|

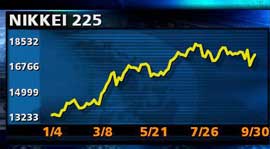

Tokyo recovers lost ground

|

|

September 30, 1999: 5:36 a.m. ET

Softer yen boosts Nikkei by 2%; HK down in thin trade; Seoul slumps again

|

LONDON (CNNfn) - Tokyo stocks rebounded Thursday as the yen continued to soften, though other Asian markets slid in thin trading.

The Nikkei 225 average in Tokyo closed up 323.18 points or 1.87 percent at 17,605.46, buoyed by the yen slipping to 107 against the dollar.

In Hong Kong, the Hang Seng index gave up morning gains and closed at a session low of 12,733.24, a loss of 101 points or 0.79 percent. The market is closed Friday for China National Day.

Singapore's Straits Times index recovered at the end of the session to close up 4 points or 0.2 percent at 2,021.93.

Investors continued to shun attempts to reform the South Korean economy, pulling the Kospi index in Seoul back another 3.8 percent to close at 836.18.

Tokyo stocks ended the first half of the Japanese business year on an upward note with an 11.1 percent rise since March 31. The index was boosted by portfolio reallocation ahead of the half-year end.

Construction stocks provided the main focus Thursday following strong housing start data for August. Sumitomo Real Estate jumped 6.8 percent and Mitsubishi Estates advanced 7.4 percent.

NTT DoCoMo, the country's dominant cellular operator, jumped 5.5 percent after announcing plans for a joint venture offering music downloadable on its mobile phones.

The yen's dip to 107.20 against the dollar helped exporters, with Toyota adding 3 percent and Mazda jumping 5.7 percent. Among electronics shares, TDK firmed 3.1 percent.

However, the yen gained ground after the market close, trading around 105.60 yen against the dollar.

Sega Enterprises rose just 1.1 percent after announcing plans to spin-off its network business.

Bank shares also rose, with Sumitomo climbing 6.7 percent and Sanwa adding 4.5 percent. However, Sakura was the star performer, closing 8 percent ahead after announcing an underwriting joint venture with Deutsche Bank (FDBK)

Investors in Hong Kong were cautious ahead of a long weekend, with the market closed Friday for China National Day.

Hotel stocks pared losses in Hong Kong, with Shangri-la Asia surged 9.6 percent as sentiment on the sector improved. Hong Kong & Shanghai Hotels climbed 2.6 percent.

Property shares firmed after slipping in the previous session. Amoy Properties added 2.8 percent and Great Eagle rose 1.1 percent.

Cathay Pacific fell 4.4 percent after its surge Wednesday.

The index was also pulled back by weaker blue chips, with HSBC Holdings off 0.6 percent and Hang Seng Bank down 1.4 percent.

Singapore remained above the psychologically-important 2,000 barrier but lacked direction at the end of the corporate reporting season.

Tech shares firmed, with Datacraft adding 1.8 percent and Elec & Eltek adding 2.1 percent.

Banking group DBS pulled the index back with a 2.2 percent decline.

Smaller markets were mixed in late afternoon trade, with the JSX in Jakarta leading the gainers with a 4.1 percent rise at 547.94 while the PHS Composite in Manila ended its session up 0.7 percent at 540.14.

The All Ordinaries in Sydney closed 14 points or 0.48 percent lower at 2,884.0.

The Set 50 in Bangkok closed 0.4 percent higher at 392.54 after more upbeat economic data including a 17.7 percent in year-on-year manufacturing output in August.

The KLSE Composite in Kuala Lumpur traded down 1.2 at 675.45 and the TAIEX in Taipei was off 0.2 percent at 7,598.79.

-- from staff and wire reports

|

|

|

|

|

|

|