|

Grab retirement $$ early

|

|

May 18, 1998: 4:55 p.m. ET

The best time to think about your retirement is when it's 45 years away

|

NEW YORK (CNNfn) - Mary Wilson is 27 years old and hasn't saved anything for retirement. For that reason alone, she speaks for a large part of her generation.

Wilson, a production assistant at a New York book publisher, said she's still early in her career and doesn't have the luxury of looking that far ahead.

"Right now at what my salary is, it's hard to save. I don't feel I can quite afford it yet," she said.

"I probably should be worried but I'm not. Retirement just seems like it's a long way off."

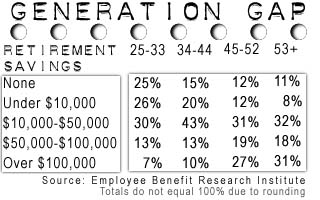

She's not alone in her reluctance to begin planning for her golden years. According to a 1997 survey done by the Employee Benefit Research Institute, 25 percent of all people between the ages of 25 and 33 have no retirement savings.

Paul Yakoboski, a research associate at EBRI who conducted the survey, said the "knee jerk" excuse among people in their 20s that they have no money is usually inaccurate.

"For some people, lack of money is a real barrier," said Yakoboski. "For many others, however, if they really took a hard look at their situation, they would have to admit, 'Yes, I could start saving.'"

Entertainment spending is usually the best place to cut, said Yakoboski. Skipping one restaurant meal per week could amount to a savings of $1,000 a year.

The incentives to start saving in your 20s are nearly overwhelming. Time is certainly on your side, since the power of compounding can make a large sum out of a small investment.

If at age 21 you invest $2,000 in an individual retirement account each year for five years, assuming a 9 percent annual return, you'd have $400,000 by age 65, even though your total investment was only $10,000.

If you waited until age 40, you could invest $2,000 for 20 years (a total of $40,000) and still only end up with $130,000.

One of the best places to start investing is with a 401(k) plan. Usually, you'll have to be at your job for one year before you're allowed to contribute, but once you're eligible, your employer will often match a portion of your own contributions.

For example, for every $1 you put into the plan, your company may match 50 cents, giving you an immediate effective return of 50 percent, much higher than almost any other investment return you could pursue.

After enrolling in the plan, you will usually be given a choice of several mutual funds into which you will place your contributions. These funds typically range from fixed income funds, which provide a more reliable but lower return, to equity funds, which invest in stocks and are subject to the vagaries of the market but could provide higher returns.

Craig Gholston thinks young people are not totally to blame if they haven't taken retirement as seriously as they should have. Rather, he feels the investment community hasn't done a good job in responding to young people's needs.

Gholston, 32, worked for a large mutual fund firm out of college and urged management to focus on the needs of investors in their 20s but was told there was no money in it. Frustrated, he started his own investment firm, GenX Invest, which aims to help people between the ages of 18 and 35 achieve financial security.

Gholsten said his greatest challenge when dealing with younger investors is competing "with Visa advertisements that say you can have everything now."

A good benchmark for people in this age group is to save or invest between 5-10 percent of their total income. When a 401(k) plan isn't an option, mutual funds are often the best way for younger investors to take on the markets. There are more than 10,000 funds to choose from, but you can research the choices online.

Mutual funds are typically within the means of most young investors. Minimum investments start as low as $250. And even if a fund has a higher minimum investment, there are often ways to circumvent that.

If you like a fund, but it has an unattainable minimum investment (say, $2,500), ask if it offers "automatic investment." Under this arrangement, a fund might waive the $2,500 minimum if you agree to automatic deductions from each paycheck.

Once you've got your money invested, don't expect instant results. "Finance is boring, and that's OK," said Gholsten."You're not going to get rich by the time you're 29."

Although you will be taking a long-term, low expectations approach to investing, that doesn't mean you should stick with dowdy stocks.

Because young investors are so far away from retirement, they're usually better off taking some risks. The stock market, over the long term, has always risen. Therefore, the short-term risk of growth stocks is mitigated by what will most likely be an overall rise in stocks over the long term.

How to allocate those stocks always depends on the amount of risk you're willing to take. However, according to the Charles Schwab & Co. retirement guide, younger investors might consider a portfolio that looks like this:

- High-growth investments - 25-50% These are investments such as high-growth stock funds, small cap stocks (those firms with under $100 million in assets) and stocks with significant earnings growth.

- Growth and income investments - 30-40%. These would include common and preferred stocks, high-quality corporate bonds with predictable earnings, indexed funds and large cap stocks (firms with more than $1 billion in assets).

- Conservative investments - 10-15%. These might include money market funds, 90-day Treasury bills or short-term certificates of deposit (CDs).

Whatever type of investments you choose, the important thing is to start right away. Young investors have a window of opportunity during their first years as wage earners. As that window closes, they lose thousands of dollars.

-- by staff writer Randall J. Schultz

|

|

|

|

|

|

|