|

Gimme (tax) shelter

|

|

March 5, 1999: 11:12 a.m. ET

Legitimate tax shelters can save you money, but beware the frauds

|

NEW YORK (CNNfn) - The 1999 tax season is far from over, but chances are you're already thinking ahead to next year, and taking a closer look at investment options that can help you keep a larger slice of your income pie.

Industry experts say government-approved tax shelters may be the answer. Differentiating the valid shelters from the abusive ones, though, isn't always an easy process.

The IRS defines a tax shelter as an investment that usually requires "substantial investment with a degree of risk." Most often, it involves short-term losses to produce future gains.

Generally speaking, tax officials say the amount of your deduction or loss is limited to the amount of money you have put at risk.

Abusive tax shelters, conversely, are trusts and other tax savings vehicles established to hide the true ownership of assets and income. They are set up for the sole purpose of lowering taxes, with little or no realistic chance of ever producing an "economic benefit."

Experts say that's become the benchmark by which the IRS evaluates tax shelters.

Sheltering income

The IRS put a stop to many of the most popular personal tax shelters in the late 1980s. But it left a few untouched.

Today, many come in the form of trusts, a commonly used estate planning tool. But retirement plans and real estate investments can also provide valuable benefits.

One of the most common examples of a legitimate tax shelter is an investment in low income property that provides depreciation benefits. There again, though, your investment must be made with the intent of turning a profit in the future.

"Taxpayers seeking to deduct losses for tax purposes that do not arise from an economic loss will face an increasingly difficult time in court," said Bruce J. Molnar, a certified public accountant and head of Molnar & Associates.

IRA's, or retirement plans for the self-employed, are another popular legitimate tax shelter. These allow you to defer taxes on your personal retirement trusts until you withdraw from it.

Also, Clifford Trusts, which transfer the income of a company or the family money maker to another family member in a lower tax bracket, have the IRS' blessing, as long as the family member is age 14 or older.

The private annuity trust is a lesser known, but potentially valuable tool for deferring capital gains taxes.

It works like this: say you're a property owner and you want to sell your land to a developer for $3 million. You bought it 30 years ago for $200,000, producing a $2.8 million capital gain.

Federal and state taxes would require you to cough up 26 percent of that gain within 90 days, totaling $728,000. But if you move that asset into a private annuity trust, and defer your taxes interest-free for 30 years, you can earn interest on that money over the course of your lifetime.

Moreover, when you die, instead of the 55 percent estate tax your family might have had to pay, they will instead pay a 26 percent capital gains tax on the property held in the trust.

"This is a dynamite way to help people not only avoid capital gains taxes, but defer it over a lifetime," said Don Forbush, senior estate advisor for the National Association of Financial and Estate Planners. "It's been around a long time, but very few CPAs and estate planners know about it."

Investments in municipal bonds also provide tax shelters since income from these bonds is tax free, though it is far less lucrative.

Paying the price

The IRS has come down hard in recent years on individuals and corporations that abuse tax shelters. Even if you're simply the victim of a promoter of illegitimate tax shelters, you're still just as guilty in the government's eyes.

Civil sanctions can include a fraud penalty up to 75 percent of the underpayment of taxes linked to the scam (on top of the back taxes owed). Criminal convictions can cost you $250,000 in fines and/or up to five years in jail (per offense).

So how do you protect yourself against accidentally falling into one of these fraudulent shelters? The National Association of Financial and Estate Planning says there's usually a clue in the material issued by the companies behind the shelters.

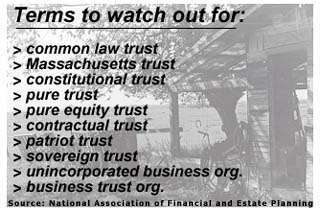

Be on the lookout for terms like common law trust, Massachusetts trust and constitutional trust. These official sounding words, though they may make the shelter sound legitimate, are actually hollow. Other suspect terms are listed in the chart below.

The scams

While the number of tax shelter scams is abundant, the IRS sites five as the most common:

The Business Trust, whereby the owner of a business transfers the business to a trust in exchange for units of beneficial interest. The trust then makes payments to the trust unit holders, under the guise of deductible business expenses. The Business Trust, whereby the owner of a business transfers the business to a trust in exchange for units of beneficial interest. The trust then makes payments to the trust unit holders, under the guise of deductible business expenses.

The Equipment or Service Trust, which holds equipment that is rented or leased to the business trust, often at inflated rates. The Equipment or Service Trust, which holds equipment that is rented or leased to the business trust, often at inflated rates.

Family Residence Trusts: Under this scam, the owner transfers his or her residence, including its furnishings, to a trust and then claims inconsistent tax treatment for the trust and its owner. Family Residence Trusts: Under this scam, the owner transfers his or her residence, including its furnishings, to a trust and then claims inconsistent tax treatment for the trust and its owner.

The Charitable Trust, where the owner transfers all assets to a purported charitable organizations that actually benefits the family - and then tries to deduct the payments. The Charitable Trust, where the owner transfers all assets to a purported charitable organizations that actually benefits the family - and then tries to deduct the payments.

The Final Trust, a multi-trust arrangement often created abroad, whereby the owner of one or more abusive trusts establishes a single final trust, which holds units of the owner's other trusts. The Final Trust, a multi-trust arrangement often created abroad, whereby the owner of one or more abusive trusts establishes a single final trust, which holds units of the owner's other trusts.

Trust the experts

If you're not sure whether your tax shelter falls into the legitimate or abusive category, check with the people who know -- estate planners, CPAs and accountants.

If you suspect someone of operating a scam, call the IRS Hotline for Reporting Suspected Tax Fraud at: (800) 829-0433.

And remember, "if it looks too good to be true, it probably is," Forbush said.

--by staff writer Shelly K. Schwartz

|

|

|

|

|

|

|