|

Number-watching on tap

|

|

August 29, 1999: 9:15 a.m. ET

Economic reports including August jobless data will be focus of Wall Street

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - Economic reports on employment growth, manufacturing activity and new home sales will be the focus of Wall Street this week as investors spend their last week of the summer pondering whether interest rates will have to rise again.

The Federal Reserve's widely anticipated quarter-point interest rate increase was the talk of Wall Street last week. Yet even before that action became official, speculation began among investors and other market participants that the Fed may raise rates a third time at its October 5 meeting.

That's why this week's economic reports will be important for the market to watch, particularly Friday's crucial non-farm payroll report, said Elliot Platt, chief economist at Donaldson, Lufkin & Jenrette in New York.

"The market is looking for numbers that will add to the information set regarding what the Fed might do at their Oct. 5 meeting," Platt said. "The odds have been greatly reduced by what happened Tuesday and with the wording of June 29-30 (Federal Open Market Committee meeting) minutes, but we need more information to see if that's true."

A cautious climb

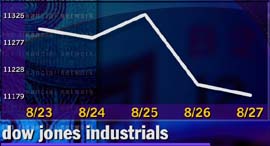

As for how the market interprets those numbers, it remains to be seen. The Dow Jones industrial average, which is still near a record high, ended the Friday 108.28 points lower at 11,090.17, almost the same as where it finished off a week before with a loss of only 0.09 percent. So far this year the Dow is up 20.79 percent.

The Dow closed at a post-rate-hike high last Wednesday, before drifting lower

Further evidence that the economy is continuing to expand rapidly may prompt investors to give back some of those gains this week -- particularly if the numbers begin to reinforce the expectation of a third rate rise by the Fed, Platt said.

Some of those numbers include July's new home sales, to be released Monday at 8:30 a.m. Eastern time. Analysts polled by Reuters expect the report to show 909,000 new homes were built last month, down slightly from 929,000 a month earlier.

Consumer confidence

On Tuesday, the Conference Board releases its monthly index gauging consumer sentiment. Analysts surveyed by Reuters anticipate consumer confidence waned slightly in August, with the index slipping to 133.5 from 135.6 in July. That report is due out at 10 a.m. Eastern time.

On Wednesday, the Commerce Department releases numbers on construction spending and leading indicators, though the big number will be the National Association of Purchasing Management's August activity index. Analysts expect the number to rise to 54.5 from 53.4. That report is scheduled for release at 10 a.m.

Thursday brings economic numbers from the Commerce Department on July factory orders and revised second-quarter productivity gains. Factory orders are expected to have risen 0.7 percent in July, the same pace as in June, while second-quarter productivity likely rang in at 1 percent, down from the initially reported 1.3 percent, according to forecasts.

The big one

The biggest report of them all, though, comes Friday with the Labor Department's release of August's employment data. Analysts anticipate that 206,000 new jobs were added to the economy in August, with the unemployment rate remaining unchanged at 4.3 percent. Average hourly earnings are expected to have risen 0.3 percent following July's 0.5 percent gain, while the average work week probably remained unchanged at 34.5 hours, according to analysts' forecasts.

Earnings

Only a smattering of corporate earnings are expected this week.

On Tuesday, retail food and drug chain Albertsons Inc. (ABS) is expected to report earnings per share of 58 cents for its most recent quarter, up from 52 cents a year ago, according to First Call Corp. Pall Corp. (PLL), meantime, which makes filtration systems for hospitals and fluid production companies, is expected on Wednesday to report earnings per share of 32 cents in its most recent quarter, unchanged from a year ago.

And on Thursday, Campbell's Soup Co. (CPB) is expected to report earnings of 29 cents a share, down from the 38-cent-a-share profit it posted a year ago, according to First Call. Camden, N.J.-based Campbell's last week announced it was retiring its label made famous by Andy Warhol's 1960s paintings, in favor of a more modern look.

IPOs

In the IPO market, a handful of companies will be making their Wall Street debuts -- AmericasDoctor.com (AMDR), Cybergold (CGLD), Gen Trak (GTRK), Oregon Baking (MSEE), PCQuote.com (PCQT) and perfumania.com (PF) PCQuote.com is expected to be the most expensive with its initial offering price ranging from $10 to $12 a share. Oregon Baking will ring in as the least expensive, beginning its debut at $5 a share.

|

|

|

|

|

|

|