|

Is there life after Rubin?

|

|

March 26, 1999: 5:09 p.m. ET

Treasury boss not leaving, but bonds, stocks will fall when he does

|

NEW YORK (CNNfn) - It's a familiar scene: elbows on the table with a gray pinstriped-suit bunched up at his shoulders, Robert Rubin is once again on the hot seat during a Congressional hearing.

Leaning forward, he unleashes his baritone voice into a microphone and seems almost completely unfazed. He could just as easily be talking to friends at a luncheon or a group of bond traders on Wall Street.

It is this familiarity that has made Rubin a fixture on Capitol Hill and President Clinton's steadiest hand on the economy.

'Minister to the Dow'

But the recently-muted buzz has kicked up again: Rubin, who some observers have called "Minister to the Dow," may soon step down.

In fact, the guessing game has become a spectator sport unto itself, taking many forms: Rubin hates the travel that his post requires; his wife dislikes the Washington clique; he is put off by his scandal-ridden boss; he's impatient about Congress's reluctance to fund the IMF.

The latest rumor of Rubin's imminent departure came last week on word Rubin would not attend a mid-May summit of Asia-Pacific Economic Cooperation leaders in Malaysia.

Rubin, in a series of appearances, declined to comment specifically on his future plans. But officials at the Treasury Department said the constant speculation is troublesome.

"The whole process of this is sort of frustrating," said Howard Schloss, a Treasury spokesman. "[Journalists] write about it without having any idea about whether it is going to happen - it feeds on itself."

So far, Rubin is still there -- but some day the rumor will become fact. Observers say that he would be most likely to resign on a Friday afternoon after the market close to minimize its unsettling impact.

What happens then?

If he stays on past mid-May, Rubin will become the longest serving Secretary of the Treasury in nearly half a century -- since John Snyder in the Truman Administration.

During Congressional testimony last week Rubin showed a hint of pride in the current U.S. economic boom.

"These are the most extraordinary economic conditions I've ever seen, and I think it's partly a result of policy decisions," said the 60-year-old Rubin.

Wall Street pundits appear to agree a departure by Rubin would affect the bond market more than stocks, in large part because he has embodied the nation's dollar policy.

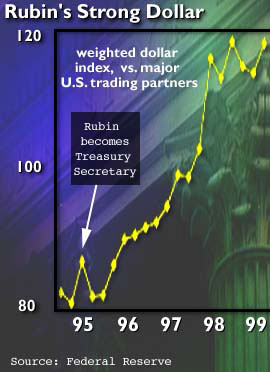

Rubin's signature has been on the dollar in more ways than one - since mid-1995 he has been a vocal defender to fortify the greenback.

A poll of about a dozen analysts and money managers showed a range of opinion about how far the Dow industrials would slide if Rubin were to announce his departure, from as little as no reaction to as much as 700 points in the immediate aftermath.

"If Robert Rubin steps down, how much would the Dow fall? Immediately the Dow would fall 200 to 300 points, and I think we could see it drop as much as 500 points within the week," said Stephen Langan, chief market strategist at brokerage Donald & Co.

[Respondents generally said that a surprise resignation of Federal Reserve Chairman Alan Greenspan could hurt the stock market more.]

One dollar, one voice

From the beginning of his tenure at Treasury, Rubin put to work a key lesson gleaned from often unflattering comments about the dollar of his predecessor, Lloyd Bentsen.

In what many said was a critical step, Rubin became the Clinton administration's voice on dollar policy, in effect saying: "the buck stops here" - with him.

"There's only been one spokesperson on the dollar. In places like Japan, you're really guessing as to what the policy is on the yen," said Anthony Crescenzi, a bond analyst at Miller Tabak Hirsch, referring to Rubin. "No one else speaks for dollar policy - it's a fact. That's why the dollar has had a three-year run against the yen."

Summers to spring eternal?

Rubin is pure-bred Wall Street. Prior to serving Clinton, he was the co-chairman of Goldman Sachs & Co., capping his 28-year career at that top-drawer investment bank.

While politically a center-left cousin of the staid and starched-shirt Wall Street culture, Rubin has the emblem of a fellow trader. His longest schooling was as an arbitrageur on the Goldman bond desk.

The top prospect as his successor, a man Rubin himself groomed, is Deputy Treasury Secretary Lawrence Summers. In their four-year long duet, Summers has played economic wizard to Rubin's market guru.

Partly because Summers, if he should take over, has had such a key role as Rubin's No. 2, the effect on the bond and stock markets from a Rubin resignation is likely to be short-lived, analysts said.

Summers' pedigree is academia. At 28, he became the youngest full economics professor ever at Harvard, and he is the product of a family of Nobel Prize-winning economists - his uncle is MIT legend Paul Samuelson.

But as a wunderkind, Summers, 44, has an intellectual prowess that can turn off Congress - and has been said to grow impatient when people don't understand him.

Under Rubin's tutelage, especially at how to play the political game Rubin too had to learn, Summers has reportedly been patching up a reportedly testy relationship with Vice President Al Gore.

Unfinished business

Rubin effectively conquered a key domestic ill -- the budget deficit -- but he still has unfinished business, particularly on the international front. Economic potholes abound overseas. Rubin's latest mantra has been about the need for a "financial architecture" to brace world markets for the turmoil that began in late 1997.

A recent manifestation of that "financial architecture" effort has been a new web site, hosted by the Organization for Economic Cooperation and Development, that displays the external debt of an array of developing countries.

Coming over from the president's specially-formed economic council, Rubin took office in 1995 just as Mexico's peso crisis cropped up. In the face of Congressional heel-dragging, he crafted a loan program. The loan was eventually paid back ahead of schedule and at a profit.

On the domestic front, Rubin has focused on reducing the U.S. deficit, maintaining a solemn respect for an independent Federal Reserve, and educating the U.S. work force.

Internationally, he has stood for cracking closed world markets, keeping the U.S. dollar strong, and setting up a "financial architecture." But he has been thrust into a role as a financial fireman ever since the Thai baht plummeted in 1997, triggering a raft of world market crises.

Since then, Rubin has helped engineer more than $100 billion in aid packages -- many of which supported by U.S. funds -- for nations such as Brazil, Russia and South Korea.

The latest speculation about a possible resignation has been fueled in part because some of those troubled world markets appear to be recovering from their dyspepsia.

One loose end, Russia, is eager to collect the rest of a $22.6 billion IMF aid package -- of which some $5 billion has already been sent. The remainder is on hold until Russia meets IMF requirements on issues such as cracking down on corruption, changing its tax law and keeping a tight fiscal policy. But hammering out new plans is going to be tricky now that Russian Prime Minister Yevgeni Primakov pulled the plug on plans to visit the United States -- and meet with Treasury officials -- because of the Kosovo crisis.

What Rubin brings to the table

Advisors say what makes Rubin so adept at his post is his unwavering commitment to being practical, using a mathematician's penchant for probability -- above political considerations.

It hasn't always been so effortless. In his earliest days at Treasury, Rubin was robotic, sticking closely to the script in testimony. Now he is cautious about his words, but relaxed. All the while, he has kept his ear close to Wall Street.

Rubin's trump-card access to Wall Street's commercial banking citadels has been used judiciously - if not always sparingly.

Earlier this month, recognizing that only private capital will keep Brazil afloat, he encouraged private banks to keep their cash flowing there.

-- by staff writer Jamey Keaten

|

|

|

|

|

|

|