|

When work doesn't pay

|

|

February 22, 1999: 10:12 a.m. ET

At-home parents re-entering the work force need to consider the costs first

|

NEW YORK (CNNfn) - It's a common misconception: the belief that a second household income will necessarily ease the burden of monthly bills.

But for families with young children, many of the nation's most cost-conscious number crunchers agree that going back to work doesn't always pay.

"There are people out there who are expecting to be able to meet their bills better (after they re-enter the work force) and never realize they are either working for a loss or for something like $4,000 a year (after expenses)," said Jan MacGregor, a financial consultant and former analyst.

Separating myth from reality

According to MacGregor, society and the popular press perpetuate the myth that families can no longer exist on a single-income.

"The general message from our culture is that we just can't survive on one income anymore," she said. "They say the American Dream is gone, and that without a second income you can't afford to buy a home."

Expectations of two or more cars, a nice house in the 'burbs, and a week's vacation in Bermuda every year only compound the problem, making most families feel forced to do the dual-income shuffle.

But MacGregor said they might be shocked to find how little that second income actually contributes to the bottom line.

To do the calculation, you have to factor in the obvious and expensive cost of day care or hiring a nanny, commuting costs and investments in professional clothing.

You also need to account for the additional money spent on lunches, the increased cost of eating out more often for dinner and the higher priced convenience foods at the grocery store that many time-crunched parents rely upon.

"The cost of returning to work is hard to quantify," said Norman M. Berk, a certified public accountant, attorney and investment advisor with Professional Asset Strategies Inc. in Birmingham, Ala. "There are a ton of things that you wouldn't be spending money on if you weren't working."

To name a few others, you should include the less obvious loss of child care tax credits that comes with higher incomes; the miscellaneous money you may spend paying for help around the house or yard and - of course - Uncle Sam.

A second household income isn't taxed as it would be if a single person earned the same pay.

It's lumped together with the salary of the parent who has been working all along, pushing more of the family income into the higher tax bracket.

For example, the Internal Revenue Service tax schedule dictates that a (married filing jointly) family earning $50,000 is taxed 15 percent up to the $42,350 mark. The remainder, up to $102,300, is taxed at 28 percent. Taxable income beyond that amount, but only up to $155,950, is taxed at 31 percent and so on.

Therefore, if you add a second salary to the $50,000 your spouse brings in, the government considers that to be combined income and taxes the additional money at the higher rate.

It may even push the family income into the 31 percent, 36 percent or 39.6 percent tax bracket, depending on how much you bring in.

But Berk said the threat of a higher tax bracket is sometimes overplayed by advocates for at-home parents.

"My response to that is that you only pay taxes if you are making money," he said. "Things may be bad, but you are not paying 100 percent in taxes. I just don't think that's a critical issue."

Unless you are "taking a helicopter into the office everyday," he added, odds are you will still come out ahead.

The cost of a second salary

That may be true, but when you factor in the total costs of returning to work, MacGregor insists that second salary can be more trouble than it's worth.

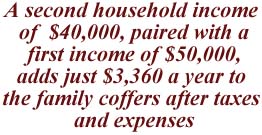

Using a hypothetical scenario, she estimates that a second household income of $40,000, added to a first income of $50,000, ends up adding just $3,360 a year to the family coffers, after taxes and work-related costs.

The calculation subtracts $9,984 for additional federal income taxes, $8,100 for day care for one child, $1,100 for wardrobe expenses, $1,000 for commuting costs, and $2,500 for the time-saving practice of eating out two extra times a week and spending more on prepared foods.

MacGregor includes a slew of miscellaneous expenses in her calculations, as well, including dry cleaning, housekeepers, and higher medical bills for children - the byproduct of increased exposure to illness at the day care center.

You also have to deducts around $3,000 from the original breadwinner's salary to account for loss of promotions, income or bonuses that result over the course of a few years from sharing the responsibilities of parenting, she said.

That includes picking up the child or children from day care and school on snow days, taking sick children to the doctor and staying at home to care for the sick child, and attending school meetings.

Using those same assumptions, a second income of $20,000 is worth just $346 a year to the family's bottom line, and a second income of $60,000 is whittled down to $8,792, MacGregor said.

The scenarios, of course, can vary widely, depending on the geographic region in which a family lives, the ability of a grandparent to help out with babysitting, or any number of other factors that can reduce expenses.

MacGregor suggests single income families with day care-aged children do their own math before sending the at-home parent back to work.

Marian Gormley, a spokeswoman for Mothers at Home in Vienna, Va. says that's good advice.

She also suggested the at-home parent, whether that be the mother or father, factor in the intangibles - or quality of life issues.

"The thing we hear over and over again when (a parent) is deciding whether to quit or return to work is they don't discriminate between their wants and needs," Gormley said. "You have to say to yourself, 'If I go back to work, do I still feel I will have time to give to my family, to give to myself, where I'm not totally stressed out and feeling like I'm not being pulled at both ends?'"

And don't underestimate the difficulty you might have in readjusting to the environment of Corporate America.

"They often find that when they were younger they were willing to put in those 60 hour work weeks," she said. "But after they have children and want to re-enter the workforce often times it's on a completely different level."

Put more simply, you'll have less time and energy to give

Career investments

On the flip side of the coin, you also need to consider the satisfaction derived from having a successful career.

Family psychologist Jean Bauer of the University of Minnesota, said it's important to differentiate between economic and psychological benefits.

While acknowledging that cash flow from work becomes negative for most second salary earners somewhere between the second and third child, she said it may still be worth it to stay in the work force.

"Some (at home parents) have invested in their human capital by going to school and doing a lot of work within their career and so in order to have a return on that psychologically, as well as for their long-term financial goals, they choose to work," Bauer said.

That's especially true if career advancement is a top priority, or your employer contributes to a 401K retirement plan, a potentially lucrative tax-deferred investment opportunity.

Berk agrees.

"There's a lot of self-worth involved in working; in getting up in the morning and putting on a dress or a suit," he said. "There's a lot of inner prestige that can outweigh the dollars and cents."

Berk also advised any at-home parent deciding how long to wait before jumping back in, to take into account the unforgiving corporate environment.

"The longer you stay away, he said, "the harder it is to come back anywhere near where you left off."

--by staff writer Shelly K. Schwartz

|

|

|

|

|

|

|