|

Ford buys Volvo car arm

|

|

January 27, 1999: 10:48 a.m. ET

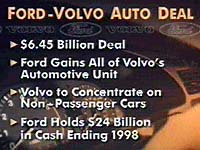

U.S. giant pays $6.45B for European rival; analysts applaud but investors yawn

|

LONDON (CNNfn) - The global auto industry's drag race to consolidate shifted into high gear Thursday as Ford Motor Co., the number-two carmaker in America, confirmed plans to buy Volvo's auto operations for $6.45 billion.

Sweden's Volvo said the sale will allow it to concentrate fully on trucks, buses, construction equipment, marine engines and aerospace equipment.

"We went through a list of different options, and believe me we have tried many different options, and we have arrived at the conclusion that Ford is the best ally, the best partner and the best owner of the Volvo car business," said Leiff Johansson, president of Volvo.

Earlier this month, Volvo announced plans to buy a 13 percent stake in Swedish truck and bus maker Scania.

For Ford, Volvo's upmarket models may provide the missing link the American heavyweight has been looking for in a European line-up struggling to compete with feisty rivals such as Peugeot, Volkswagen and Fiat.

"If Ford makes Volvo work, it has the potential to break out of the pack of second-tier automakers," John Casesa, an auto analyst with Schroder and Co., told CNNfn's "Business Day." "Right now in Europe there's Volkswagen and everybody else. Since Volvos fit between Fords and Jaguars, in theory this really could make a difference."

Volvo S70

The merger of Ford and Volvo's car division largely mirrors the $38 billion merger between Detroit-based Chrysler and Daimler-Benz of Germany late last year.

The deal created the world's fifth-largest automaker and gave Chrysler a significant inroad into the lucrative European market.

Ford already owns Jaguar, the high-end line of luxury cars. But Lou Ehrenkrantz, an analyst with Ehrenkrantz King Nussbaum, said Volvo brings to Ford a new set of potential customers and a polished reputation.

"Unlike the other international mergers it doesn't really cannibalize itself," he said. "Jaguar is much higher priced than Volvo. It's a different market."

Equally important, he said, Volvo gives Ford a much-needed image boost. Ford has been plagued with a series of auto part recalls of late.

"This gives Ford an image in the safety area something they badly needed," Ehrenkrantz said. "Volvo is an acknowledged leader in safe driving. What Ford has done in one stroke is it has broadened its market not only domestically, but internationally. This is really a very big plus for Ford Motors. It changes the game."

Jacques Nasser, Ford's president and chief executive officer, agreed.

"What we are really buying here is generations of hard work and dedication and brand building and ingenuity that has been put together over decades and decades," he said. "We are buying the strength of the brand, the reputation of the brand, and we are buying a team that is incredibly best in breed in terms of its worldwide capacity and research and development."

Volvo's car division accounted for more than 50 percent of the company's revenue in 1997, or about 96.45 billion Swedish crowns ($12.5 billion).

But on a global scale, the car operation paled in comparison to the competition.

"On cars they were always going to be small and always stand a chance of being buffeted by the larger players," said Stephen Reitman, an auto analyst with Merrill Lynch.

Reitman said the deal will enhance Ford's brand cachet, an issue on which the company's success in Europe will hinge as Ford tries to round out its vast production portfolio with upscale offerings.

"The key issue (for Ford) is brands," Reitman said, adding, "Volvo has a very good image in terms of technology, quality and environmental concern."

Schroder & Co.'s Casesa concurred, saying that keeping Volvo's image, particularly its appeal as a safe car, is a "top of mind" concern for Ford, citing its experience with Jaguar. "They treated Jaguar well. They were patient. They put a lot of money into it and they didn't mess up the brand image, the things that made Jaguar uniquely British," he said.

Both carmakers suggested that the integration of the Swedish carmaker's line of luxury automobiles into Ford's production operation will be relatively seamless.

"Volvo is a premium automotive brand with unique appeal that represents a good opportunity to profitably extend our lineup," said Ford's Nasser.

Ford will take over all of Volvo's car facilities worldwide, including three major assembly plants. The two companies will jointly own the Volvo brand name.

Ford's bid beat out Italy's Fiat. Fiat had offered about $7 billion, but that price was said to have included Volvo's truck operations, which Ford is not taking.

Reports also circulated that Volvo held discussions with General Motors Corp. [GM ] and Volkswagen of Germany.

Ford's purchase brings it Volvo's 1.6 percent of the European market share to its existing 10.1 percent share, according to Ward's Auto World.

Analysts said Volvo sold nearly 500,000 cars worldwide last year. Volvo's largest single market is the United States, where it sold about 100,000 vehicles.

Ford (F) shares were up 1-3/8 at 61-11/16 on the New York Stock Exchange following confirmation of the deal. Volvo's (VOLVY) stock was up 7/16 at 27-13/16 on the Nasdaq.

In a related development, Volvo announced Thursday plans to terminate truck and bus production at its Irvine plant in Scotland by July 2000. The action is expected to result in the loss of 450 jobs, Reuters reported.

Analysts say that with Ford's solid cash flow, the company is still well-positioned to pursue other merger opportunities in the international market.

"I wouldn't be surprised to see Ford make more acquisitions in the European market, even in an automobile replacement parts business," Ehrenkrantz said, adding he continues to rate Ford's stock a "buy" for investors.

|

|

|

|

|

|

Ford

Volvo

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|