|

CNNfn market movers

|

|

February 5, 1999: 2:32 p.m. ET

IPOs suffer mixed first day while techs including Sterling Commerce, SCI fall

|

NEW YORK (CNNfn) - Wall Street's stern tone sharpened Friday, as investors chastened a wide range of recent market darlings from blue-chip IPO spinoffs to airlines to e-commerce providers.

Two of the day's three initial public offerings posted only lackluster gains, kept from blockbuster birthday performance by the market's general downturn and the fact that neither is an Internet company.

Del Monte Foods (DLM) limped out of the gate, up only 3/8 from its offering price of $15, while General Motors (GM) spinoff Delphi Auto Systems (DPH) climbed 1-1/16 to 18-1/16.

Internet-related IPOs have been the holy grail of investors since the debut of Yahoo! (YHOO) nearly three years ago, with some Net stocks posting three- and even four-digit percentage gains in their first day of trading.

As an example, the day's third IPO, Pacific Networks (PCNTF), climbed 213 percent, gaining 31-1/4 to 48-1/4.

The grim mood on Wall Street also humbled another of the market's recent fascinations, the discount brokerage sector.

J.B. Oxford (JBOH) stopped short in its tracks, falling 3-1/4 to 12-5/8, while M.H. Meyerson (MHMY) shed 3-7/16 to 8-15/16 and other discount brokers including Siebert Financial (SIEB) were broadly lower.

Also caught in the backlash was Eastbrokers International (EAST), a small broker which concentrates on emerging markets as well as U.S. securities. Eastbrokers shares slid 1-7/8 to 6-1/8, giving up virtually all of the broker-frenzy gains it had enjoyed earlier in the week.

Truckers lifted, airlines fall

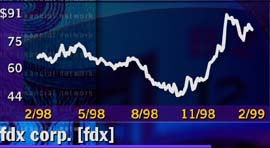

News that Federal Express pilots have approved a five-year contract boosted shares of Federal Express holding company FDX Corp. (FDX) 11/16 to 82-5/8, sparking a sympathetic surge in Airborne Freight (ABF), up 13/16 at 38.

Truck rental firm Ryder System (R) gained 1-1/2 to 26-7/16, while CSX (CSX) climbed 3/4 to 42-7/16.

However, broad selling of airline stocks left the four freight companies alone as the only gainers in the Dow transports index, which outpaced the wider market to slip 5.71 points to 3,241.43.

Among the airlines, Northwest (NWAC) led the way down as investors took profits, sliding 3/4 to 24-1/2. American Airlines parent company AMR (AMR) lost 1-7/16 to 59-5/16, US Airways (U) shed 1-9/16 to 48-5/16 and Delta (DAL) dropped 1/4 to 57.

Techs repeat retreat

Massive selling of big-name computer stocks had a contagious effect on stocks throughout the high-tech industry, while investors jittery over the future of Internet and chip shares prowled the market looking for disappointing profits to punish.

Steve Jobs' two corporate children both suffered. Apple Computer (AAPL) fell 5/8 to 37-1/4 amid the general tech bearishness, while animation firm Pixar (PIXR) dropped 2-1/4 to 41 after saying it has yet to see substantial revenue from its hit film, "A Bug's Life"

Corporate tech services provider Electronic Data Systems (EDS) fell 5-15/16 to 46-1/16 despite reporting fourth-quarter profit that beat Wall Street estimates by a penny per share.

Electronics manufacturer SCI Systems (SCI) tumbled 7-7/8 to 35-1/16 after confirming reports that sliding market share will cause first-half 1999 revenue and earnings to come in short of expectations. To compensate, the company said it is exploring "a multi-plant head-count reduction program."

Sagging earnings at publisher turned Internet player Ziff-Davis (ZD) drove its stock down 1-5/16 to 19.

Despite ZD's decline, the Internet's real morning profit surprise was e-commerce firm Sterling Commerce (SE), which plunged 10-5/16 to 32-1/8 after software revenue met with analyst disfavor.

Discouraging words from influential Wall Street firm Lehman Brothers drove CD Radio (CDRD) shares down 6-3/8 to 25-3/4.

Lehman lowered its 1999 price target for the digital broadcasting company to $55, citing mounting delays in the launch of its satellite network, now in development.

Outside the digital world, delays also sank shares of research firm BioReliance (BREL), which fell 1-7/8 to 7-1/8 after warning shareholders that sluggish manufacturing progress will make upcoming earnings miss the mark.

In brighter medical news, St. Jude Medical (STJ) climbed 2-5/16 to 28-3/8 on the strength of a successful new pacemaker. ING Barings rated the stock a "buy."

Another winner in the ratings race was media software firm Avid Tech (AVID), which surged 4-7/32 to 32-11/16 after receiving an "outperform" rating from Morgan Stanley.

|

|

|

|

|

|

|