|

The business of Medicare

|

|

July 5, 1999: 10:57 a.m. ET

How Washington's health-care debate may reverberate on Wall Street

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - As Washington gears up for what looks to be a long fight over the future of Medicare, health-care companies -- and the people who invest in them -- are closely watching how the reform plans could affect them.

At the center of President Clinton's proposal to revamp the nation's 34-year-old federal health insurance system is a plan to offer partial prescription drug benefits to all 39 million people covered under Medicare. An estimated one-third of senior citizens and disabled people on Medicare currently have no drug coverage.

While the debate is still in its early stages and many observers doubt that the Clinton plan as envisioned will be approved by Congress, analysts say the proposed reforms could have huge ramifications for pharmaceutical companies, HMOs, hospitals and nursing homes.

Especially for drug companies, there could be some tumultuous times ahead as the proposal moves through Congress, predicts Hemant K. Shah, an independent pharmaceutical analyst.

"There'll be a yo-yo" movement in stocks, he said. "It will be dependent on how the wind is blowing in Washington."

How it works

Under the Clinton plan, Medicare recipients could choose to pay a higher monthly premium and in exchange the federal government would pay half the cost of their prescription drugs. Beginning in 2002, the premium would cost an additional $24 and the government would pay a maximum of $1,000 in drug costs a year. By 2008, the extra premium would rise to $44 a month and annual coverage would increase to $2,500. Low-income senior citizens would not have to pay the premiums and also could get a break on the co-payments.

Some drug industry analysts say pharmaceutical companies could see sales rise as a result of expanded prescription drug coverage, particularly for medications that treat hypertension, cholesterol, arthritis, cancer and other diseases that afflict many older Americans.

Senior citizens comprise about 12 percent of the U.S. population, but account for as much as one-third of all prescription drug sales, says the Washington-based Pharmaceutical Research and Manufacturers of America (PhRMA), citing federal statistics. Among the biggest makers of drugs that primarily serve the senior citizen market are industry leaders Merck (MRK), Pfizer (PFE) and Glaxo Wellcome PLC (GLX).

But some analysts think the boost in drug sales through the expanded Medicare plan would likely be very small and warn that the plan could lead to price controls on pharmaceutical companies down the road.

"If any form of drug reimbursement bill is passed, I think it will be very, very negative for the industry -- not for the near term, but eventually," Shah said. He said the U.S. government would become by far the largest single purchaser of drugs, with about a third of the market, and some sort of government control on prices would then be just a matter of time.

"I don't think there will ever be a direct price control," he said. But "competitive price controls" could be on the horizon because "any time when the market is driven by a major purchaser, it becomes a buyer's market," he said.

For its part, the drug industry is taking a wait-and-see approach to the Clinton plan, saying that it supports expanded prescription drug benefits for needy Medicare recipients but that it opposes price controls that could restrict marketplace freedoms and reduce the amount of money that drug companies have available to channel into new product research.

"At this point, what we have are questions," said Jeff Trewhitt, a spokesman for PhRMA. "Frankly, the White House has not been very quick or forthcoming and we're still having details coming in."

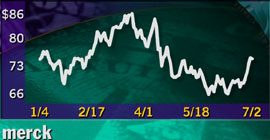

It's been a tumultuous year so far for drug stocks, as this chart showing the performance of Dow component Merck demonstrates.

After Clinton's plan was unveiled last week, drug stocks posted immediate gains. Bolstered by last week's performance, stock prices in the sector were up more than 40 percent in the last two weeks of June, notes James Keeney, a pharmaceutical analyst at ABN Amro.

Keeney said investors were relieved that the Clinton plan did not contain any out-and-out price controls and he predicts that for the year, drug stocks will continue to rebound, exceeding the averages by 10 percent to 20 percent. Like many analysts, Keeney also said he doesn't think the Clinton plan will receive enough support from Republicans to pass.

A big winner?

Experts say that one of the big winners to emerge out of the entire debate could be the companies that handle management of prescription drug programs, such as Express Scripts Inc. (ESRX) and MedPartners (MDM). These companies could see lower profit margins because the federal government would demand volume discounts, but these firms also would do significantly more business, said Bill Bonello, senior analyst at US Bancorp Piper Jaffray.

Warburg Dillon Read last week initiated coverage of Maryland Heights, Mo.-based Express Scripts with a "strong buy" rating and set a 12-month price target of $80. Shares in the company jumped 4-5/16 to close at 68-1/8 Friday.

Performance of Express Scripts stock

over the past year.

Also poised to benefit from the Clinton plan are disease-management firms, which likely would see their patient traffic increase as a result of the plan's provisions for restructuring Medicare coverage, said Lori Price, a health care analyst at CIBC Oppenheimer. Among her picks in this category is Marietta-Ga.-based Matria Healthcare (MATR).

A rocky road ahead for HMOs

Meanwhile, health maintenance organizations that manage Medicare accounts could be in for some rough sailing under the Clinton plan, analysts said.

HMOs once heavily courted senior citizens in an attempt to build up profits, but now say the federal government has cut too deeply into their Medicare reimbursements and they are having trouble keeping pace with rising costs. Already, leading HMOs including PacifiCare Health Systems Inc. (PHSY), Humana Inc. (HUM) and Foundation Health Systems (FHS) are raising the premiums for many of their Medicare patients and dropping some patients in unprofitable markets altogether. Patients will either have to find another plan or revert to traditional fee-for-service Medicare.

The Clinton plan calls for reforming the reimbursement system for these so-called Medicare+Choice plans. Patients would get a discount for choosing cheaper plans, which the Clinton administration says would inject a competitive element into HMO Medicare coverage and save about $8 billion over 10 years.

Coupled with the proposal to add a prescription drug benefit to traditional fee-for-service Medicare, the changes could mean the beginning of the end for managed-care Medicare plans, Price said.

If the Clinton proposal is enacted, "not only would the payments likely be reduced, but that flexibility to say 'this market is no longer profitable' goes away," she said. "If this is what the government is going to propose, it's almost ensuring the demise of Medicare HMOs."

Performance of PacifiCare

stock since late June.

The main draw of these HMO plans is the prescription drug coverage they provide, leverage that would be lost if the Clinton plan is enacted for traditional Medicare, Price said. About 17 percent of Medicare recipients, or about 6 million people, are enrolled in such health plans. PacifiCare, which gets about 60 percent of its revenues from Medicare, is the most vulnerable, followed by Humana, she said.

Other HMOs that manage Medicare contracts include United Healthcare Group (UNH), Cigna Corp. (CI) and Aetna Inc. (AET).

Big hospital companies and physician companies such as Columbia/HCA Healthcare Corp. (COL) and US Oncology Inc. (USON) also are closely watching the debate, analysts said. These companies also depend heavily on Medicare reimbursements.

Other companies watching the proposal include struggling nursing home operators, such as Sun Healthcare Systems and Vencor Inc., which both have been de-listed from the New York Stock Exchange amid major financial problems.

Sun looks to be on the verge of bankruptcy, said Charles Lynch, a health-care analyst at Schroder & Co., while Vencor is in the process of trying to work out a restructuring plan with its creditors so that it can avoid declaring Chapter 11, he said.

The companies blame their woes on a revamped Medicare reimbursement system that went into effect last year as part of the Balanced Budget Act of 1997. After criticism that those cuts were too sweeping, Clinton has proposed setting aside up to $7.5 billion in funds over 10 years to reimburse health-care providers if they can prove that patient care has been hurt by the drop in federal funding. Nursing homes would be at the top of the list for these relief funds, Lynch said.

The nursing home operators also are awaiting more sweeping legislation that is likely to be introduced in mid-July, which revises the so-called Prospective Payment System to provide greater Medicare reimbursement for long-term care operators, Lynch said.

These reform proposals could provide some relief for long-term care companies, but it may come too late for some that already are on the brink of bankruptcy, Lynch said.

"It's arguable that even if legislation is enacted beginning in October, it may be too little, too late for a couple companies in this group," he said. Also, Lynch said, he fears that the issue could get "bogged down in all the political battles that are undoubtedly going to be held on the drug debate."

A long debate

Analysts say that whatever implications the proposals have for companies now, the outlook is almost surely going to change as the plans move forward, with powerful lobbyists from the health-care industry and senior citizens -- a major voting bloc -- playing major roles in the debate.

Many analysts also say that the issue is likely to be around for a while. While many Republicans oppose the plan, arguing it is too costly, many Democrats -- for different reasons - aren't eager to pass sweeping reform either, Keeney said.

"There's a lot of feeling that even the Democrats don't want to pass the legislation this year," he said. "They want to keep it around for next year's elections."

|

|

|

|

|

|

|