NEW YORK (CNNfn) - The visits occur every few months and they are almost always the same: she'll grill you about some of the most intimate details of your life and then she'll ask for money.

She's not your shrink, or even a blackmailing ex-lover.

She's your financial planner and what happens at these meetings could largely determine your pecuniary future.

Do you need professional help?

Not everyone needs a financial planner.

While experts agree it's never too soon to start thinking about your financial future, professional financial planning is generally reserved for those whose income and assets have gone beyond a monthly paycheck.

However, there is a wide range of reasons for you to seek out a financial planner that you may not have considered.

You may not have the time or expertise to assess your own financial situation or you may want to get a professional opinion on a financial plan you have developed yourself.

You may have an unexpected life event, such as a birth, inheritance or major illness, which you need to know how to deal with. Or you may want improve your current financial situation but don't know where to start.

"People often confuse financial planning with investing, but financial planning is much broader than that," said Noel Maye, spokesman for the Certified Financial Planner Board of Standards.

Financial planning relates to what kind of a life you want to lead. While investing may be one element of that, it may also include home-buying, caring for an aging parent or funding a child's college education. Financial planning also helps prepare you for significant life changes, such as a long-term disability, retirement or death of a loved one.

Everyone's financial goals are different and a good financial planner is one who is willing to help you work toward your individual goals.

Your first encounter

If you're just starting out, it is probably a good idea to set up meetings with three or four prospective financial advisors.

Since most planners don't charge for initial consultations, the meetings will enable you to choose among different personalities, planning approaches and means of compensation.

Above all, your aim should be to find someone you feel comfortable with, so that you can develop an appropriate plan together.

"The consumer has to be an active participant in planning for their future," said Maye. "You need to work with the financial planner so he or she can educate you in the process."

Generally, you will need to meet with your planner about every 3 to 6 months, depending both on your preference and the extent of the plan. Initially, you may meet more often as you establish your goals and how to achieve them.

Getting help

Because not one overriding qualification or degree validates financial professionals, finding out if a financial advisor is legitimate can be tricky.

Financial advisors may be trained in insurance, securities or estate planning, for example, and may be certified by one or more professional boards or organizations. Generally, they are regulated by whichever body governs their specialty. Anyone who is paid to give securities advice, for instance, would be regulated by the Securities and Exchange Commission.

The task of separating the cons from the genuine article is further complicated because the term "financial planner" is not regulated by any state or federal body and anyone can legally claim to run a financial consulting business.

"There are a lot of people out there using the financial planner term who are salespeople and are not providing advice," said Maye.

As a result, you'll want to carefully assess the background of any prospective planner, a process many consumer neglect.

"It is unbelievable," said Maye. "People will spend more time planning their vacation than researching the person they are going to trust their future with."

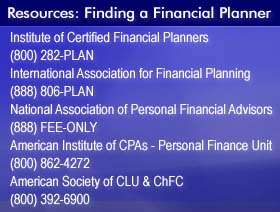

Checking up on a planner may be easier than you expect. A call to the agency that sponsors the planner's credentials will almost always tell you what you need to know.

The acronym game

The most common financial planning designations include Certified Financial Planner (CFP), Chartered Financial Consultant (ChFC) and Certified Public Accountant - Personal Finance Specialist (CPA-PFS).

Each designation comes with its own set of training and qualifications requirements, some more rigid than others. (Click here for definitions of the various designations and what they mean.)

The CFP designation is considered the most reliable by many in the industry, since it requires re-certification every two years and has stringent practice standards and policing methods.

But some advisors say designations come second to experience.

"Whether you have an MBA, a CFA or a ChFC, you're all learning the same material," said San Francisco-based financial planner Mary K. Sullivan said. "I can't say one is better than the other. To me, experience lends more credence than the designation."

A CFA who has only been practicing for six months, for instance, may not offer as much as a planner with a different designation who has been practicing for ten years.

Beyond credentials

Aside from credentials, you'll want to choose a planner whose professional background best meets your needs. If insurance is going to be a big component of your financial plan, you may want a planner who is also a Chartered Life Underwriter. If you are more interested in retirement planning, you'll want an advisor who has a background in stocks.

In addition, you'll want to ask a prospective planner what his or her approach to financial planning is. Some consultants prefer aggressive strategies focused on young clientele, while others take a more balanced perspective aimed at families.

The right planner for you is likely someone whose other clients share needs and agendas similar to your own.

Once you have verified credentials and experience, "it comes down to the issue of a personality match," Elissa Buie, president of the Institute of Certified Financial Planners, said. "You should pick the one with whom you can be the most honest and open with. You need to deal with someone who makes you comfortable."

Because trust is such an important component of financial planning, you may want to get a referral from friends or family members. Other professionals you work with, such as an accountant or attorney, may also be able recommend a competent planner.

In addition, many independent organizations, such as the International Association for Financial Planning or the Certified Financial Planner Board of Standards, provide free referral services.

Considering cost

The cost of financial planning varies dramatically depending on geography, services rendered and the experience of the professional.

In addition, financial planners use different methods to charge their clients. Deciding in advance what method you prefer may help determine which type of advisor you choose.

Generally, financial planners are compensated in one of several ways: by fees; a combination of fees and commission; solely by commission; or through a salary and bonus paid by advisor's company.

Some experts say fee-only advisors have fewer conflicts of interest because they don't stand to make any money off their clients outside of the cost of the consultation.

But others say the type of compensation is irrelevant, as long as billing is spelled out.

Method of payment "is really a personal preference," Buie said. "The issue comes down to competency and disclosure. If an advisor discloses all conflicts of interests, the client should have sufficient information to make a decision. Everyone has conflicts of interest. Simply being compensated by fee does not remove conflict of interest."

Your adviser should fully reveal how much you will be paying for his and her services and what additional charges will be applied for the purchase of products, such as life insurance or mutual funds.

For example, an advisor may recommend a comprehensive plan in which some cash is to be invested in mutual funds. The client would be charged a fee for the plan and a load, or commission, on the investments.

In most cases, fees and commissions will depend on the complexity of your financial situation and decisions you make in implementing your financial plan.

But roughly speaking, financial planners charge anywhere from $75 to $350 an hour and implementation of a financial plan can cost anywhere from $500 to $15,000. Commissions can range from 1 to 7 percent.

Be sure to get any agreement regarding fees and services in writing in your first few visits.

Watching for red flags

There are some warning signs to watch for when choosing a financial planner.

"The most obvious red flag is that thing called intuition," said Maye. "If there is a level of discomfort on part of the person meeting with the planner… they should not get involved."

In addition, if you feel like you are getting rushed into making a decision, you should probably seek advice elsewhere. Financial planning is about preparing for the long-term and there is no need for on-the-spot decisions.

If something sounds too good to be true, it probably is, adds Maye. A financial planner who is guaranteeing unbeatable returns, for example, is probably trouble since ultimately no one can predict how the market will perform.

Finally, if a planner is offering a strong sales pitch for certain products -- a life insurance policy or a particular mutual fund, for instance -- beware. A planner who is more interested in making a sale probably does not have your best interests at heart.

-- by staff writer Nicole Jacoby

|