|

How to value a stock

|

|

September 15, 1998: 3:15 p.m. ET

Correction brings cheaper stocks, but when does the price become right?

|

NEW YORK (CNNfn) - The recent market correction has trimmed a lot of fat off overpriced shares but investors still can't trust any one stock to be more fairly priced than it was six months ago.

So far this year, all the major indices, from the Dow Jones industrial average to the Nasdaq Composite and beyond, have fallen more than 15 percent.

Many on Wall Street said such a correction was overdue as stock prices rose ever higher. Douglas Cliggot, U.S. equity strategist with J.P. Morgan (JPM) said the recent downturns have brought some sanity to stock prices already.

"Since their July highs, depending on your index, we're down in some instances almost 20 percent," said Cliggot. "I think we really have brought a much better balance into what price levels are and what the actuality of earnings is."

However, even if share prices have, in general, fallen, discerning the true value of a stock is more than just a matter of lower prices.

Assets vs. earnings

Determining the true value of a stock has been the pursuit of investors ever since the New York Stock Exchange was young. Over the years, though, the process used by traders has evolved.

In the past, "book value" ruled the day as the ultimate determinant of a stock's value.

The book value takes the value of all of the company's assets, then subtracts its liabilities, such as debt. What's left over is divided by the number of shares outstanding. The higher the book value, the more attractive the stock.

Book value was a solid little number and had the advantage of being based on a situation that actually exists. As time went on and the stock market became a more high-flying pursuit, restless investors wanted a different look at the company's stock value.

Enter the price-earnings ratio. Whereas the book value looked at the company's tangibles, the price-earnings ratio-- known as the P/E ratio -- looks instead at what the market is willing to pay for a corporation's earnings.

The P/E ratio divides the current market share price by the company's earnings per share. If a company's stock price were $15 per share and the company earned $1 per share last year, its P/E ratio would be 15.

Simply put, the higher the P/E ratio, the more you're paying for each dollar of that company's earnings. It would be easy enough, then, to assume stocks with low P/E ratios are the best value.

However, value investors downplay the importance of the P/E ratio, using it as a secondary figure, if at all, when assessing the value of any individual stock.

"It's important to me only as a surrogate to cash flow and earnings per share," said Bob Davis, editor of the Napeague Letter, an investing newsletter devoted to undervalued stocks.

Davis said P/E ratio is too often affected by items which have no bearing on the underlying capacity of the company to produce solid earnings.

Non-recurring factors like the acquisition or sale of a particular piece of the company, the development of a fund to use for reorganization or the writing off of a major asset could all bulge or shrink the P/E ratio.

"You want to look at the quality of the earnings per share instead," he explained. "Frequently I'll take financials and recast them to isolate the underlying factors."

To do this, Davis said you'll need to look at the cash flow of the company. The company balance sheet contained in their annual reports will give you a look into where the company makes its money.

Davis recommends trying to figure out whether a company's source of revenues is likely to continue or whether it's temporary.

For example, a toy company may have the hot item for the holiday season. Are you willing to bet your investment dollars those strong sales will continue after Christmas?

The reverse is also true. For example, a company may roll out a major marketing campaign for a new product, reducing its quarterly earnings and, consequently, its P/E ratio.

"That may actually be investment spending," said Davis. "Those ad dollars that are being spent now may be a base for earnings in the future."

Particularly if the new product ties into an existing product line, the increased marketing costs are less likely to hurt earnings in the days ahead and more likely to build on them. It's something which needs to be taken on a case-by-case basis, but is a good way to determine the overall value of a stock.

Back to the future

Allen Benello is another investment professional who, while not ignoring the traditional P/E ratio, looks at the past to gauge the future.

"A lot of times we try to look at the price to book ratios to what they've been in the past," said Benello, a portfolio manager at Summit Global Management Inc.

The price to book ratio is the price of the stock divided by the book value per share. If the firm's stock is selling for $10 per share and the book value is $5 per share, the price to book ratio is 2. The lower the ratio, the better the stock's value would appear to be.

Benello's main concern is not so much how the company has been doing this year -- markets can go up and down wildly over a 12 month period as Wall Street has seen recently.

Instead, he looks at how the company's price to book value has been over at least the last 5 years. If possible, Benello advises looking at an even longer term, such as 10 to 15 years.

"Earnings can be manipulated more easily but the price to book value tends to be more stable over time," he said.

Benello said his firm shoots for a price to book value of about 1, and he tries never to pay more than 1.5 times the price to book value.

While the prices of individual stocks within an area can vary wildly, Benello said there are certain types of stocks which tend to be more overvalued than others.

Household name stocks like General Electric Co. (GE) (P/E: 32.25) and Coca-Cola Co. (KO) (P/E: 46.40) tend to be more highly valued since mutual fund companies like the liquidity of these stocks. "That has nothing to do with real value," said Benello.

Value factors

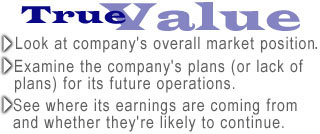

The process of figuring out a stock's real value is a complicated one, relying on skills and hunches which test the mettle of even full-time investment professionals but even the average investor can take some steps to separate the fairly-valued equity from the inflated one.

First, you'll need to look at the company and its place in the overall business world. Is it a company that is likely to be affected by what's going on overseas?

Additionally, listen to what the company is saying about itself and where it's going. Does it sound like it has a plan for the future or does it seem content to stick with what's working for it right now?

Second, you'll need to comb through its earnings statements. Many companies post their annual financial reports on their websites, providing you with an ample amount of revenue and earnings data.

In addition, companies must file an exhaustive 10-K report with the U.S. Securities and Exchange Commission. The SEC provides a searchable database to Web users.

In these reports, companies break down where their earnings are coming from and you'll be looking to see whether the numbers are being driven by solid operating activities or by things that are unusual and unlikely to occur in the future. Also keep an eye on whether the company has been taking on debt.

Third, if you want to incorporate the price-earnings ratio into your stock assessment, Davis recommended sticking with a P/E ratio of 20 or under.

"When I'm buying stocks, I'm buying earnings," he said. "I like low P/E stocks where the earnings stream is essentially validated by the company's operations."

In a turbulent market such as Wall Street has experienced this summer, knowing when to get in or out of an investment can be tricky. Looking for the true value of a stock gets your attention off of the gyrations of the market and onto the fundamentals of the stock itself, making it more likely you'll get a better stock buy.

-- by staff writer Randall J. Schultz

|

|

|

|

|

|

|