|

Rosy outlook for 3Q profits

|

|

September 30, 1999: 6:38 a.m. ET

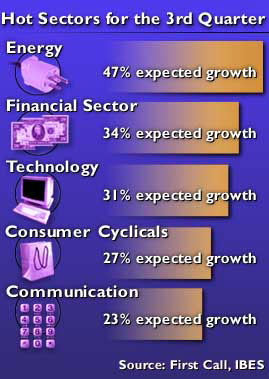

Energy, financial firms could help earnings growth hit 4-1/2 year high

By Staff Writer Tom Johnson

|

NEW YORK (CNNfn) - Energy, financial and technology companies are expected to lead what some analysts believe will be the best quarterly earnings period for U.S. firms in more than four years when third-quarter profit reports begin emerging in the next few weeks.

But while the companies that comprise the S&P 500 are expected to grow earnings by roughly 22 percent on average, the best year-over-year gain in 4-1/2 years, analysts caution the reports could prove a double-edged sword for investors.

Despite rapid bottom-line growth, aided in large part by weak comparisons from a year ago, third-quarter results aren't expected to offer any substantial surprises. After two consecutive quarters of consistently missing corporate earnings -- often badly -- by aiming low, analysts appear to have caught up.

"Since the first quarter, the earnings surprises have been getting smaller and we expect that to continue based on anecdotal evidence that analysts know the economy's moving faster and all the pre-announcements that come out now," said Joseph Abbott, equity strategist at Institutional Brokerage Estimating System.

"For the third quarter, analysts are bringing their estimates down again, but not by as much as normal," Abbott said. "Analysts have caught on and adjusted their models accordingly."

Energy, financial companies top gainers

Even so, analysts say several companies could surprise on the upside, particularly in the energy sector, where a sharp jump in oil prices in recent months has fueled rapid bottom line growth.

Tony Crooks, a retail analyst at First Call Corp., which tracks earnings estimates, predicted energy firms will grow third-quarter profits by an average of 47 percent, setting the stage for an even bigger increase toward the end of the year.

"Last year we were looking at $14 a barrel" for oil, Crooks said. "This year, it's $19 a barrel. We will be hitting 100 percent growth for the fourth quarter."

Close behind are financial sector stocks, particularly large banks and brokerage firms that suffered trading losses because of the Russian currency crisis last summer.

"Because of last autumn's financial panic, comparisons are easy on Wall Street and business is currently strong, though somewhat weaker than in the first half of 1999," said Edward Kerschner, in his recent report on third-quarter earnings.

First Call anticipates financial earnings to climb an average of 34 percent before decelerating through the end of the year.

Among the quarter's biggest winners could be the very firms that were stung so badly during the similar period last year, such as BankAmerica Corp. (BAC), Bear Stearns Cos. Inc. (BSC) and Citigroup (C).

Still, the industry's good fortune will not extend to all sectors. Commercial insurance companies are expected to struggle this quarter as they begin mopping up from Hurricane Floyd and the quarter's other natural disasters.

One of the nation's largest insurers, Allstate Corp. (ALL), for one, already has warned its third-quarter earnings will fall short of expectations.

Some believe credit card issuers also could suffer, particularly among companies that don't boast diversified earnings streams. The Federal Reserve hiked interest rates twice during the quarter, possibly amplifying the already growing problems with delinquent customers.

Tech hot, but not as much as GM

Rounding out the quarter's top gainers should be technology and consumer cyclical companies, particularly General Motors Corp., which gets a big financial cushion to play with because of last summer's crippling strike.

The 54-day walkout last summer cost the world's largest automaker $1.2 billion and resulted in a 1998 third quarter loss in excess of $800 million. This year, GM (GM) is basking in the glow of record-breaking auto sales as its third quarter draws to a close.

Analysts said GM's gains will provide roughly 87 percent of the sector's quarterly increase, but other companies also should fare well because of the healthy economy.

Likewise, technology shares should boost profits by an average of 31 percent during the quarter, according to First Call.

That is a slowdown from the more than 40 percent growth posted during the second quarter, and will be aided by inventory control problems at several firms that spilled over into the third quarter last year.

Analysts predict the industry will be led by high-growth companies like Intel Corp. (INTC) and Motorola (MOT). Blue chip firms like Microsoft Corp. (MSFT), Lucent Technologies Inc. (LU) and International Business Machines Corp. (IBM) also will provide solid growth, but at a slower pace.

Trouble spots in the sector are expected to be with companies like Compaq Computer (CPQ), Advanced Micro Devices Inc. (AMD) and Micron Technologies (MU), Abbott said.

Finally, communications service firms are expected to grow earnings at a 23 percent clip, as 12 of the 14 companies in the sector post an increase in profits, Abbott said. Leading the sector should be MCI Worldcom (WCOM).

Transports, consumer staples head south

Analysts said two sectors expected to struggle during the third quarter include the transportation industry, which was hurt by the energy crisis, and several well-known consumer companies, like Walt Disney and Coca-Cola.

Transports "have really dropped off a cliff," Crooks said. "At the beginning of the quarter, we were looking for transports to post 16 percent earnings growth. Now, we're looking for a 7 percent decline."

But perhaps the most disappointing results will come from multi-billion companies that have become synonymous with American culture.

"Not everybody is invited to this party," said Ed Keon, an equity analyst at Prudential Securities. "Some of the consumer cyclicals are still struggling to feel the earnings bottom."

Principal among those companies are Coca-Cola Co. (KO), still reeling from a massive European product recall, and Walt Disney Co. (DIS), struggling to overhaul its business lines and jump-start earnings.

What it means for stocks

Still, despite analysts' enthusiasm for the third quarter's earnings potential, it remains unknown how investors will react to the numbers once they start flowing across Wall Street.

With the magnitude of earnings surprises during the first and second quarter ranking among the largest this decade, stocks seemingly advanced significantly only when companies managed to beat the estimates. Falling below or even simply matching analysts' predictions would often send a stock lower.

With analysts' estimates expected to catch up to actual earnings this quarter, some are wondering how traders might react, particularly given their recent jitters over interest rates and the weakening dollar.

"From a valuation perspective, the market has already paid for perfect," Kerschner said in his report, dated Sept. 26. "Even after a 10 percent correction, current stock prices adequately reflect this perfection."

That leaves companies with a very narrow line to walk on. Accordingly, many firms have taken to releasing potentially unwelcome news early in the hopes of diluting its impact on their stock.

For example, Gillette Co. (G) warned Tuesday that while its third-quarter earnings, not due out for another two weeks, would be right in line with analysts expectations, its sales would fall off slightly because of currency exchange issues.

"Investors should remember that if we do see companies start hitting estimates and not beating them, that wouldn't be such a bad thing," Abbott said. "It would mean there's less earnings management going on."

|

|

|

|

|

|

|