|

Jobs, wages boom in July

|

|

August 6, 1999: 7:18 p.m. ET

Buzz about Fed rate hike mounts as U.S. adds hefty 310,000 jobs in July

|

NEW YORK (CNNfn) - The U.S. economy cranked out jobs and drove up wages at a surprisingly rapid rate last month, virtually assuring the Federal Reserve will raise interest rates later this month.

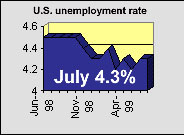

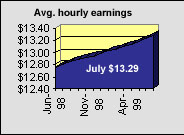

The Labor Department said the economy created 310,000 jobs outside the farm sector in July, far more than the 199,400 jobs economists had expected. And, in an even more troubling development, hourly wages grew a surprising 0.5 percent to $13.29 - the biggest jump in six months. Overall, the jobless rate held steady at 4.3 percent.

The stronger-than-expected report roiled stock and bond markets as investors predicted the Fed will seize on this information to nudge interest rates higher later this month.

On Wall Street, the Dow Jones industrial average tumbled nearly 80 points to close at 10,714 while the bellwether 30-year Treasury bond plunged 1-17/32 of a point in price to 87-9/16. The yield, which moves in the opposite direction, jumped to 6.16 percent.

A nail in the coffin

"This really was the nail in the coffin for the Aug. 24 meeting," Sung Won Sohn, chief economist at Wells Fargo & Co. in San Francisco said, referring to the next meeting of the Fed's Open Market Committee. "I think it implies interest rates will go up faster in the future."

Unemployment remained steady…

Economists said the job-growth figure is virtually certain to drive the jobless rate - already near 29 year lows - down even further in the months ahead, because the labor force isn't growing as fast as the number of new jobs. Job creation in July was more than double the average monthly labor-force growth in the last year -- 154,000.

The Clinton administration praised the rapid job growth in the economy - insisting inflation isn't out of control yet.

"It's going gangbusters," Labor Secretary Alexis Herman said in an interview with CNNfn. "Overall, this is a very balanced report. I think it's much too premature to talk about inflationary pressures on the job market."

…but wages rose sharply.

Fed Chairman Alan Greenspan recently told Congress the Fed's policy-making panel will act quickly -- possibly through an interest rate hike -- to slow the economy and ward off inflation.

"The report is universally strong and is pointing to growth in excess of Greenspan's objectives," Anthony Crescenzi, a bond analyst at Miller Tabak, wrote in a note to clients Friday after the report.

Many economists have said the Fed has been pushing the speed limit on economic growth over the past three years as the gross domestic product grew roughly 4 percent a year. But with no signs of inflation imminent, Greenspan laid off the brakes.

That could be changing this summer. The Fed last raised short-term rates in June. Higher rates tend to slow the economy and cool inflation, but they also slow corporate profit growth by raising borrowing costs -- and that can hurt stock prices.

To be sure, there is a full plate of economic data for the Fed to digest in the run-up to the Aug. 24 meeting, including the consumer and producer prices indexes -- the bellwether inflation gauges.

But the backdrop hasn't been favorable.

The job figures come just a day after reports showed that claims for jobless claims stayed low last week, while gains in productivity -- a key driver of the economy - ebbed in the second quarter.

According to a CNNfn poll conducted Friday, nearly 85 percent of the 25 economists surveyed said the Federal Reserve will move swiftly later this month to head off inflationary pressures.

By the numbers

Average hourly earnings, an inflation indicator closely watched by the Fed, rose a faster-than-expected 6 cents, or about 0.5 percent, to $13.29 an hour. It marks the biggest one-month rise since January; there has not been a rise of more than six cents in a single month since 1983.

The department also said jobs grew faster than first reported in the two previous months. The economy added 273,000 jobs in June -- 5,000 more than first reported.

The job growth cut across most major sectors of the economy. The recently lagging manufacturing sector added 31,000 new jobs -- its first gain since last August, when striking General Motors workers returned to the assembly lines. There were 91,000 jobs added in retail and 110,000 new jobs in the service sector.

Analysts said the manufacturing sector's boom played a key role in bumping up wages during July.

"One of the key reasons payrolls exceeded the consensus was due to a 31K gain in manufacturing jobs, the first gain in 11 months," Crescenzi wrote. "With more of these high-paying jobs in the mix, average wages were pulled higher."

|

|

|

|

|

|

U.S. Labor Department

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|