|

AOL has 3Q profits

|

|

April 27, 1999: 6:36 p.m. ET

Online-service provider beats Street as subscriptions revenue jumps 50%

|

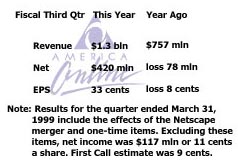

NEW YORK (CNNfn) - America Online Inc. Tuesday reported a fiscal third-quarter profit of $117 million, beating Wall Street estimates as the No. 1 online service provider added nearly 2 million members to its service.

Excluding the results of the recently acquired Netscape Communications Corp., the Dulles, Va.-based company reported an operating profit of 11 cents a share on $1.1 billion in revenue. Analysts polled by First Call expected AOL (AOL) to report a profit of 9 cents a share.

AOL easily outstripped last-year's third-quarter performance when it reported a profit of $39 million, or 4 cents a share, on $704 million in revenue.

AOL shares fell 7 to close at 155 on the New York Stock Exchange prior to the announcement. Its shares dropped to 151 in after-hours trading on the Instinet trading system after the announcement.

New sources of revenue

Analysts said AOL is clicking on all cylinders even as it works to integrate Netscape into the company.

"The company is really a well-oiled machine at this point," said Lise Buyer, an analyst at Credit Suisse First Boston. "What's most impressive is the incremental revenue per customer they were able to generate - meaning the extra advertising and commerce revenue on top of subscription fees."

AOL said its advertising and e-commerce revenue jumped 101 percent to $157 million.

The company also added 1.8 million new subscribers to its service, bringing its worldwide membership to 16.9 million. Unlike Web portals, AOL's user base directly translates into revenue.

AOL's subscription revenue increased 50 percent from last-year's third quarter to $869 million.

"This was a pivotal quarter for America Online," said Steve Case, AOL chief executive officer. "Through key acquisitions and partnerships, we substantially broadened and deepened our capabilities, and advanced our leadership in interactive services."

AOL's third-quarter figures don't include income results from Netscape and other one-time items. Including those figures, the company posted a net income of $420 million, or 33 cents a share, as revenue jumped 66 percent to $1.3 billion.

Excluding one-time items, however, AOL took a slight hit to its earnings as a result of the Netscape integration. Excluding pre-tax gains of $567 million and a $103 million charge for the Netscape merger, AOL's consolidated net income (that is, including Netscape) amounted to $109 million, or 9 cents a share.

Mike Kelly, AOL chief financial officer, said the Netscape acquisition should be "slightly accretive" to AOL's earnings in subsequent quarters.

Expanding the brand

AOL recently closed its $10.2 billion acquisition of Netscape. AOL hopes the deal will further extend its already well-established brand and expand its electronic-commerce business.

But the deal has had ramifications beyond the companies directly involved.

Case is scheduled to give a deposition on May 7 to Microsoft Corp. (MSFT) lawyers, who argue the deal undercuts the government's long-running antitrust case against the company.

AOL entered into other deals and joint ventures during the quarter to expand its brand and its service offerings.

In February, AOL acquired movie-ticketing and listing company MovieFone Inc. for $388 million, which Case said should represent a new source of e-commerce revenue. AOL expects the deal to close next month.

The company has also been working to position itself at the forefront of high-speed Internet access, signing deals with Bell Atlantic Corp. (BEL) and SBC Communications (SBC) to offer digital subscriber line service in those carriers' regional areas.

"More such alliances are likely in the future as we work to make the promise of broadband a reality for millions of users," Case said.

|

|

|

|

|

|

America Online

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|