|

Fidelity takes Intuit stake

|

|

June 9, 1999: 9:28 p.m. ET

Fund manager snaps up more than 10 percent of financial-software developer

By Staff Writer Alex Frew McMillan

|

NEW YORK (CNNfn) - Mutual fund specialist Fidelity Investments and its affiliates have picked up more than 10 percent ownership of software developer Intuit Inc., Fidelity revealed Wednesday.

That makes the investment house made famous by Peter Lynch the largest outside owner of the stock.

Boston-based Fidelity and the other subsidiaries of parent FMR Corp. owned 6.3 million Intuit shares as of May 31, a position worth more than half a billion dollars. Fidelity declared its stake in an electronic Securities and Exchange Commission filing.

Any company or individual who buys more than 5 percent of a public company has to file with the SEC.

A Fidelity spokeswoman declined comment, saying the company does not discuss specific stock holdings. But the vast majority of the Intuit shares, 6.0 million, fall under its Fidelity Management & Research Co., the U.S. investment-management arm overseeing its 283 mutual funds.

Individual fund managers make their own investment decisions, so the Intuit holdings may be spread among a number of the funds. Fidelity fund managers were unavailable for comment as to which mutual funds might own Intuit.

Fidelity's trust-management subsidiary owns another 344,740 Intuit shares. Fidelity International Ltd., the Bermuda-based company that oversees its offshore funds, has a tiny stake of 3,000 shares.

All in all, Fidelity's holdings were worth $548.1 million as of Intuit's Wednesday closing price of 86-27/32. It was up 11/32 for the day. The filing, dated June 10, will likely be filed physically with the SEC Thursday. Fidelity does not say in the filing when it acquired the shares.

Intuit, which develops financial software such as TurboTax and Quicken and is a partner of the CNNfn.com Web site, likewise said it does not discuss individual shareholders.

But only Intuit founder Scott Cook now owns more Intuit stock than Fidelity. And only just. He owned 6.6 million Intuit shares as of last December, or 11 percent of the company, according to a filing with the SEC.

But that share has dropped slightly. Cook sold 3 million shares between October and the end of the year. And Intuit has added around 1.4 million more shares since October, the time of the last proxy, bringing it to 61.1 million shares outstanding at the end of its last quarter. Its fiscal year ends in July.

Intuit is a popular institutional play - more than three quarters of the stock lies in investment houses' hands. Putnam Investments Inc., Janus Capital Corp., Capital Research and Management Co. and Alliance Capital Management all have stakes of more than 6 percent.

The software maker had an encouraging last quarter, outdoing analysts estimates by 3 cents a share.

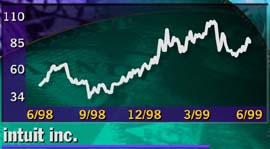

But its large institutional holders have generally been selling Intuit stock recently. It has had a nice run-up over the last year but is off 21 percent from its 52-week high of 110-1/4, which it hit in early April, after it bought private Computing Research.

|

|

|

|

|

|

|