|

AT&T, MSFT near deal

|

|

May 4, 1999: 7:43 p.m. ET

Source says talks ongoing in wake of AT&T-Comcast compromise

|

NEW YORK (CNNfn) - AT&T Corp., fresh from signing a truce with Comcast Corp. over the buyout of MediaOne Group Inc., is close to following up the blockbuster move with an even bigger deal -- a partnership with Microsoft Corp.

As talks roll on, Microsoft is considering whether to invest about $5 billion, for a 2-percent to 3-percent stake in AT&T, one source close to the talks told CNNfn.com.

Microsoft, in exchange, may be looking for a commitment AT&T would rely on Microsoft's Windows operating systems in set-top boxes -- as one of many outstanding issues.

The success of any partnership is not yet certain, the source said, and the situation is very fluid -- which could change at any time.

By nabbing the leading role in the cable business through its MediaOne buy, AT&T would become an important player in setting a standard for set-top boxes in the future.

Microsoft would like a role in providing software that would help those set-top boxes run.

Microsoft officials declined to comment on the reports, and AT&T Chairman C. Michael Armstrong, while not confirming the deal specifically, said if AT&T and Microsoft do link up, it would not include an exclusive vendor arrangement.

"We will not have a discussion or transaction that would be exclusive," he said in a conference call with analysts. "There will be no exclusivity."

But a partnership between AT&T and Microsoft could have huge consequences for the future of high-speed data, voice and video.

The two could bring to bear their hefty cash resources and affect the development of what standards will be used to provide high-speed, or "broadband," communications.

The dawn of high-speed digital

The uncommon, and somewhat unlikely, expression of comity between AT&T and Comcast points to just how importantly the two perceive high-speed telecommunications infrastructure as the Digital Age dawns.

While unable to enter the local phone market through deals with the regional telephone companies, AT&T has rushed headlong into the cable business in a wily effort to sidestep that.

Instead, AT&T can use the high-speed, or "broadband," transmission abilities of cable -- much of which linked straight to millions of U.S. homes.

AT&T approached Comcast Monday, while the cable company was frantically trying to line up cash to beef up its spurned $48-billion bid from the likes of Microsoft (MSFT) and America Online (AOL). However, once AOL passed, Comcast's options narrowed considerably, prompting the two rivals to try to hammer out a compromise.

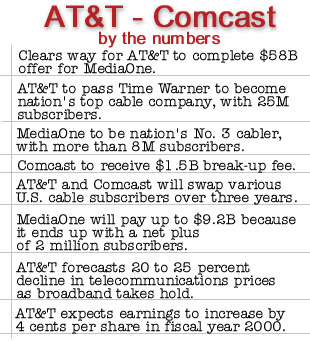

Under terms of the complicated deal, AT&T and MediaOne will give 2 million cable subscribers to Comcast, allowing the Philadelphia-based cable giant to firmly plant its footprint across mid-Atlantic states.

"This is a marvelous resolution for Comcast," Brian Roberts, president of Comcast, said, insisting the cabler can now boost its territory, roll out telephone service and build into "clusters" -- mainly across mid-Atlantic states.

The go-ahead for AT&T's deal -- which still could face another competing offer -- could rankle the regional phone companies, known as Baby Bells, and consumer groups that fear a new AT&T monopoly in cable.

Bell Atlantic spokesman Eric Rabe said AT&T is playing down the numbers about how many homes it will reach through a deal with MediaOne.

"[AT&T] has access to well over half of U.S. homes, about 60 million, " Rabe said. "It has unregulated, exclusive access and no one else can use their systems."

AT&T just bought Tele-Communications Inc., the No. 2 U.S. cabler, earlier this year. It has plans to line up with the cable leader, Time Warner, to deliver its branded phone service, and now wants No. 3 MediaOne.

"Anybody in the industry ... in the country ... has to be concerned about the power that it puts in AT&T's hands," said Rabe.

Tim Klein, a spokesman with Atlanta-based BellSouth Corp., said the company isn't ready to say whether it opposes a deal between MediaOne and AT&T.

Meanwhile, consumer groups, clearly remembering the days before the break-up of AT&T's phone monopoly in 1984, could pose a potent threat to any MediaOne buy.

"It's more of the same, and the same is an ever-tightening oligopoly at the heart of the cable TV broadband Internet industry," said Mark Cooper, director of research at the Consumer Federation of America.

AT&T will have more than 25 million customers -- and access to about 13 million more through prospective partnerships with cablers such as Time Warner Inc (TWX), the parent of CNN and CNNfn.

"Armstrong has a problem. He has locked up so many lines that he really violates the anti-trust laws in terms of concentration of market power," Cooper said. "He's trying to get below the radar screen of the anti-trust authorities."

AT&T insists it will improve the competitive landscape and help lower prices for high-speed transmission of many services such as local phone, data and video by 20 to 25 percent in coming years.

For all its preaching about the benefit AT&T offers to bring to consumers, the nation's top long-distance provider -- now poised to become the biggest cable service firm too -- could face regulatory scrutiny.

It's still early -- a AT&T-MediaOne deal hasn't closed. But regulators will get their shot. Federal Communications Commission officials and perhaps the Department of Justice are likely to look it over.

But those close to the deal said AT&T appears to have made an important early concession by agreeing to hand over some 2 million subscribers to Comcast as part of their accord.

"There is a lot of wisdom in selling off some subscribers because it just eases that regulatory question, " said Roberts in an interview with CNNfn Wednesday. "This hastens the time when there is real competition in local phone."

AT&T comes away without having to protect its $58 billion buyout of MediaOne, seen as an important move for its survival in the upcoming era of high-speed telecommunications.

The prospect other cable companies could find their way onto AT&T's plate next -- or at least into partnerships with Ma Bell -- led those shares higher Wednesday.

Several are family-owned or controlled: Cox Communications (COX) rose 3/4 to 79 Adelphia Communications (ADLAC) rose 2-7/16 to 73-1/16; Cablevision Systems (CVC) -- AT&T has a 30 percent stake in it already -- rose 2-1/2 to 80-15/16.

-- by staff writer Jamey Keaten

|

|

|

|

|

|

|