|

Senior investors fall short

|

|

May 18, 1998: 4:52 p.m. ET

Investors 50 and older often know only the basics of brokers' practices

|

NEW YORK (CNNfn) - The choices older investors make can have a significant effect on the comfort of their lives, but many of them are making those decisions without a solid understanding of their investments.

Pride, obstinacy and secretive brokers make it difficult for older investors to learn all they need to know about where their investment dollars are going.

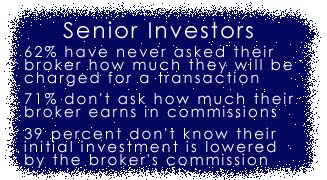

Only 62 percent of investors 50 years and older have ever asked their broker how much they will be charged for a transaction, according to a recent survey by the American Association of Retired Persons. Over 70 percent of them don't ask how much their broker earns in commissions.

The stakes for seniors are high, since 56 percent of people in that age group have at least one major investment tied up in a pension, mutual funds, stocks, bonds or commodities.

Seniors are held back by a long-held sense of propriety, which dictates that financial matters are not openly discussed, said Helen Boosalis, chairman of AARP.

Additionally, brokers often do not explain the securities process to older investors without being asked first, she noted. These attitudes, she said, have to change. (147K WAV) or (AIFF).

The knowledge shortfall by senior citizens starts with the fundamentals of investing. Many don't fully understand even basic terms, such as what a "load" is and how it relates to mutual funds, said Boosalis.

More critical to seniors' bottom line is their confusion about how brokers are compensated.

Seniors should see their brokers for what they are: salespeople. Jim Stone, academic associate at the College for Financial Planning, said people don't make the connection that these brokers are making their living doing transactions.

"People have to be paid and they're either paid by commission or other investment management fee," said Stone.

Different stocks can carry different commissions and, since brokers often make a higher commission on riskier stocks, it is important older investors understand why certain stock are being pushed by the broker.

Additionally, seniors need to know commissions reduce the value of their investment. For example, if a broker earns a 5 percent commission on a $10,000 mutual fund, $500 would go to paying him or her. As a result, only $9,500 would actually be invested.

Whenever a broker recommends a stock, ask him why he is suggesting that particular equity and what it will cost in commissions and other transaction charges.

Fortunately, brokerages provide much of what you need to know on monthly account statements. Review them thoroughly and ask your broker about any terms or transactions you don't understand.

It's possible to clear some of a statement's clutter by tracking two important patterns. Tally how investments are performing and how much they're costing you. This will provide a hard figure to help assess your broker's performance.

Seniors don't have to hack their way through the dense jungle of investments alone. Family members can sometimes offer education and advice about how to approach the markets. Unfortunately, say retirement experts, elderly parents are often reluctant to discuss their finances and admit they need help from their children.

More solid help is available from financial planners. Unlike brokers, who need transactions to make commissions, a financial planner usually charges an annual fee unrelated to the number of trades.

"This puts them on the same side of the table as you," said Stone. When shopping for such help, look for someone who is has a certified financial planner (CFP) designation.

"This indicates someone who has gone to extra lengths to learn more about the area they're concerned with," explained Stone.

If you want to check up on your own broker or look for a new one, a good place to start is with the National Association of Securities Dealers. The organization offers seniors an opportunity to obtain information about brokers online.

-- by staff writer Randall J. Schultz

|

|

|

|

|

|

|