|

The 'art' of deal pricing

|

|

June 25, 1998: 8:03 p.m. ET

As mergers get more complex, valuing the deals becomes guesswork

|

NEW YORK (CNNfn) - It's been more than 24 hours (an eon in Wall Street time) since AT&T wowed the merger-weary with its $48 billion marriage proposal to cable operator TCI. But to Jim Mallea, the research manager at Securities Data Co., a merger-tracking firm, and the financial advisers who helped structure the mega-deal, Thursday was more than just the day after.

It was time to tidy up a little unfinished business.

"We're having a conference call today to find out what should be included and what should not," said Mallea. Included, that is, in the value of the deal.

At a time when merger and acquisition activity is attaining a fever pitch, the growing complexity of many transactions, experts say, is leaving ample room for guesswork when it comes to putting a price tag on the deal. Faced with a nightmarish hodgepodge of variables, accountants are finding that "due diligence" can be a relative term.

"It's an art," said Deborah Harrington, a spokesperson for the Financial Accounting Standards Board, the guiding light for accountants across America. "There are no rules about what to do."

Harrington and others contend that deal-value computing is "not really an accounting issue," but rather one best left to the companies and their financial advisers to hammer out.

At the Securities and Exchange Commission, the pre-eminent watchdog of the securities industry in the U.S., spokesman John Heine says there's really "no easy answer" to the question of deal valuation.

'It's open to debate'

"It really depends on the situation and we basically go by generally accepted accounting standards," Heine said. While the SEC prosecutes scores of industry miscreants every year, Heine said he is unaware of any financial officer ever being apprehended for doctoring the value of a big deal.

"We're talking about things that are very complicated. It's open to debate."

The complexities, however, have not slowed down the dealmakers. In the first quarter of 1998, global merger and acquisition activity exceeded $236 billion. The figure was $919 billion, representing 10,700 deals, in all of 1997, according to Securities Data. But that number is a lot lower if assumed debt is excluded.

Conversely, the figures head into the stratosphere if one simply tallies up the market capitalization of the merging companies. This may seem a dubious practice, but the approach has plenty of proponents. (By the market-cap measure, the Chrysler-Daimler Benz deal would have mushroomed from a $39.5 billion deal, or sixth largest of all time, into a nearly $140 billion chart-topping blockbuster double the value of the Citicorp-Travelers Group merger.)

Securities Data valued the AT&T-TCI hitch-up at $45.3 billion, using a standard formula that accounts for all assets purchased by an acquiring company, along with any assumed debt or other liabilities. But the deal's financial advisers -- Donaldson, Lufkin Jenrette; CS First Boston; and Goldman Sachs -- applied a slightly different combination calculus to come up with the $48 billion figure.

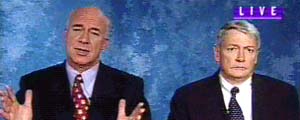

AT&T's Armstrong and TCI's Malone

The discrepancy lies in differing computation standards. Mallea does not question the advisers' math -- or their methodology. He recognizes that deal values in this fluid age of mega-mergers is, in many ways, a subjective art.

A de facto guardian of stats

Yet this very absence of strict standards has made Securities Data a sort of de facto gatekeeper of merger statistics. And that role carries a heavy -- some might say outsized -- responsibility.

"We're going to go with the information that we think is best for the database," Mallea said Thursday as he headed into the first of three separate conference calls.

The yeoman's work of deal valuation, of course, is done by the merging companies themselves, and is typically the product of tortuous weeks and months of negotiation.

Mark Sirower, a professor at the Stern School of Business at New York University, who specializes in mergers and acquisitions, described the deal-valuing process as one that requires a fair degree of prescience. Acquiring companies must decide, for example, how much of a premium to pay -- if any -- for the stock of a target firm. They must anticipate future cash flow, and stay attuned to potential shifts in the tenor of the market.

Once a deal is hammered out, debt often becomes a floating factor, chopped off here, inserted there. Hence the variance in AT&T's characterization of its TCI takeover as a $48 billion deal as compared to $32 billion in some news reports. The latter number omitted $16 billion in assumed liabilities.

Sirower said, "I don't think that there's one number that's the most accurate representation." However, he noted that full disclosure is essential, whether given in one lump sum of assets and liabilities, or broken down.

Is that $68 billion, or $48 billion?

In the AT&T case, Armstrong initially pegged the value at $68 billion, to account for the "value" of Liberty Media, the programming arm of TCI. That figure was later amended to $48 billion, once AT&T realized that the first figure suggested it was paying twice for Liberty Media.

Judith Cohen, the editor of Mergers and Acquisitions Report, a weekly newsletter, said that including debt in a deal price might work to a firm's advantage in high-profile cases like the AT&T-TCI merger.

"We live in an age of first impressions and the street's first reaction is very, very powerful," Cohen said.

But Cohen was also quick to point out that since most deals these days are stock swaps, they are ultimately only as valuable as the paper they're printed on. "When you're talking such big numbers, if you're talking stock, not that it's monopoly money, but the markets are so high, and the valuations are so high" that you have to put things in perspective.

Simeon Gold, a partner at Weil Gotshal & Manges in New York, had some cautionary advice for those who may be easily seduced by megadeals.

"A sophisticated evaluator will not only want to look at the face value being paid (by the acquiring company), but at the contract itself." That's where you're likely to find what Gold called the "hidden bombs."

--By staff writer Douglas Herbert

|

|

|

|

|

|

|