|

CDnow, N2K to merge

|

|

October 23, 1998: 10:51 a.m. ET

Agreement struck after weeks of talks; N2K shareholders offered premium

|

NEW YORK (CNNfn) - CDnow Inc. and N2K Inc. will merge to form an online music retailer with a customer base of 1.2 million consumers, both Internet companies announced Friday.

The merger underscores the significant growth that has characterized electronic commerce and the importance that size will play to competitors as the marketplace continues to mature.

"The stocks that have been successful are the ones that have reached a very large scale which is to say critical mass basically," said James Preissler, Internet analyst at PaineWebber.

Online spending on books and music is estimated to total $300 million in 1998, according to Forrester Research. The market is projected to grow to $4.5 billion by 2002.

The CDnow/N2K combination comes during a time when other online retailers are seeking out merger partners because of the bleak conditions for initial public offerings.

Ticketmaster Group and CitySearch Inc., a provider of local entertainment guides, agreed in August to merge. And Bertelsmann recently agreed to pay $200 million for 50 percent of barnesandnoble.com, the online unit of Barnes & Noble.

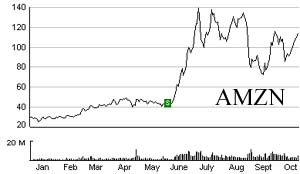

And the recent merger wave emphasizes the importance of marrying content with commerce and creating brand awareness, a strategy that has helped Amazon.com become the widely recognized leader of the sector.

Amazon.com shares have climbed...

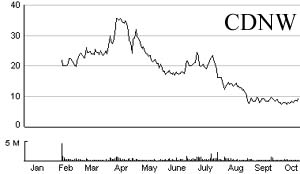

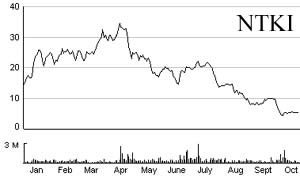

while CDnow

and N2K have slumped.

"Two companies have benefited from the time-to-market advantage: Yahoo! and Amazon. Those are the single success stories. Every single day, it gets more and more competitive," Preissler said.

And the PaineWebber analyst believes that other retailers likely will follow Barnes & Noble's lead by seeking out strategic partners that are rich with content.

"I think that is a very successful model for any of these companies to follow," Preissler said.

CDnow, based in Jenkintown, Pa., has been in talks for weeks with Manhattan-based N2K, which operates under the Music Boulevard brand name. The two Internet companies confirmed talks back on Oct. 7.

The deal is structured for the two companies to form a new publicly traded entity, initially known as CDnow/N2K Inc. N2K shareholders will receive 0.83 share in the new company for each share they own while CDnow investors will receive stock on a one-for-one basis.

The deal offers N2K shareholders a premium of 42 percent. N2K shares (NTKI) rose 15/16, or 17 percent, to 6-7/16 in early Friday trading. CDnow stock (CDNW) lost 11/16, or 7 percent, to 8-3/4 on the Nasdaq.

As of Thursday, the combined company had an equity market capitalization of about $250 million. The combined company will have pro-forma sales of $75 million for the 12 months ended Sept. 30.

Jon Diamond, co-founder and vice chairman of N2K, will be chairman of the new company. Jason Olim, CDnow president and chief executive, will retain his title under the combined entity. A nine-member board will consist of four directors appointed by CDnow and three from N2K -- one of whom is N2K Chairman and Chief Executive Larry Rosen.

The merger is expected to be completed by early 1999, subject to approval by the shareholders of both companies, regulatory approval and other customary terms and conditions.

Separately, CDnow reported third-quarter results that were slightly better than expected.

For the latest quarter, net losses totaled $12.7 million, or 74 cents a share, versus analysts' consensus estimate of 77 cents. Sales jumped to $13.9 million.

A year earlier, CDnow posted a loss of $2.58 million, or 36 cents a share, on sales of just $3.9 million.

Meanwhile, N2K reported a wider-than-expected operating loss for the third quarter.

Net loss totaled $24 million, or $1.69 a share, compared with estimates of $1.28, according to First Call. A year earlier, losses from continuing operations totaled $6.9 million, or $2.25 a share.

Sales rose from $3.6 million to $10.5 million.

-- by staff writer Robert Liu

|

|

|

|

|

|

N2K

CDnow

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|