|

Fed keeps rates steady

|

|

May 18, 1999: 4:20 p.m. ET

Federal Reserve opts to leave interest rates alone but shifts bias to tightening

|

NEW YORK (CNNfn) - The Federal Reserve held interest rates steady Tuesday but said it would consider raising them in the future, citing inflationary pressures.

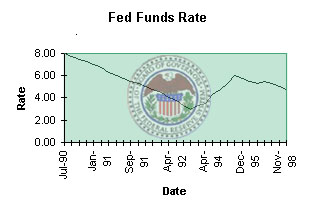

As expected, the Federal Open Market Committee left the federal funds rate, its target for the interest rate banks use to lend money to each other, at 4.75 percent. But it announced it was shifting its bias to tightening rates, from neutral.

That marked the first time in its 86-year history the central bank gave a clue to its future actions on the same day its policy-makers met, in a move toward openness at the Fed.

Wall Street reacted harshly to the news the Fed was considering raising rates. The Dow Jones industrial average tanked more than 100 points, from a modest gain Tuesday afternoon ahead of the announcement to a loss.

But stocks recovered to end modestly lower. The Dow Jones industrial average fell 16 points to 10,837 and the Nasdaq composite index slipped 3 to 2,558.

Gary Thayer, chief economist at brokerage A.G. Edwards, called the sell-off a "knee-jerk reaction." He said the Fed was "prudent" to keep rates steady but told CNNfn he did not foresee the economy overheating. "The long-term economic picture is still very good," he said.

The shift in the Fed's monetary policy toward tightening rates came amid concern inflation was creeping into the U.S. economy. Higher interest rates would slow the economy and inflation, but could also hurt corporate profits and depress stock prices.

The "bias change" means Fed Chairman Alan Greenspan and company are considering raising interest rates in the future to keep inflation in check.

The Fed said it saw "a buildup of inflationary imbalances" with little to keep the U.S. economy in check. "Domestic financial markets have recovered and foreign economic prospects have improved since the easing of monetary policy last fall," the Fed said after its meeting.

Despite that cautionary tone, the bias has not always been a good predictor of how the Fed will act. "For long periods of time, the Fed has tilted towards tightening and not pulled the trigger," said John Williams, chief global markets economist at Bankers Trust Corp. One wag called the moves "tilting at windmills."

Other economists said the strong U.S. economy might force the Fed to act. Doug Porter, senior economist at brokerage Nesbitt Burns Inc., had not expected a tightening bias until last Friday. Now, "we suspect the economy will remain strong enough to warrant a tightening."

Ted Giuliano, fixed-income director at Neuberger & Berman, predicted the Fed's actions would not help a bad market for bonds. The tightening bias "just reconfirms the point that we're in a bear bond market over the short run, and it may last into the summer, unfortunately."

The Fed last cut interest rates in November, the last of three cuts meant to protect the U.S. economy from turmoil overseas.

Tuesday it also left the little-used discount rate at 4.5 percent. That's the rate the Fed uses to lend money to banks overnight in emergencies.

Some analysts had predicted the Fed might raise rates Tuesday following a surprisingly strong consumer price index report May 14, a sign the economy might be overheating.

But the actions by the Fed, which had hinted earlier it might change its bias, did not come as a great surprise.

That means market losses should be short-lived, according to Roy Blumberg, a money manager at Sheer Asset Management. The moves were "pretty close to consensus," he said, "which shouldn't make this too major an event."

The FOMC next meets to discuss interest rates June 29, and the change in its stance suggests it may raise them then.

-- from staff and wire reports

|

|

|

|

|

|

Federal Reserve Board

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|