|

45 and nothing to show?

|

|

May 18, 1998: 4:39 p.m. ET

Even if you haven't started saving for retirement yet, it's not too late

|

NEW YORK (CNNfn) - The bad news is you're 45 and you haven't saved anything for retirement. The worse news is your life span is increasing.

While these two factors could contribute to headaches, nausea and the occasional bout of night sweats, it's not unusual to be above the age of 40 and have little or no savings for retirement.

Fortunately, you can do something about it.

Even at age 45, you probably have at least 20 years before you retire. And judging by the market's performance over the past 20 years, you still have plenty of money-making opportunities.

Before jumping into the market, determine how much you'll need for retirement. The common amount is roughly 70 percent of your current income.

Factor in expected mortgage and life-insurance costs, if you haven't yet paid those off (although most people will have done so by retirement age). And allow for the increased health-care costs you'll probably incur as you grow older.

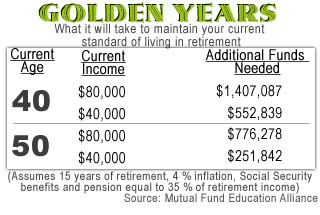

As a benchmark, the average 40 year old who makes $80,000 annually will need an estimated $1,407,087 over and above Social Security and pensions to maintain her standard of living. At age 50, she would need $776,278.

The difference in those figures is the result of increased costs of living. A 50-year old will retire in just 15 years, and the cost of living in 2013 will be much lower than in 2023, when the 40 year old will reach retirement.

Assuming a 10 percent annual return, if you start investing for your retirement at age 45, you'll have to set aside $138 per month for each $100,000 you hope to have after you retire. If you're 55, you'll need to set aside $496 per month.

After you've computed what you'll need, take a look at the money you've already got.

Whether or not you believe Social Security will still be around when you retire, it's worth your time to check what your benefits might be. Request a personal earnings and benefit statement from the Social Security Administration. (Call 1-800-772-1213 and ask for form SSA 7004.)

Also, check the balances on any retirement plans you may have contributed to at your workplace, such as a 401(k). If you're not participating in one yet, it's the best place to start on your retirement planning, especially since many employers will match 50 percent or more of what you contribute.

"You wouldn't want to pass up anything in terms of a company match," said Mark Maselli, retirement planner at Kwash Lipton. "That will beat the return on anything else in the market."

After completing your financial inventory, it's time to take action on your future. And the last person you want to trust, in many ways, is yourself, said Steven Neamtz, executive vice president at SunAmerica Asset Management Corp.

"You'll need to get money taken out of your paycheck systematically before you have an opportunity to do what you've been doing, which is using it for things that don't have anything to do with retirement," he said.

Most retirement planners suggest putting your money in stocks. If you're wary of high risk in the market, you can invest in more conservative value stocks, which are stocks believed to be undervalued but likely to grow.

Maselli suggests spreading your allocations across a wide variety of stock types.

"You want to be diversified with large-cap stocks, like the ones on the New York Stock Exchange, small caps and even foreign stocks," said Maselli. "When one type is down, the others could be up."

Fixed-income and money-market mutual funds may be better for people with a more temperate stock personality. The security those offer can cost you, though. Experts caution these investments may only keep pace with inflation and negate your plans for making your money grow.

Gary Doninger, a financial planner at Creative Asset Management, recommends keeping between 40-45 percent of your investments in fixed income funds, depending on your risk tolerance. Keep the same amount in equities, he recommends. That allows for 10-20 percent of your money to be available for any immediate needs.

As you begin to approach retirement age, begin shifting your investments more toward equities, said Doninger. Someone at 50, for example, might increase their equity investment stake to nearly 60 percent.

Tax deferral is an important part of your retirement picture. The advent of the Roth individual retirement account, which requires you to pay taxes on money before you put it into the IRA is in direct contrast to the 401(k), which requires taxes to be paid when you withdraw your money.

"Everybody has to look at this Roth IRA," said William Starkey, retirement plan director at the Prudential Insurance Company of America. "This is a great deal, in terms of having after-tax income during retirement."

Starkey said the 20 year retirement plan a 45 year-old undertakes will be an ever-evolving process. During the first 10 years, he suggested, you'll probably want the majority of your investments in growth stocks.

When you're five years from retirement, consider switching to income equities. Then, upon retirement, a mix of income stocks and bonds might be best.

It helps if you don't look at retirement as a finish line. Even after you've entered the golden years, your investments will still be working for you.

The important thing is to take a determined, if shaky, step toward planning your retirement, said SunAmerica's Neamtz.

"There's no better time than today, or at the very latest, tomorrow."

-- by staff writer Randall J. Schultz

|

|

|

|

|

|

|