|

How to protect your assets

|

|

February 27, 1998: 6:37 p.m. ET

No method is risk-free, but there are several ways to keep creditors at bay

|

NEW YORK (CNNfn) - In a world where plaintiffs, creditors and ex-spouses are lurking like sharks waiting to gobble up your assets, here's a cruel truth: there's no way to stop them.

But there are ways to protect your assets before a court judgment empties your bank account, lawyers and financial advisers say.

"The effectiveness of any asset protection plan is how many obstacles you put in your creditors' way," said Gideon Rothschild, a partner in the Trusts and Estates Department at Moses & Singer in New York.

Who is after your house and your stock portfolio? If you're a professional, like a doctor or a lawyer, you're vulnerable to malpractice lawsuits.

If you default on a loan or rack up giant credit card debt, the bank can sue you and seize any assets it can find to satisfy a court judgment.

And an angry ex-spouse may be salivating over your financial condition.

The problem is, once you're in the hot seat for money, it's too late to protect your assets. You have to plan ahead before even the hint of a problem or else you could face fraud charges.

And all of the options have disadvantages, experts said.

"There is no risk-free way to keep your assets away from creditors or else everyone would do it," said Eric Nelson, a lawyer in New York who represents individuals and small businesses. "Everything is a tradeoff."

Harry Scheyer, a Certified Financial Planner and president of Practitioners' Financial Advisors Inc. in New York, said the "first line of defense" is good insurance coverage.

Lawyers and doctors should have enough malpractice insurance to satisfy the steepest judgment. A person should have an umbrella insurance policy in addition to home and auto insurance. Depending on the terms, an umbrella policy will cover you in case you're sued.

"Insurance is so critical," Scheyer said. "Try to get as much as your net worth."

You can also transfer your house into your spouse's or a child's name -- but then you surrender control of the asset, said Avery Neumark, a lawyer and Certified Public Accountant at Rosen Seymour Shaps Martin & Co. in New York.

"The unfortunate thing is most people transfer assets too late," Neumark said. If a lawsuit has been filed against you, or you know it's coming, a judge could reverse the transfer.

There are other options for people who don't mind the extra cost or effort. Rothschild calls one option, a family limited partnership, a "bullet proof vest." Another method, an offshore irrevocable trust, is the "armored tank" of asset protection, he said.

If the husband has a big credit card debt, creditors can't go after assets in the partnership, he said. But the partnership must have a designated "business purpose," such as for tax or estate-planning needs. If not, a judge could rule the partnership was intended only to hide assets from creditors.

An irrevocable offshore trust is a safer alternative, Rothschild said. Bermuda, the Cayman Islands and Nevis are among a group of international jurisdictions that allow you to set up an irrevocable trust where you can name yourself the beneficiary. (With the exception of Alaska and Delaware, you can't make yourself the beneficiary in a trust in the United States).

You designate a trustee in one of the jurisdictions to set up the trust -- and you can make yourself a "trust protector" with veto power over the trustee's decisions. Most people prefer setting up trusts with more established banks in Switzerland or Luxembourg, he said.

You can put cash, stock or a home in the trust, Rothschild said. You'll have to report the asset on your federal income tax statement, but creditors are less likely to come after you, he said.

Not all of the jurisdictions have the same rules, however. In the Cayman Islands, for example, a creditor has six years to contest a trust. Rothschild said the Cook Islands have the most favorable laws.

Only six jurisdictions, including the Cook Islands, don't recognize foreign judgments, Rothschild said.

It will cost you about $20,000 to set up an offshore irrevocable trust and about $2,000 a year to maintain, Rothschild said.

Another option is to set up a limited liability company in the United States in which the offshore trust owns 99 percent and you own 1 percent. If you ever have a creditor problem, the trust can liquidate the partnership and hang onto most of company's assets.

"You aren't transferring assets after a problem developed: you're just changing the character of what the trust owns," Rothschild said.

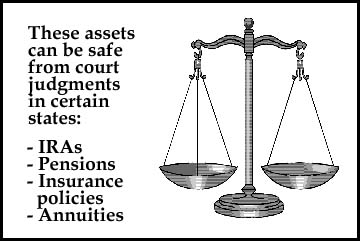

Lastly, don't think that your assets are history once the wolves are at your door.

Bankruptcy may actually help you keep some possessions. For example, Florida allows people to hang onto homes after filing for bankruptcy, Rothschild said.

Nelson said the best way to hang onto assets in bankruptcy is to file for Chapter 13 protection. Only people with regular income can file under this provision. It allows them to keep property while paying a certain amount to creditors each month through a trustee.

"There is no way to protect assets legally in the face of a judgment, other than paying the judgment or filing for bankruptcy," said John Cairns, a banking expert and a partner at Wilkie Farr & Gallagher in New York.

-- by staff writer Martine Costello

|

|

|

|

|

|

|