|

Picking a credit card

|

|

July 21, 1999: 9:46 a.m. ET

If you're not careful, you may wind up paying big fees, high rates

By Staff Writer Nicole Jacoby

|

NEW YORK (CNNfn) - With a constant flood of credit card offers making its way into your mailbox each week, it may be hard to resist those envelopes promising sky-high credit limits and almost inconsequential interest rates.

But don't be too eager to sign up for these ubiquitous offers, some industry watchers say.

"There's a lot of unbelievable offers out there that sound too good to be true," said Robert McKinley, President of CardWeb.com, an organization which tracks the credit card sector. "A lot of consumers sign up for these deals and don't even realize when they get something different."

In many cases, customers find they do not qualify for the cards advertised and end up with less advantageous cards. Often, the much-touted low-interest rates are too good to last or are associated with hefty fees.

Watching for pitfalls

There are some advantages to these widely-marketed credit card offers. Rock-bottom introductory rates can offer temporary respite from high-interest payments and help some consumers get back on their feet.

And if you use them right, they can bring you much closer to being debt-free. Unfortunately, many cardholders do not take advantage of debt reduction potential these rates offer.

"A lot of people will transfer their balances (to a lower-rate card), but then fail to send more than the minimum due," Michael Kidwell, vice president of Debt Counselors of America, said.

A customer who was mailing in $100 at 19 percent interest, for instance, might reduce that payment to $45 at 3.9 percent interest.

Devil in the details

Because the advantages offered by these so-called teaser rates often come with heavy conditions, it's important to read the fine print before signing up for any credit card offer.

Many issuers advertise benefits that only a fraction of the population will actually qualify for. Most recently, cards with fixed interest rates of about 10 percent have been widely touted, requiring no annual fee and offering credit limits of as much as $100,000.

Upon applying for these cards, consumers commonly receive credit offers that may not even come close to the original deals, based on their income and credit history, but sign up anyway without looking closely at the agreement.

"I hear so many consumers say: 'I didn't know they were going to do this. I didn't know they were going to do that,'" Kidwell said. "But it was probably in the fine print."

Often consumers neglect to notice that introductory rates only apply to certain purchases or balance transfers, that fees may be charged in exchange for those low rates, or that the rates can be changed with as little as 15 days notice.

Paying attention to the fine print will also keep you from getting roped into unnecessary fees.

Low rates = high fees?

An increasing number of card issuers are compensating for lower interest rates by bolstering fees.

"There's been a fee frenzy," said McKinley. "(A wide range of charges) have been beefed up."

Late and over-limit fees have seen the biggest increases in the past few years, with late fees currently averaging $24.02, up from $11.97 five years ago, according to CardWeb. Average over-limit fees have jumped to $23.44 from $12.57 in the same time period. In addition, most major issuers have reduced their late payment grace period from 14 days to 0 days.

Card issuers have also gotten more creative when it comes to fees, finding new areas for which to charge consumers. Some of the more unusual fees established of late include charges for closing your account and for customer service.

Lenders have also upped charges on overseas transaction and on cash advances.

To find out what fees you might be liable for, read your card agreement closely and call your card issuer if you have any questions.

"Credit cards are powerful tools, but they can be dangerous, so you have to read the instructions carefully," said Janet Eissenstat, spokeswoman for the American Bankers Association.

What to look for

Choosing the right card is particularly important for those consumers who do not plan on paying off their balances every month. The card you pick will determine how much you pay for the privilege of borrowing. Consequently, it pays to shop around.

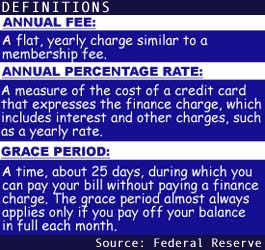

The primary factors to consider are the annual percentage rate or APR, the annual fee and the grace period.

Those factors -- along with your budget and repayment habits -- will help assess how you can get the most out of your credit card.

Consumers who do not pay off their balances each month, for instance, are usually best off choosing a card with a very low interest rate, even if there is an annual fee. That's because the cost of a higher interest rate might exceed the $25 or so yearly charge required by some credit card issuers.

Someone who pays off their balance in full each month, however, will be less affected by the card's APR and should pay close attention to grace periods, annual fees and other charges.

Of course, a low-interest, no-fee card is ideal for most consumers.

Be true to yourself

No matter what your payment habits, how you intend to use your card should also be taken into consideration.

"Cards vary dramatically. Some of them fit your needs more than others," said Kidwell.

For instance, consumers who frequently use their card's cash advance feature should look closely at the conditions involved, as many issuers do not permit a grace period when it comes to ATM transactions.

You'll also want to see if the credit limit is high enough, how widely the card is accepted and the plan's services and features.

Someone who travels frequently, for instance, may benefit from a card that offers frequent flyer miles or additional travel insurance.

Others may be interested in affinity cards, all-purpose credit cards that are sponsored by professional organizations, college alumni associations or other groups you support.

However, don't assume the benefits of these cards will outweigh the cost.

"Don't be swayed by bells and whistles, like reward programs or miles," McKinley said. "A lot of consumers are drawn to these, but if you carry a balance, the interest rate may not be worth it."

Reward cards tend to have higher interest rates than other credit cards, says McKinley, and the higher rate may wipe out any prospective savings.

For people who don't revolve their balances, these cards can offer perks, but only if there is no annual fee.

Credit cards galore!

A mailbox chock full of credit card applications may indicate a strong credit rating, so don't ruin it by applying for too many cards.

Many creditors judge you not just for the debt you have acquired, but for your potential to accumulate debt. You may be rejected for a mortgage, for instance, if you have too many cards because lenders know new homeowners are susceptible to big spending upon moving into a new house.

"There are a lot of odds and ends people like to buy when they move into a new home," Kidwell said. "Banks might see you as a credit risk if you have ten cards, all of which you could max out."

Even applying for many cards can put your credit at risk.

"Creditors get nervous if they see a lot of inquiries in your credit history," said McKinley "They may think you're ready to leave the country or something if you just applied for 40 cards."

In most cases, two credit cards are more than enough: one for everyday use and another as a backup. That way if you lose a card or it gets rejected, you will another source of credit.

While it doesn't matter if both your cards are the same brand (Visa, Mastercard, etc), they should come from two different lending institutions. In the event your identity is stolen or a processing problems ensues, you will be less likely to be denied credit.

For the credit-challenged

For someone who has a marred credit history, a secured credit card may be a viable solution.

Secured cards operate much in the same way most credit cards do. But instead of credit being extended to the cardholder, the cardholder sends a fixed amount - say $500 - to the creditor. The credit card issuer determines the user's credit limit based on the pre-paid amount and the credit history.

In some cases, a 100 percent security is required, in which a the pre-paid amount becomes the credit limit. In other cases, the card will be only 25 percent or 50 percent secured, meaning a cardholder's limit will exceed their down payment.

"This way the creditor risk is minimized, but (the consumer still has the convenience of having a credit card)," said Kidwell.

Provided payments are made on time, secured cards also enable consumers to rebuild their credit.

|

|

|

|

|

|

|