investments in Hartford, Conn., recommended Compuware (CPWR) as a good alternative.

"A year 2000 fund could be over in a couple of years," Finch said. He asked: "What happens in 2005?"

Morningstar's Kinnel said many of the fund's holdings have already seen good runs.

"If you came up with the idea years ago, it would have been clever, but at this point, I don't know if there's much left to be earned," Kinnel said.

But Besecker is used to naysayers.

Money Magazine, for example, cited the Y2K Fund as the second worst "original idea" for a mutual fund in its December 1997 issue. (The Pauze Tombstone Index Fund, which invests in the death industry, was No. 1 on the list).

"I used to think it was a lot of hooey," Besecker said about the Y2K Fund. "Then I became informed."

-- By staff writer Martine Costello

|

|

|

|

|

|

|