|

Using her power wisely

|

|

June 19, 1998: 10:15 a.m. ET

The 'toughest babe in business' shows why she's among the best

|

ATLANTA -- Business is full of poker-faced CEOs, but Darla Moore may stare down opponents better than anyone.

During the 1980s her negotiating skills made her the highest-paid woman in banking. Then she joined a private investment company where she wasn't afraid to take on chief executives -- or chase powerful men out of companies they had built.

That's why Fortune magazine put Moore on its cover and called her "the toughest babe in business."

When asked what makes her so tough, Moore replies, "An ability to withstand great stress without tearing or breaking."

Her husband, Richard Rainwater, explains it another way: ". . . If you want to win the game and it's in the last few seconds, you can give the ball to certain people because you know they can sink the shot. Darla is able to do that same thing in a business setting."

Rainwater says he lacks that ability. In fact, he says he hates confrontation and would rather play at the Canyon Ranch health spa near Tucson. Which, conveniently, they own.

Marriage, money and deals

Canyon Ranch is just one of Moore and Rainwater's many investments. In their business partnership, Rainwater finds places to invest and Moore executes the deals. And her deals have tripled his wealth.

Together, they're now worth $1.5 billion, which is mostly invested in oil and gas companies, real estate and health care.

Explaining their business, Moore says, "We identify areas of opportunity. Then we allocate capital to the best ideas, the best assets and the best managers within those areas of opportunities."

They work with so much capital -- often hundreds of millions of dollars -- that people pay attention to what they want, even though they don't appear on management charts or take seats on boards of directors.

"We pick great managers and we back them. Then we get out of the way. If, over time, they don't perform, we replace them," Moore says.

Saying 'Farewell to the chief'

T. Boone Pickens can vouch for that. The corporate raider, whose attacks on executives with big perks and weak stocks made CEOs fear his hostile takeover attempts, experienced Moore's philosophy firsthand.

In 1996, his own firm, natural gas and oil producer Mesa Inc., was in debt. Rainwater and Moore put $66 million into it. Then, instead of solving his problems, she told Pickens he was the problem. She said his arrogance was why the company couldn't borrow.

She made Pickens quit the company he founded. Then she restructured its debt and changed its name to Pioneer Natural Resources. That's when she watched her $66 million stake double in value.

From the mouth of a babe

Moore's determination to be powerful surfaced early on the South Carolina tobacco farm where she grew up.

As a teen she worked hard to improve herself. "I was going to do something significant. I was going to be remembered for what I did," says Moore.

Her father, a high-school coach, taught her the value of aggression. Her mother taught her diligence and made her practice before piano lessons with Miss Ruby Smith.

"It was terrible. I remember getting to Miss Ruby's and I was so intimidated by this battle-ax," says Moore. "It was one of the few times in my life I can remember being intimidated. It was before I learned how to deal with that type of personality."

But upon entering the business world, she "became Miss Ruby," as she says. And she needed to be, where she was going.

Darla and Goliath

"This is somebody who is driven to succeed. Whatever it is that she focuses on, get out of the way, because she's gonna get there," says former boss Bob Conway.

In 1981, at Chemical Bank in New York, Moore and Conway were focused on a new idea: loaning money to corporations teetering on the brink of bankruptcy, such as Macy's, Texaco and Eastern Air Lines.

She went into rooms full of senior managers whose mistakes were about to sink their companies. They were defensive and belligerent. Moore was undeterred.

"I used to love a good fight. Like David and Goliath. As long as you stay on the facts and information and keep the emotional stuff out of it," Moore says.

"She was going to make a business out of this or die trying," Conway says.

"I had my entire group quit on me. Couldn't stand to work with me. I was so demanding, so intolerant," Moore concedes.

Rainwater offers evidence. "Her superiors called her in and said she was a management problem."

"That required some adjustment," she admits.

But she made the adjustment. And her team started making killer deals -- deals that made her the best-paid woman in banking. By 1990, at the age of 36, she was earning more than a million dollars a year.

Showing CEOs the door

Soon after, she met and married Rainwater, who made her president of his investment company. They now had $500 million to put wherever they wanted.

That's when she pushed T. Boone Pickens out . . . and then to a hard look at Rick Scott.

Scott was Rainwater's good friend. They had bought two hospitals in Texas and shared a vision: a nationwide chain of hospitals using cost controls.

By 1997, Scott's company, Columbia/HCA, was the nation's largest managed care provider.

But Moore said Scott was unwise to ignore subordinates who questioned his practices and foolish to dismiss a federal investigation of how Columbia billed Medicare. Even though he was a friend of her husband she forced Scott out.

"No one felt good about this. You feel bad. … But you get through that because the stakes are too high and something has to be done and it's your responsibility," Moore says.

Under a new CEO, Columbia is cooperating with the government and eliminating some of Scott's management practices, though its stock is down.

Taking South Carolina by storm

When asked if she thinks people, particularly employees, are afraid of her, Moore smiles and says she doesn't know. But she does seem to make some people nervous whether they work for her or not.

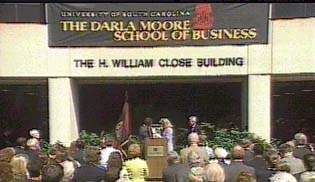

This spring, for example, Moore gave $25 million to the University of South Carolina. Now its Graduate School of Business is the Darla Moore School: the first major business school named for a woman.

She charmed everybody on dedication day. But ever the businesswoman, she came back six weeks later to check on her investment. While there, she chastised South Carolina legislators for not spending enough on public secondary schools. She said they were not preparing high schoolers to go to her business school . . . or any other. Then she challenged them to stop rebating taxes and use the money for education instead. (157K AIF) or (157K WAV)

Her hometown hasn't seen a new school building in 40 years. She knows because she's back a lot, restoring the family farm, or, as she puts it, "a black hole into which one pours money." But, she says, she's not sorry: "There's not a higher or better use for my money than this particular (money) pit."

Is Darla Moore mellowing? She readily admits to having a soft spot for the pack of dogs on her family's property. But what would happen if they ran the wrong way with one of her multimillion-dollar investments? "They would be gassed," she says, smiling.

With a stance like that, it seems Darla Moore is in no danger of losing her status as "the toughest babe in business."

|

|

|

|

|

|

|