|

CNNfn market movers

|

|

May 6, 1999: 2:59 p.m. ET

Retailers, software firms benefit as consumers keep spending and surfing

|

NEW YORK (CNNfn) - It was dress-up-the-portfolio day Thursday as investors tried on stocks of retail and specialty stores for size, particularly after reports of stronger-than-expected same-store sales during April.

Shares of software makers geared toward the Internet also got a lift as several of them reported better-than-expected first-quarter earnings.

Neiman Marcus Group (NMG) jumped 1-3/8 to 25-9/16, Federated Department stores (FD), which owns such fabled retailers as Bloomingdale's, Burdines and Macy's, rose 1/2 to 49. All three reported double-digit sales gains during April. Tommy Hilfiger (TOM) shares jumped 2-3/8 to 73, while Children's Place Retail Stores (PLCE) shares surged 6-1/16 to 45-9/16. Children's Place also announced record sales of $92.6 million for the first quarter, ended May 1, an increase of 65 percent from sales of $56 million for the same period last year. Comparable-store sales for the first quarter increased 32 percent, compared with a 7 percent increase for the first quarter of 1998.

Not faring as well were Sears Roebuck (S) and Gap (GPS) Both saw their shares decline after reporting lower-than-expected April sales figures. Sears said sales declined 5.6 percent, while sales at the Gap rose a much lower-than-anticipated 1 percent. Sears shares rose 1/2 to 49-1/16 while Gap shares fell 6-1/8 to 63-1/4.

Outpacing both was Wal-Mart (WMT) The No. 1 U.S. retail discount chain and world's largest retailer said its same-store sales rose 4.9 percent in the month, less than analysts' forecasts.

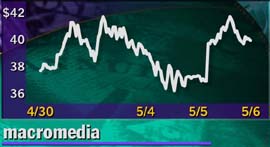

Macromedia (MACR) shares rose 3-1/8 to 40-1/4 after the technology company said its fourth-quarter earnings report beat consensus estimates. It reported a profit of 16 cents per share, 3 cents ahead of the consensus estimate, according to analysts polled by First Call Corp. Revenue rose to $44 million, from $30 million. Macromedia develops software and other technology that enhances the way Web pages are viewed on the Internet.

Actel (ACTL) shares rose 9/16 to 12-11/16 after it said it completed its goal of reducing its global work force by 6 percent, a move intended to boost the company's focus on developing new products. The job cuts will produce a charge in the neighborhood of $4 million in its current quarter, though the long-term prospects for the company look positive, analysts said. Actel is an integrated circuits maker.

Ampilion (AMPI) rose 1-1/16 to 12-1/2 after the high-tech leasing firm's board said it approved a repurchase of as much as 5 percent of the company's outstanding stock. That adds up to as many as 600,000 shares.

@Home (ATHM) jumped 7 to 161-15/16 on expectations that it and Road Runner may form an arrangement to offer cable Internet access in the U.S. Discussion about the possible arrangement emerged following AT&T (T)'s pending purchase of MediaOne Group (UMG). At Home is the No. 1 high-speed Internet access provider in the U.S. while Road Runner is No. 2. Excite (XCIT), the Internet directory firm being acquired by @Home, rose 5-5/8 to 165-3/8.

Cabletron Systems (CS) rose 1-1/16 to 10-3/4 after the computer-networking company said it may sell or spin off parts of its businesses to boost the value of the firm. Cabletron makes products used to link computers to the Internet.

Cell Pathways (CLPA) rose 1-3/16 to 11-3/16. The biotechnology company reported positive data from a trial of its "Prevatac" drug in prostate cancer patients.

Elegant Illusions (EILL) rose 21/32, or 30 percent, to 2-7/8. The jewelry retailer said it will develop an Internet site to sell its jewelry online within the next three to four months.

National Semiconductor (NSM) rose for a second day, gaining 1-3/4, or 10 percent, to 19-7/16 after the maker of chips for cars, phones and computers said it will exit its money-losing personal computer processor business.

Qwest Communications (QWST) shares rose 3-3/8 to 87-1/8 after the Internet communications company said its shareholders approved a measure to increase the number of authorized Qwest shares to more than 2.02 billion from 625 million. A portion of the additional shares will be used for the company's upcoming 2-for-1 stock split, set for May 24. Company officials said the remaining shares will be used to support Qwest's continued global expansion and other strategic initiatives.

Lernout & Hauspie Speech Products (LHSP) stock jumped 2-1/8 to 40-7/16 after it said it signed an agreement with Intel Corp. (INTC) to develop e-commerce and telephone solutions using its speech and language technologies. Intel already had committed to investing $30 million into Lernout & Hauspie.

Dames Moore (DM) shares jumped 3 to 15-5/16 after engineering planning firm URS Corp. (URS) said it will pay $16 per share to acquire the company, a 30 percent premium over Dames' closing price Wednesday of 12-3/8. URS said it also will assume about $300 million of Los Angeles-based Dames' debt, bringing the total value of the transaction to approximately $600 million.

Radio One (ROIA) rose 8-1/2 to 32-1/8 in the radio station owner's first day of trading following an initial public offering Wednesday of 6.5 million shares at 24 apiece. That's a 35 percent gain in two days on the stock.

And there was a little bit of fun and games Thursday on Wall Street. Premier Parks (PKS) rose 7/8 to 36-1/2 after the amusement park operator said it bought Mexico's biggest theme park for $59 million and also agreed to acquire a large water park in Houston. Premier Parks operates "Six Flags" amusement parks.

|

|

|

|

|

|

|