|

Shipping changes course

|

|

March 17, 1999: 3:30 p.m. ET

Carriers now seek to reverse more than a decade of consolidation

|

NEW YORK (CNNfn) - The transportation industry is changing course.

Since the mid-1980s major carriers, anxious to give customers "one-stop shopping" for all their freight needs, have concentrated on expanding into other areas of the transportation chain. As a result shipping, railroad, trucking, even airline cargo operations have been consolidating under various corporate roofs.

But a major corporate revamp and a $315 million deal this week suggest the transport integration trend is at an end.

"Both things are being driven as a matter of financial necessity and shareholder value, but they do signal a change," observed Leo Donovan, a transportation consultant with Booz-Allen & Hamilton Inc. "Pushing shareholder value is always a concern, so that's the same. But in terms of operating strategy, it's a reversal."

In one case, a U.S. shipping company is being broken into three distinct operations, reversing more than a decade of company consolidation and integration. In the second, another North American-based shipping company is tossing off a railroad operation that was once the diamond in its transportation crown.

Stacktrains away

The latter event took place Wednesday when Neptune Orient Lines, a shipping conglomerate based in Singapore, announced it is selling its freight train service to a New York-based investment group, Apollo Management LP, for $315 million.

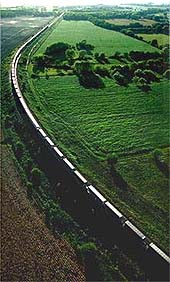

Neptune Orient acquired the train operation when it took over American President Lines in 1997. The so-called stacktrain operation -- so named because it uses special trains that carry shipping containers stacked on one another -- made APL a powerhouse in U.S. transportation. Using its own rail equipment under special contracts with railroads, APL is able to guarantee regular deliveries and meet tight shipping schedules for major customers moving goods throughout the United States from Asia.

NOL, however, has decided to split off non-core assets.

"Our future," said NOL Group President and CEO Lua Cheng Eng in announcing the stacktrain sale, "will depend less on point-to-point transportation and more on our broad and integrated capabilities to assist global manufacturers and retailers enhance the efficiency of their supply chains."

Neptune Orient still will have access to the stacktrain service through a long-term contract with Apollo's transport unit, California-based Pacer International Inc.

The sale also may ease NOL's financial situation. The Singapore company posted a net loss of $140 million in the first half of its fiscal 1998 year, reported last September.

Adding to the line's financial woes, the shipping business is at the bottom of a tough business cycle. Too many ships and too little cargo, especially from the United States to destinations overseas, have pushed shipping rates down.

"The amount of shipping capacity has far outstripped demand, so rates are down," said James Dowling, an analyst with Furman Selz Inc. "In addition there are imbalances in major trade lanes....The economics of the whole business is still not good."

That has put pressure on shipping lines to find ways to boost their bottom lines, analysts say. So operations in various modes outside the main business -- like a ship line's trucking company or a railroad's port terminal -- are being analyzed.

"All this vertical integration is nice, but it's very expensive," said Ted Prince, a transportation consultant and former shipping executive. "We're starting to see vertical dis-integration, in part because what we're seeing is a shipping industry desperately in need of cash."

Fracturing Sea-Land

That, analysts say, is also pushing CSX Corp.'s move this week to recast its shipping arm, Sea-Land Service Inc., into three units.

CSX, primarily a railroad company, bought Sea-Land in the late 1980s hoping to produce a seamless, ships-to-railroad transportation operation. The tough conditions in the shipping industry, particularly in the last year, have hurt the ship line's contribution to CSX's bottom line.

That has led to speculation that CSX may want to get rid of the shipping operation.

"We have been taking a very close look at its lines of business and believe there is a clear opportunity to unlock more value by running Sea-Land's three key components as distinct profit centers," John Snow, CSX's CEO, said.

However, a suitor willing to pony up $2 billion, the price analysts say would be the likely target, may be hard to find. Hence the decision to split the unit up.

"There are probably parties out there interested in pieces of Sea-Land, but not interested in taking over the whole group of businesses," said Jim Winchester, an analyst with Lazard Freres.

The three pieces are Sea-Land's terminal operations, its domestic shipping operations to Hawaii, Puerto Rico and Alaska, and its international shipping operations.

Analysts say Sea-Land's current shipping partner, Danish carrier A.P. Moller-Maersk, would be a good candidate to pursue the terminal business. Other interested parties could be Stevedoring Services of America, a major U.S. terminal operator, or other stevedores based overseas.

The domestic shipping business could attract the attention of other companies in the domestic shipping business, like Neptune Orient's APL unit, Canadian Pacific's shipping unit, or Matson Navigation Co., a unit of Alexander & Baldwin.

The international shipping business, however, could end up being a wallflower, at least until business conditions improve, analysts say. In the meantime, CSX can entertain offers on the other units.

"The sum of Sea-Land's parts are probably worth more than the whole, financially," commented Donovan of Booz-Allen.

Analysts argue that conditions in the shipping industry should force other companies to adopt a similar, stick-to-the-knitting strategy. But given the multi-culture nature of the shipping industry, there might be differences.

"I don't think it's accidental that the two companies with American management were the first to do this," said Prince. "Other international companies need to, but whether they do or not is questionable."

-- by staff writer Allen Wastler

|

|

|

|

|

|

|