|

AT&T, Microsoft seal deal

|

|

May 6, 1999: 8:02 p.m. ET

Microsoft could double access to AT&T cable set-top devices for $5B stake

|

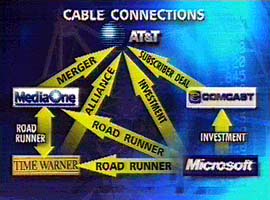

NEW YORK (CNNfn) - Marrying two premier names in technology, AT&T Corp. and Microsoft Corp. announced Thursday an alliance to speed up the launch of cable-based broadband and Internet services.

In its biggest external investment to date, Microsoft will buy $5 billion worth of AT&T stock in exchange for more access to the long-distance giant's newly bought cable networks.

AT&T will use some of that cash for its $58 billion deal, officially concluded Thursday, to acquire No. 3 cable company MediaOne Group Inc. (UMG) -- making AT&T the biggest cabler in the nation.

With new cable networks under its belt, AT&T will have a major role in determining the future of so-called "set-top boxes" used to deliver communication and information service via cable into the home.

The Microsoft-AT&T deal will give the Redmond, Wash-based software giant a leg up in crafting the software systems that will run those television set-top devices.

AT&T (T) already had agreed to use Microsoft's Windows CE-based systems in 5 million set-top boxes. The deal Thursday expands that by 2.5 million to 5 million boxes.

The deal allies two cash-rich leaders of technology behind AT&T's cable-oriented vision -- what some call a gamble -- about the what the future of high-speed, or "broadband," communications will look like.

"What today's announcement means is a mutual commitment to make this work," said C. Michael Armstrong, AT&T's chairman and chief executive officer, during a conference call Thursday morning.

Once staid and bedeviled by the telecom revolution, Armstrong's AT&T is in the midst of a full-tilt makeover for the Information Age; lining up Microsoft marks a stamp of approval.

"[The deal] puts a halo on AT&T as a broadband play, not just an old-fashioned telephone company," said one analyst whose firm worked to craft the partnership.

First rivals, then friends

Marking a seemingly all-conciliatory mindset, AT&T inks its partnership with Microsoft just days after the two companies were in a staring match over MediaOne.

Earlier this week, Microsoft held talks with Comcast Corp. (CMCSK) about how they could boost the Philadelphia-based company's $48 billion offer for MediaOne, one AT&T had trumped two weeks ago with its bid.

But sensing its best bet was alliance over antagonism, AT&T struck an accord with Comcast, extending to it a $1.5 billion break-up fee and two million new cable subscribers for dropping out of the bidding.

That step paved the way -- what Armstrong called a "catalytic" event -- for the partnership with Microsoft.

As one advisor to the AT&T-Microsoft conversations put it late Wednesday: "One minute you're knifing the other company, but you realize you have to wake up next to them."

And in that same train of thought, Armstrong reached out Thursday to another potential foe, America Online (AOL).

If the MediaOne deal goes through, AT&T will add its cable assets into an empire built by No. 2 cable player Tele-Communications Inc., which AT&T acquired in February. Its direct reach will be more than 25 million homes.

Competitors say however that AT&T, through buyouts and partnerships, will have access to more than 60 percent of cable households.

That prospect of near-dominance of cable unsettled AOL, to the point that it too spoke with Comcast about how it could contribute in an effort to stave off AT&T from MediaOne.

A key AOL asset is online content; a near-monopoly in cable could give AT&T leverage in determining how, and at what cost, that that content arrives to consumers' computers.

But in what is rapidly appearing to be Armstrong's style, he took pains to explain AT&T is looking to sit down with AOL, and said his company has no desire to reach into a content realm.

"We've had some starts and some stops with America Online," said Armstrong. "The way a network operator like we make money is with network traffic ... we just haven't been able to get together."

AOL, Baby Bells threatened

Despite that talk, AOL still faces challenges. AT&T owns nearly half of high-speed Internet service provider @Home (ATHM) and will get a stake in @Home's rival RoadRunner through the MediaOne buy.

RoadRunner is part owned by Time Warner (TWX) parent of CNN and CNNfn.

AOL and the regional Bell companies that have long rivaled AT&T may find themselves shut out of cable, and relying on an alternative technology called Digital Subscriber Line. That is also capable of high-speed transmission.

The pact Thursday, willy-nilly, defines two camps as the Information Age dawns: AT&T and Microsoft opposite the "Baby Bells" AOL and MCI WorldCom -- a AT&T rival in long-distance.

Microsoft is betting that the majority of consumers will get their high-speed Internet connections through TV set-top devices. By putting Windows CE on as much as 10 million AT&T-manufactured devices, the company is working to secure its foothold on non-PC-related devices.

Armstrong insisted there would be no "exclusivity" extended to Microsoft or any other suppliers looking for access to the set top boxes -- and he said that Microsoft's rival Sun Microsystems is likely to be a partner also in providing software for its set-top systems.

A pact, by the numbers

The deal calls for Microsoft (MSFT) to pay $5 billion for newly issued AT&T convertible trust preferred securities and warrants priced at $50 per security.

Those securities, convertible into 66.7 million shares of AT&T common stock at a price of $75 per share, have a 30-year maturity.

The warrants can be exercised after three years to purchase 40 million AT&T common shares at the $75 share price. The conversion feature can be terminated after three years by either party under certain conditions.

Microsoft will also acquire MediaOne's 29.9 percent stake in Telewest Communications, a British cable television and telecom operator.

For its part, AT&T agreed to license and deploy Microsoft's client-server interactive-TV software in two unidentified cities by the second quarter of 2000 and in a third city at another unspecified time.

AT&T said it expects the accord to increase earnings 1 cent to 2 cents per share in fiscal 2000. Microsoft Chief Financial Officer Greg Maffei said the partnership would not hurt Microsoft's earnings, noting that the impact on its revenues would be "relatively immaterial."

After the deal, shares of Dow component AT&T closed up 5 to 61-15/16. Microsoft shed 1-3/16 to 77-15/16.

-- by staff writer Jamey Keaten with additional reporting by Tom Johnson

|

|

|

|

|

|

AT&T

Microsoft Corp.

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|