|

Net brokers: What's ahead

|

|

June 20, 1999: 8:08 p.m. ET

Online trades highlight Internet era as old timers jump in

By Staff Writer Jamey Keaten

|

NEW YORK (CNNfn) - While some segments of the new Internet economy have gotten off to a sluggish start when it comes to profits, online brokers are without question enjoying a stellar run already.

The trigger has been the soaring stock market, which has brought out both pure-play Net trading firms and Internet affiliates of some blue-blooded Wall Street houses.

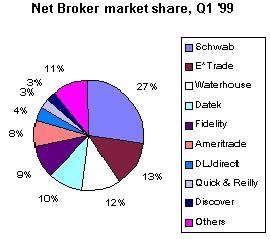

Online trading firms such as E*Trade Group (EGRP), Ameritrade (AMTD) or Datek Online -- full of energy and dressed in brilliant colors to grab attention -- have been on a mad dash. CS First Boston recently estimated that online trading volumes ballooned at their fastest quarter-by-quarter rate to start 1999, at 47 percent in the first quarter, blowing past a previous record of 34 percent. Online trades now account for just under one in six trades in the stock market.

This quarter, Charles Schwab -- a leading discount broker that's hardly a newcomer to the Wall Street game -- is expected to execute more than half of customer trades via the Net.

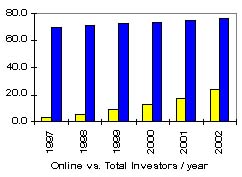

In millions - Source: International Data Corp.

Now, seeing all the bets being made on its nimble rivals, in comes Merrill Lynch & Co. --a thoroughbred of Wall Street -- indicating the other horse shoe is now about to drop.

"Consumers are saying .... if Merrill is doing this, it bodes extremely well for future of online trading," said Dan Burke, senior analyst at the Internet data tracking firm Gomez Advisors.

What Merrill's entry means

Wall Street's biggest bull, Merrill Lynch, announced last week it would, in its typically deliberate fashion, join in on the online trading craze -- first reaching out to its deep-pocketed clients, then to a wider public by December.

That move, said e-commerce analysts, was nothing short of a revolution for online trading. Prudential Securities also is getting into the act.

"A year ago [Merrill] claimed clients had absolutely no interest in online trading," said Paul Johnson, a senior analyst at International Data Corp., a research firm. "It's a major point in the evolution of online investing."

While top brokers such as Morgan Stanley Dean Witter or Donaldson, Lufkin & Jenrette had already spread their online wings, they had preferred to view Internet trades as a separate phenomenon from their traditional business.

Merrill's entry, on the other hand, highlighted what some call a watershed realization by the brokerage - that the Internet isn't just a fly-by-night occurrence, it's forcing the brokerage to recast its entire business model.

Bill Burnham, an Internet stock analyst with CS First Boston, estimates the online brokers processed as many as 499,000 trades per day in the first quarter, siphoning off some business from traditional Wall Street houses.

While a lumbering giant, Merrill is poised to fare well in cyberspace, analysts said. That is because it's got a base of customers that forms its revenue core -- and reaching onto the Net is just another service for them.

Yes, analysts admit, there is the potential for hemorrhaging of customers at Merrill because of the online trading phenomenon -- that's why the brokerage is getting in the game.

The lure of cut-rate trading options is an enticing one for many investors. But in the Internet era, as far as brokers' survival goes, the key, analysts say, will be something Merrill already has: client assets.

In the old world of banking, as you may recall, banks used to make their money off of interest from the loans they gave you. And the more of you -- the customers -- a bank had, the more it could collect in interest.

The young online brokerages don't have that. While they've shown promise in assembling a solid base of devotees, they're still far from the size of Merrill.

Sterling of Jupiter said, for example, that Merrill's assets under management, at about $1.3 to $1.4 billion, amounts to roughly 1,000 times more than an upstart like Suretrade, at about $1.3 billion.

By latest count, Schwab has about $520 billion under management, E*Trade $15.2 billion, Ameritrade, $11.4 billion, DLJdirect, $8.9 billion and Datek about $4.6 billion.

So while online brokers will need to spin their wheels -- by way of a hefty marketing push -- to catch up, Merrills of the brokerage world sit comfortably on their client cash hoards and take their time plotting Internet strategy.

Merrill still faces challenges. Bill Doyle, an analyst at Forrester Research, wrote in a brief that mid-tier online brokerages will chalk up as many as 700,000 new accounts before the bull brokerage offers a per-trade option, at $29.95 per trade, starting in December.

"Online brokers face a lot of challenges with technical issues -- Merrill is no different," said Johnson. "They aren't accustomed to operating at Internet speeds."

Even with Merrill, the pie will get wider for everybody. Gomez estimates the number of U.S-based Internet brokerage accounts will nearly double to 18 million by 2001.

Source: CS First Boston

What's ahead for Net brokers

That's one sign that growth isn't letting up. E*Trade, for example, recently reported its fastest-growing quarter, nudging past a total of 1 million customer accounts.

To be sure, online brokerages have faced troubles. They are no strangers to computer system woes -- and a resultant ire of investors -- and the close inspection of U.S. regulators.

Those are the known problems.

But they have yet to run into a law of Wall Street physics -- namely, that boom times in the market don't last forever. Analysts say that will force them to diversify their businesses for when the market euphoria dries up.

"The market's not always going to go up, up, up," Burke added. "It is important to diversify the revenue stream."

Online firms -- as with many of their "off-line" counterparts -- can expect to ride the wave as only as long as the stock market is at high tide, as it has been throughout the heady 1990's.

So what's the prescription?

It's especially urgent for the "deep discount" online trading firms that have staked a claim in the low-end, cheap trades-only niche - such as Datek, Suretrade, or Ameritrade, experts say.

"[Online brokerages] who are in a 'deep discount' niche are going to have to come up with new revenue stream, or they are going to be in trouble," said Robert Sterling, a digital commerce analyst at research firm Jupiter Communications in New York.

Echoed Burke: "There's a convergence going on in Internet online financial service offerings -- adding cash management functionality to their clients. They can't live on trades alone."

What's happening gradually, analysts say, is that equity trading is becoming a commodity -- and where brokerages are really going to cash in is through value-added services.

That'll mean that, for example, instead of serving as a gateway for profit-hungry traders, brokers will need to offer an array of services, like retirement or estate planning and banking.

There have been early signs of that already. E*Trade, the second most-trafficked online broker, recently said it will purchase the Net banking firm Telebanc for $1.8 billion. And it just launched eoffering.com, a site on which its customers can get in on initial public offerings.

The launch of eoffering.com came just as E*Trade announced plans to reach into the hot online banking business with a $1.8 billion buy of Telebanc. E*Trade participates in CNNfn's Broker Center.

One challenge that companies like E*Trade face is that they are not a known entity in the financial marketplace, and they must establish trust with customers.

The pure-play Internet firms are expected to spend a total of more than $535 billion dollars for marketing in 1999, IDC estimates.

The leading Internet brokers may begin to differentiate themselves further -- with firms such as Datek and Suretrade staking out low-fee terrain, E*Trade and Ameritrade in a mid-level with limited service options, and Schwab and Merrill offering near full-service options.

"It's actually somewhat difficult for them not to be profitable," Paul Johnson, senior analyst for International Data Corp., a research firm, said.

That's because online brokerages not only collect fees from members' trades, which are automatically carried out, but they also collect interest on members' money in their vaults.

"There's a bright future for online brokers -- banking will be a key factor because it'll give [clients] greater control of their assets," added Johnson.

|

|

|

|

|

|

|