|

An option for the dying

|

|

September 2, 1999: 7:21 a.m. ET

Viatical settlements can ease financial concerns, but also raise questions

By Staff Writer Shelly K. Schwartz

|

NEW YORK (CNNfn) - For the terminally ill, battling the emotional highs and lows of everyday life is enough to contend with already.

Unfortunately, many grappling with AIDS, cancer and other potentially life limiting diseases have to deal with the added stress of financial constraints -- especially if they're no longer gainfully employed.

Will the money hold out long enough? Will they be able to meet their mortgage payments, cover their health insurance? Will they drive themselves, and their loved ones, into debt?

Not easy questions. And the choices they face are harder still.

For some, viatical settlements are the answer. Such transactions enable the terminally ill to sell their life insurance policy to a third party -- either an individual investor or institutional one -- and in return receive a percentage of the policy's death benefit while they're still alive.

But experts and regulators say that while these types of settlements do indeed solve a short-term cash-flow problem, they can also create new ones. The person selling the policy, they add, had better be clear on what it is they're getting out of the deal -- and more importantly, what they're giving up.

"I think what happens is a lot of times when people are diagnosed with a deadly illness they panic and sell their policy to the first person who will give them 75 cents on the dollar," said Tom Foley, director of accident and health division of the Kansas State Insurance Department. "But later on they start to think about the reason they bought that policy in the first place; to take care of their loved ones."

The viatical way

A viatical settlement is defined as the sale of an existing life insurance policy by a terminally ill person to a third party. Upon the sale, the viator -- or seller of the policy -- collects a percentage of the death benefit.

Most often, the viator receives about 60 percent of the policy value -- on a $100,000 policy, the viator would collect $60,000.

From that point on, the new owner of the policy becomes the one paying premiums to the insurance company and would collect the entire death benefit upon the viator's death -- and pocket the $40,000 difference.

(Click here for a story on the risks involved for the investors who buy these life insurance policies.)

It's not kind of financial transaction many of us like to think about. But realistically speaking, advocates of the industry say viatical settlements provide an option for those who might otherwise lose their entire death benefit by missing too many premium payments -- or wind up broke and unable to maintain their current level of health care.

"Many viators who sell their policies say they feel better because they don't have that extra stress," said Valerie Bergman Cooper, executive director of the National Viatical Association. "The relief from financial stress is very important."

Then and now

The viatical industry entered the scene in the late 1980s alongside the escalating number of AIDS patients.

Investors began noticing that thousands of terminally ill patients were having their life insurance policies terminated toward the last few years of their lives, when the money ran out for premium payments.

That enabled the insurance companies to collect payments from these individuals for decades and never have to pay out the benefits.

Viatical settlements became the solution. It's estimated that $500 million in life insurance policies are viaticated each year.

Today, the $3 billion industry is regulated on the state level, but government officials admit it has not been easy. In some states, the industry has been regulated by the insurance commissioner and in others it falls under the auspices of the securities regulators.

"This industry really falls into one of those gray areas, where a lot of state insurance commissioners can't regulate them because they are considered securities instruments," said Bob Martin, a spokesman for the National Association of Insurance Commissioners.

Increasingly, he said, there have been calls among both insurance commissioners and securities regulators to create more uniform oversight rules.

Until then, he said, it's recommended that anyone considering a viatical settlement contact their state insurance commissioner first. In many cases, he said, they can provide literature to help you make a more educated decision, and to suggest other options that may exist.

The choice

Individuals choose to viaticate, or sell their life insurance policies, for several reasons.

Many do so to maintain the quality of their health care, to ease the financial burden on themselves and their loved ones, and to ensure their financial independence.

As for how they spend the proceeds, Cooper said the sky's the limit. "They can use it for anything they want," she said.

There are no rules that dictate how money must be used, but industry data reveal that many who cash out of their life insurance plans spend the money on health care expenses and to meet their monthly obligations -- including rent, mortgage and car payments. In some cases, they are able to completely retire their outstanding debts.

Some, too, distribute the proceeds of their settlement to friends and loved ones, charities and schools. And still others splurge on a dream vacation or start a home-based business so they can continue supporting themselves.

"From an AIDS community perspective, a lot of groups didn't want to get engaged in this because they see it as a gruesome issue," said Jeffrey Crowley, deputy executive programs director for the National Association of People with AIDS. "But people with HIV need options and [viatical settlements] really can be an important means of financial assistance for people who are at the end of their lives."

In some cases, he said, even $10,000 or $20,000 can mean the difference between financial independence and a broken bank account.

But before they make the sale, Crowley said NAPWA always advises individuals to shop around and to seek out professional tax and estate planning advice.

"We always counsel people to never accept the first offer they hear," he said, noting there are a group of viatical brokers who can walk you through the process and do some comparison shopping for you.

Viatical settlements, of course, aren't just restricted to people with AIDS. They're available as an option for anyone with a life-threatening disease.

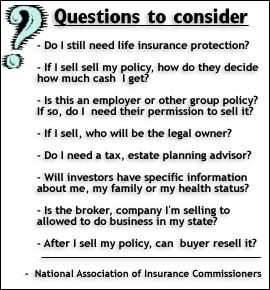

If you, or someone you know, is considering a viatical settlement, you should at least seek answers to the questions laid out in the chart below.

Don't forget

If you do viaticate, the NAIC said you should be aware that the proceeds you collect are subject to the claims of creditors. Moreover, you may inadvertently render yourself ineligible for federal assistance programs, including Medicaid and food stamps.

A few other tips: Make sure the viatical settlement provider agrees to put your settlement process in escrow with an independent party or financial institution to make sure your funds are safe during the transfer. And always ask if you've got the right to change your mind after you get the proceeds. If you do have that right, you'll have to repay the proceeds, of course.

The tax ramifications of entering into a viatical settlement are hugely complex. As such, the NVA recommends all would-be viaticators consult a tax professional first.

But generally speaking, the NVA said it's safe to assume that the Internal Revenue Service deems viatical settlement proceeds tax-free if the original policy holder has a life expectancy of less than 2 years. Certain other criteria must be met as well.

If the viator is not terminally ill, but instead was eligible to viaticate due to chronic illness, there are other tax considerations as well.

Risks

Add to the potential drawbacks of viatical settlements the growing concern about frauds - not just for the policy seller but for the policy buyer as well.

Late last month, Florida Treasurer and Insurance Commissioner Bill Nelson charged American Benefits Services Inc., a South Florida viatical broker, with deception and misrepresentation.

The company allegedly sold to investors blocks of life insurance policies that weren't valid.

"Viatical settlements have been determined as one of the top ten investment scams," said Terri Vaughan, Iowa Insurance Commissioner and Chair of the NAIC's Life Insurance Committee.

To prevent more life insurance holders and policy buyers from becoming victims, the group last month pulled together three draft brochures explaining the pros and cons of selling life insurance policies.

Copies of the brochures, which have not been finalized, are available on the NAIC's Web site at www.naic.org.

Bottom line, it says: always check with a professional before signing anything.

Review your options

Lastly, before you decide to viaticate, you should at least explore your options. The most common alternative for the terminally or chronically ill is Accelerated Death Benefits (ADBs) -- the insurance companies' answer to viatical settlements.

ADBs are a feature of a life insurance policy that, like viatical settlements, allow the holder to collect some or all of the policy's death benefit before the insured dies.

These days, Foley of the Kansas State Insurance Department said nearly all insurance companies include an accelerated death benefit provision.

Most allow you to accelerate, or take out, up to half of your policy's total death benefit, he said. But some enable you to take out nearly all of it.

"As far as I'm concerned, the viatical settlement should be your last option," Foley said.

The primary difference between viatical settlements and ADBs is that in an accelerated death benefit transaction, there is no third party involved.

You arrange the deal directly with your insurance company and, perhaps most importantly, your designated beneficiaries receive the unused portion of your policy's death benefit after you die.

"The number one thing I would advise if you find out you need money (due to a terminal illness) is to contact your insurance company first and find out your options," Foley said.

Moreover, Foley added, the concept of a disinterested third party owning your life insurance policy raises a number of ethical questions.

"Here we have me owning a policy on your life where I stand to gain from you dying sooner rather than later (since premium payments would stop)," he said. "I'm really fearful that we are going to have one or more catastrophic events happen, where it will be shown that people are murdered to collect the policy."

If it's happened with other beneficiaries who kill their loved ones for their life insurance policy, he said, why couldn't that happen in this industry?

But Cooper of the NVA said that's absurd. She noted there have been no reported cases of such an incident, and said professional viatical companies and brokers take careful pains to ensure the ultimate buyer of viatical settlements never gets personal information on the original policy owners.

Moreover, she noted ADBs can sometimes be restrictive, only allowing individuals to cash out of their insurance policy toward the very end of their lives.

Even so, Foley said ADBs have the dual effect of providing the terminally ill with upfront cash and leaving a little behind for the beneficiaries -- the ones for whom the policy was purchased in the first place.

He also noted there are many other ways to come up with cash, too.

"I would ask people to investigate getting loans instead, either from banks or other financial institutions and even from relatives," Foley said. "You can almost set up your own viatical settlement, where you borrow $40,000 from your aunt and agree that your spouse will repay that amount from the death benefit when you die.

You can also find out if you have any cash value in your life insurance policy. You may be able to use some of the cash value to meet your immediate needs and keep your policy in force for your beneficiaries.

And lastly, the NAIC said you may also be able to use the cash value as security for a loan from a financial institution.

|

|

|

|

|

|

|