|

Planning early retirement

|

|

August 30, 1999: 6:33 a.m. ET

A little foresight and a few cutbacks can make early retirement a reality

By Staff Writer Nicole Jacoby

|

NEW YORK (CNNfn) - Early retirement has become almost a given for many employees in the high-tech sector, as stock options transform many workers into virtual millionaires.

But calling it quits at the ripe young age of 55 -- or sooner -- does not have to be a dream limited to the Internet-savvy.

A little restraint, combined with some tenacity, can put Florida golf courses, bingo games and Caribbean cruises -- or however you picture your golden years -- well into reach.

"I think early retirement is achievable for anyone who seriously wants to do it," said Deborah Voso, a Frederick, Md.-based certified financial planner. "It just may mean you have to cut back on how you are spending your money."

Many workers ill-prepared

The biggest challenge prospective retirees face is figuring out what it will take to live comfortably in early retirement.

It's a calculation many workers discount.

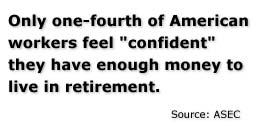

Only half of all workers have even tried to determine how much they will need to save by the time they retire, according to the American Savings Education Council.

And many employees have a false sense of security when it comes to Social Security, with few workers realizing the federal program's eligibility age is being phased up from 65 to 67. Of the 43 percent of workers who plan to retire before they reach 65, one-fourth believe they will be eligible four or more years before they actually will be.

Many workers also commonly miscalculate how long they will have to support themselves after they retire. With lifespan figures higher than ever, many retirees will need to have enough funds to live on for about 20 years, and possibly more, after quitting work.

Estimating costs

Being aware of -- and realistic about -- what type of expenses you will have in old age will improve your chances of a comfortable early retirement.

"People often underestimate how much money it takes to live in retirement," Voso said.

While some expenses will decline, others will rise.

Many would-be retirees misjudge, for instance, the extent their health care costs may change after they quit work. In most cases, Medicare won't kick in until the age of 65 and many company health plans do not extend into retirement. As a result, a pair of early retirees could be looking at $4,000 annually in health care costs.

Early retirees also may need to have larger emergency funds, since they no longer will have a steady income to back them up in the event of an unexpected turn of events. Voso recommends having enough cash to cover six months of living expenses, versus the three-month reserve she recommends for working clients.

On the plus side, mortgage payments and children's college loans may cease to be burdens in the golden years, assuming your home has been paid off and the loans have been taken over by your adult children.

Lifestyle goals also will play a large factor in how much needs to be saved. While some people think of retirement as an age in which to catch up on lost time, others see quitting their jobs as an opportunity to simplify their lives.

"Some people don't have really expensive hobbies and just want to take one nice big vacation a year, especially if their families are nearby," said Voso.

However, because early retirees usually are in fairly good health for at least the first 10 years of their retirement, chances are they will lead active -- and hence more expensive - lives.

"Clearly, many people are spending as much -- if not more -- during the retirement years," said Linda Lubitz, a Miami, Fla.-based certified financial planner. "They're taking more trips, they're eating out more."

Prospective retirees "need to visualize what their retirement will be and then translate that into numbers," Lubitz added.

Doing the math

The bottom line: Unless you already are independently wealthy, most aspiring early retirees will have to make some short-term deferments to achieve their long-term goals.

"People need to put together a good realistic plan and determine where they can make changes in their lifestyle in order to achieve that," said ASEC spokesman Danny Devine. "They also have to be consistent."

Maximizing contributions to a 401(k) plan offered by your company is one of the most effective ways of making early retirement a reality.

But financial planners warn against get-rich-quick schemes and high-risk speculations in your IRA.

"I'm not saying don't be aggressive," said Lubitz. "But you should (use) vehicles like mutual funds where the danger of losing principal through company bankruptcies and the like is virtually eliminated."

A wide range of tools can help transform retirement expectations into action.

The ASEC's retirement personality profile can tell you what retirement planning strategies you may have previously overlooked. And a look at your retirement readiness rating may reveal how well you've prepared so far.

A retirement planner can help determine what sort of funds you'll need to save to stop working early.

Time off not everyone's bag

While it would seem that everyone would welcome a break from years of hard work, early retirement is not necessarily a good idea for everyone.

If you are in a precarious financial situation, early retirement simply may not be worth the stress. People who have a lot of debt and tend to live paycheck to paycheck, for instance, are probably not good candidates.

"You have to be frugal and if you're not a saver now, it's going to be very difficult," said Voso.

Others may come to the conclusion early retirement is not everything it's cracked up to be.

"Retirement is an area where there is a lot of depression. There's only so may 'early-bird specials' you can eat," said Joel Isaacson, a New York-based certified financial planner.

Many retirees find they miss the social interaction and sense of purpose associated with work. Consequently, putting thought into what you will do with your days upon retiring is nearly as important as being financially prepared.

"The worst thing that can happen is that the person who stops working doesn't have a plan in place and asks himself: 'Now what am I going to do for the next 40 years?' " said Lubitz. "Unless they have a plan, they really shouldn't retire."

|

|

|

|

|

|

|