|

Schizoid season for IPOs

|

|

March 31, 1999: 2:49 p.m. ET

Early 1999 saw the debut market split between Net winners, non-Net losers

|

NEW YORK (CNNfn) - For Internet companies going public last quarter, this was one of the best seasons of all time, but non-connected offerings got a chilly reception when they tried to sit at the IPO table.

Counting the quarter-closing $2.3 billion debut of Pepsi Bottling (PBG) March 31, more than 70 companies have fought their way through the pipeline to make it to Wall Street this year. This is a substantial upturn from last year's lukewarm offering calendar, and ordinarily would be reason for IPO watchers to celebrate.

Furthermore, the quarter gave birth to a number of stunning offering-day rallies, including three of the five largest first-day leaps of all time.

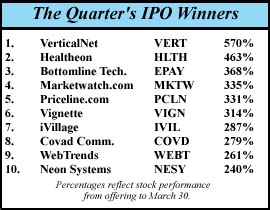

Marketwatch.com (MKTW) set the season's high-water mark in January with its blockbuster 473-percent opening gain, the second-best IPO performance ever, only to be joined by Healtheon 's (HLTH)'s 292-percent birthday surge and Priceline.com's (PCLN) 331-percent opening climb.

Gloomy without a Net

However, investors' fascination with Internet debuts masked a widening and ominous split in the overall IPO market. Excluding the 26 Internet or Internet-heavy companies going public this quarter, only 44 IPOs have made it to the market in the last three months, a substantial downturn from last year's already narrow market conditions.

Moreover, nearly half of the non-Web IPOs now are trading well below their initial pricing levels, while another seven of the offline debuts have made only minimal progress.

On average, non-Net companies going public this quarter have made less than a 7 percent premium for their underwriters and early investors -- a miserly return on risk, given the number of outright declines in the group.

This overall weakness in the non-Internet IPO market is reflected in weakness in the broader small-cap stock market.

In sharp contrast to the more prestigious Dow industrials or the S&P 500 index, the Russell 2000 small-cap index has retreated as much as 11 percent over the last three months, making the non-Net IPOs' poor performance seem almost tempting in comparison.

The offline hall of losses

Among the biggest of the quarter's disappointments, Del Monte Foods (DLM) is down 21 percent from its starting price of $15 and teleconferencing provider Vialog (VLG) has stumbled a full 50 percent from its own starting block of $10.

Finance companies were most numerous among the losers, with only South Jersey First Capital (SJFC) seeing substantial gains in its first quarter of trading. Together, the eleven finance-oriented offerings that made it to Wall Street so far this year are down nearly 6 percent on average from their debuts, crushing earlier hopes that finance companies, and insurance in particular, could be the "Internet IPOs of 1999."

Likewise, the biotech sector, one of the market's favorite flavors before the Internet, found its previous triumphs largely forgotten this quarter. So far, the biotech class of 1999 is split between a loser, Invitrogen (IVGN), and a winner, Albany Molecular Resarch (AMRI).

Software and, at last, the Net itself

Software offerings had a better time staying in the plus column, perhaps because Net-hungry investors sometimes found it difficult to discern between pure Internet plays and the software companies that provide e-commerce applications, security and other services.

Of the software firms going public this quarter, only SERENA Systems (SRNA) disappointed the market, falling 8 percent off its starting highs. Other programming houses -- ranging from Perot Systems (PER) to Onyx Systems (ONXS) -- were firmly in the black, with Internet-intensive Neon Systems (NESY) even joining the elite list of the season's biggest winners with a 240-percent overall gain.

Telecommunications companies were also a relatively safe bet as the sector moves toward complete convergence with the Internet holy grail. Covad Communications (COVD), which provides digital telecom services to Internet companies and other corporate customers, was another of the quarter's big winners, while none of the three other telecom IPOs was trading in the red.

As for the pure Net debuts, the gap between the market's online darlings and the neglected rest of the world became almost unbridgeable. On average, the 24 pure Internet offerings climbed 210 percent in their first quarter of trading, a stark contrast with the non-Net average loss of 6 percent.

Even the Web laggards outpaced all but the most successful offline debuts, while the true superstars like VerticalNet (VERT), with its 570-percent cumulative gain, made the rest of the market seem insignificant.

Next season's debuts

With these figures in mind, it is no wonder that the spring IPO calendar is packed with Internet hopefuls like Razorfish, iTurf, eToys and Marimba, but also with non-Web companies praying for crumbs from investors devouring the virtual banquet.

One early warning sign is the preponderance of familiar names on the list. Many companies postponed their debuts in recent weeks, citing unforgiving market conditions, but they are set to try again over the next few months.

These companies, which include such names as Consol Energy, Implant Sciences and Destia Communications, tend to be much bigger and better-established than their wired competition for investors' attention. However, in the market's current state of mind, this fundamental advantage is unlikely to do the non-Nets much good.

One star in sight for the non-Nets is the long-awaited debut of Goldman Sachs, set to raise as much as $2.1 billion when it goes public sometime in May.

If anyone can lure investors back to the bottom lines -- and not necessarily the Bottomlines (EPAY) -- that offline companies offer, it could be the venerable investment firm, the last of Wall Street's great partnerships. Between now and then, though, the "I" in "IPO" is likely to stand at least as much for "Internet" as for "initial."

-- by staff writer Robert Scott Martin

|

|

|

|

|

|

|