|

Avoid property 'lemons'

|

|

September 27, 1999: 6:24 a.m. ET

Home inspections, appraisals can ensure you get your money's worth

By Staff Writer Nicole Jacoby

|

NEW YORK (CNNfn) - It's easy to overlook a few creaky floorboards and a stain or two on the ceiling when you finally land what is in every other way the perfect home.

But before you let your excitement get the better of you, consider the possibilities. The floor might be ready to collapse and the stains could indicate recurring leaks.

Even a seemingly impeccable house or apartment can be full of hidden flaws, but a home inspection, along with a property appraisal, can help ensure you get what you pay for.

"Anybody purchasing a home should obtain a home inspection to ensure the quality and condition of the property," said Gary Weaver, senior housing representative for the National Realtors Association. "You want to be certain everything is in operating condition, that the heat producers heat, the A/C produces cool air, et cetera."

Worth your while

Home inspections and property appraisals are commonly confused, but they are both an important part of the home-buying process.

"Like doctors with specialties, professional appraisers and home inspectors can see things that their customer typically cannot," said Thomas Byrne, president of the American Society of Home Inspectors. "It's vital that both professionals be involved in the process."

Even the most experienced home owner is unlikely to be familiar with the many elements of home construction, their proper installation and maintenance. Similarly, home buyers will find it difficult to evaluate a property's worth simply by looking at its exterior or driving around the neighborhood.

Appraisers assess the monetary value of a home, while home inspectors evaluate a property's physical condition. Any final home purchase should be contingent on an inspection, since problems may arise that could cause you to reconsider the purchase.

The inspection

The cost of a home inspection depends greatly on location and size of the property, but they typically run about $200 to $300 and take about 2 to 3 hours to complete.

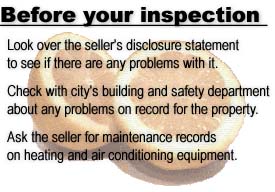

The inspector will broadly evaluate the property's condition, assessing its physical structure along with its systems and foundation. Areas reviewed will include the home's heating system, plumbing and electrical systems, roof, attic and visible insulation. Drainage conditions and the structure of decks and chimneys will also be looked at.

The inspector's final report should include a clear and objective evaluation of the home, including immediate defects and any potential problems. Get your inspector to answer any questions about the report well before closing time.

It's a good idea to be present at the inspection to get a better understanding of what defects may exist. If the inspector finds problems with the home, don't be surprised if you are referred to a specialist.

"A home inspector is a generalist who identifies visible existing conditions," Byrne said. "They are not acting as specialists in all of the different disciplines that go into the construction and maintenance of a home."

Choosing an inspector

Choosing a home inspector is no easy task.

"Not every home inspector is truly qualified to perform an inspection," said Byrne. "And it can be tough for homeowners to judge the professional qualifications and experience of a home inspector."

Referrals from friends or family are usually the most surefire way of finding a reliable contractor. But in the absence of a recommendation, you will have to depend on the experience and credentials of the inspectors available.

Membership in a trade organization, such as the National Association of Home Inspectors or the American Society of Home Inspectors, can increase the likelihood that certain inspection standards are met. Experience is also relevant. Ask prospective inspectors how many years they have been on the job and don't pick someone who has been doing it for less than 5 years.

Never accept a referral for an inspector from your real estate agent, who has a vested interest in selling the property. In fact, you may want to pick an inspector before you start your house hunt, so you won't be rushed into hiring someone at the last minute.

Picking an appraiser

Appraisals -- which are generally required by mortgage lenders -- usually take place after the home inspection has been completed.

Many of the same rules regarding home inspectors apply to appraisers. They should be state licensed or certified, with a professional designation from the Appraisal Institute or other trade group.

Sometimes the mortgage lender will select an appraiser from a pre-approved list. If this is the case, be sure to request a copy and ask for the appraiser with the best specific credentials or formal professional designations.

Appraisals usually cost about $200 to $400. Never choose an appraiser who charges a fixed percentage of the amount of value or of the estimated cost that is being determined. An ethical and objective appraiser will charge a flat or hourly fee.

Getting your money's worth

Appraisals are valuable because they can prevent you from spending too much on a home by giving give you an accurate sense of the property's current market value, especially if the property is fairly unique or has been renovated in recent years.

"Appraisals assess the valuation of a property and ensure that it is not overvalued or undervalued compared to other properties of its size and nature," said Weaver.

While comparable sales and average prices per square foot can you give you a general idea of the home's value, they can also be highly inaccurate if improvements have been made to the home or if the home doesn't fit the cookie cutter mold of the neighborhood it's in.

Appraisals take into account a wide range of factors when determining value, including the current cost of replacing the building and the value the property's net earning power will support. Like home inspections, they shouldn't take more than a few hours.

Appraisals can be handy even after you buy your home. By establishing an accurate market value of the property, you are more likely to buy the correct insurance coverage for the property. And appraisals become relevant if you want to refinance your home or applying for a home equity loan, helping establish the amount of equity you can borrow against.

|

|

|

|

|

|

|