NEW YORK (CNNfn) - The world's developed economies are poised for sustained growth and little inflation through 2000, particularly the regions of Asia and Latin America, which are past the worst of their economic woes, the International Monetary Fund announced Wednesday.

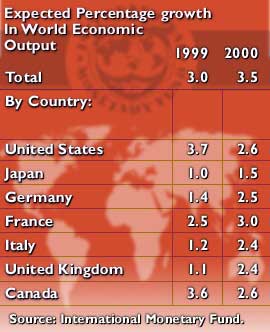

In its World Economic Outlook, the IMF said the global economy is on track to expand at a 3 percent pace in 1999 and a 3.5 percent clip in 2000 -- a little higher than what was initially reported when the Dutch Finance Ministry accidentally posted the IMF's preliminary numbers on its Web site three weeks ago. That's also above the 2.5 percent collective showing in 1998, though not as stellar as the 4.2 percent growth registered in 1997.

The IMF's forecasts -- particularly for countries such as Japan, China, Brazil and India -- indicate a remarkable about-face in the Washington-based agency's view of the world a year ago, when events in Eastern Europe, Latin America and Asia appeared to be on course to slow world economic growth significantly.

"The world economy appears to be on the mend following the global slowdown in 1998 in the wake of the Asian crisis, and the further bouts of financial turbulence associated with the Russian and Brazilian crises," the report said. "For all the Asian crisis economies, growth projections for 1999 have been revised upward significantly, and the economic downturns in Brazil and Russia have been shallower than expected earlier."

Not all rosy

Even so, the agency warned that continued vibrancy in the U.S. economy -- the result of unprecedented stock gains and robust consumer spending, among other things -- could spoil the party. In other words, the economic success of the rest of the world depends partly on Federal Reserve Chairman Alan Greenspan orchestrating what the IMF called a "soft landing" in which the U.S. economy slows with "little friction or disruption."

"The generously valued stock market, the sharp decline in household saving in recent years into negative territory, high business capital outlays, the heavy reliance on foreign saving and the high exchange value of the dollar relative to medium-term fundamentals all point to strains and imbalances that may lead to a more abrupt slowing of domestic demand," the report said.

And, the report said, "if growth were to weaken significantly in the U.S. without offsets in Japan and Europe, there would be reason for concern about the sustainability of the recoveries underway in the Asian economies recently in crisis, and much of Latin America would be particularly vulnerable under such a scenario."

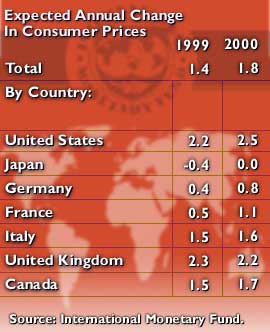

For all intents and purposes, analysts and economists agree the U.S. economy has entered a new era. It has enjoyed in excess of 100 consecutive months of expansion. It has a jobless rate of 4.2 percent, minimal wage gains, inflation under 2 percent and a budget surplus of over $100 billion and rising. Its biggest negative -- a record trade deficit -- is more a product of internal demand than lack of external want for its goods and services.

Risk factors

But there are several factors that could bring the New Economy to its knees, the IMF said.

For one, inflation could begin to accelerate, prompting the Federal Reserve to raise interest rates and choke off the economic expansion too abruptly. For another, the dollar could begin to depreciate against other major currencies as investors find other, more attractive places to buy securities. What's more, a significant drop in stock prices could rattle the U.S. economy enough to jeopardize the rest of the global expansion, it said.

If any or all of those scenarios hold true, the ample growth the IMF is predicting for the Group of Seven industrialized nations and many other countries could go out the window, the report said.

"It is mainly the task of monetary policy to prevent a rise in inflation, through forward-looking policy actions," the report said. "The Federal Reserve's actions to raise short-term interest rates in June and August, which partly reversed the cuts that played an important role in helping to stabilize international financial markets late last year, were appropriate steps," the IMF said.

Smart numbers

As for numbers, the U.S. is expected to lead the industrialized economic pack in 1999 with 3.7 percent growth. Canada will follow a close second with 3.6 percent output with France in third at 2.5 percent. Japan's economy is expected to expand 1.0 percent this year, while Germany's is expected to grow 1.4 percent. Italy is seen growing by 1.2 percent and the United Kingdom by 1.1 percent.

Developing countries are a whole other story. China's economy is expected to expand a whopping 6.6 percent this year and India is expected to grow 5.7 percent. Asia as a whole is expected to expand at a 5.3 percent pace this year and Africa is anticipated to expand at a 3.1 percent pace. Countries in transition, which include places such as Russia and a few central Asian countries, will likely see their economies remain flat through 1999 before showing some signs of life in 2000.

And for 2000, almost everybody's economy looks good, according to the IMF's forecast. The U.S. economy will likely slow to 2.6 percent growth in 2000, while Canada, the United Kingdom, Italy and Germany are all expected to post growth in the mid-2-percent range. Japan, which saw its economy contract 2.8 percent in 1998, will probably register growth of 1.5 percent in 2000.

Reflecting on the decade past, the IMF pointed to several "striking developments" in 1990s economics that helped contribute to the longest-ever U.S. economic expansion as well as the rapid recovery of many economies around the world that a year ago looked poised for long-term pain rather than gain.

Licking the inflation bug

Low inflation across the board and central banks' determination to keep it low, along with more liberal trade policies and extensive deregulation of key industries such as energy and telecommunications have helped boost productivity and kept prices in check.

Integration of financial markets has also helped make the global economy work better, the IMF said. It used to be that plunging demand in one country meant the eventual slowdown of another as demand for goods and services slowed. During the Asian crisis, though, many investors moved their money into U.S. assets, offsetting those losses and helping sustain the U.S. economy.

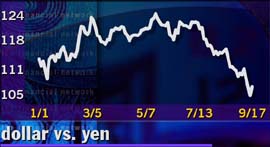

The recent surge in value of the yen against the dollar, according to analysts and economists, suggests that financial markets think Japan's economic recovery is now fully underway. The IMF gave a less optimistic view, however, suggesting "there are still many weaknesses and uncertainties in the current economic situation," including fragile consumer confidence and large debt loads among both consumers and businesses.

The dollar vs. the yen since January

As for Europe, the IMF was equally cautious in its forecast, suggesting the continent as a whole could stand to benefit from governments reducing their debt levels -- particularly in Austria, France, Italy and Portugal. Reducing personal and business tax levels that are already "at or close to historical peaks" would also help keep Europe on more sure footing toward economic prosperity in 2000 and beyond, the IMF said.

"Assuming that a sustainable recovery materializes, all countries in the area should ensure that their programs are strong enough to produce fiscal positions close to balance or in surplus by 2002, and also strong enough to create room for reducing Europe's debilitating tax rates," it said.

Outside the euro zone, the IMF was a little more optimistic, indicating that the United Kingdom's economy "appears to have bottomed out without a recession, and projections show growth picking up through 1999 and reaching its potential early next year."

For Latin America, the IMF's outlook proved mixed. Overall growth for the region is expected to be flat in 1999, while projections for 2000 were revised upward to 4 percent. Stronger growth in countries such as Brazil and Mexico will likely offset weaker economic output from Argentina, Chile, Columbia, Ecuador and Venezuela, the IMF said.

|