|

Fed holds rates steady

|

|

October 5, 1999: 5:16 p.m. ET

FOMC leaves key rate at 5.25%, but indicates it's leaning toward tightening

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - The Federal Reserve opted to leave short-term interest rates unchanged Tuesday, but signaled to financial markets that it's leaning toward raising rates in the future if it spots any sign of faster inflation.

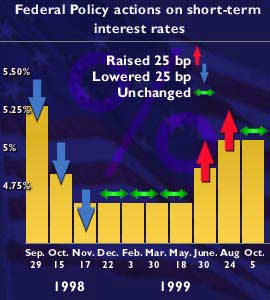

As expected, the Fed's policy-making arm left both its influential fed funds rate and its less-tinkered-with discount rate unchanged. The fed funds target for overnight loans between commercial banks remains at 5.25 percent, while the discount rate -- the rate at which the Fed's 12 district banks lend directly to financial institutions - stays at 4.75 percent.

The decision gives consumers and businesses temporary reprieve following this summer's two consecutive rate rises, each of which led to higher borrowing costs. The Fed also made clear in its brief statement that further increases may be coming unless it sees some clear-cut evidence that the economy is slowing from its resilient pace.

But the Fed immediately tempered its warning by saying the shift toward a tightening bias did not mean that a rate hike was imminent.

Wait-and-see approach

"Committee members emphasized that such a directive did not signify a commitment to near-term action," the statement said. "The Committee will need to evaluate additional information on the balance of aggregate supply and demand and conditions in financial markets."

"The Fed is saying that they're willing to keep the experiment of strong growth without inflation going, but that they won't hesitate to raise rates if they see problems," said Adam Blankman, a senior U.S. economist at Standard & Poor's MMS in San Francisco. "Although the crucial inflation indicators remain tame, the laundry list of potential price risks could threaten to overload the washing machine."

The Fed has already raised rates twice this year - consecutive quarter-point moves in June and August - in an effort to slow the economy and keep inflation under wraps. With the economy showing some signs of slowing and inflation showing little sign of accelerating, the Fed chose a wait-and-see approach before kicking rates up a third time.

"They want to see how these first two rate increases go first," said Jan Hatzius, an economist with Goldman Sachs in New York. "They are trying to straddle between not committing themselves to a third rate rise and not driving the stock market through the roof by saying they're done."

Taming the shrew

The stock market was in no danger of that Tuesday. The Dow Jones industrial average gave back a 100-point gain within minutes of the announcement, plummeted more than 80 points. It then turned around in the last hour of trading and ended the day almost unchanged.

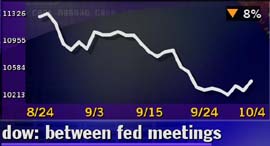

Interestingly enough, the Dow average is down a little more than 8 percent since the last Fed meeting - partly because of the weakening U.S. dollar against the Japanese yen and partly because of concern among investors that more rate rises are on the way. Higher rates tend to erode corporate profits by making borrowing more expensive for companies.

Bond investors were a little more clear on where they see rates going in the future. The 30-year benchmark Treasury fell a point and a quarter, pushing its yield up to 6.18 percent -the highest level in two months.

"Strengthening productivity growth has been fostering favorable trends in unit costs and prices, and much recent information suggests those trends have been sustained," the Fed said in its one-page statement.

Straddling the fence

Even so, persistently strong employment growth and the possibility of rising wages means the FOMC "will need to be especially alert in the months ahead to the potential for costs to increase significantly in excess of productivity" - something that could spur inflation and ruin the economy's stellar track record, the Fed said.

The U.S. economy has been characterized by much the same thing through the latter half of the 1990s - strong economic growth with little inflation. The past three years, in particular, have held true to that as financial crises in Asia, Latin America and Eastern Europe refused to damp the enthusiasm of the U.S. consumer.

Many economists still expect the Fed will "take back" the third of three rate rises it implemented last year

Some indicators of late have suggested that the long string of inflation-free growth may be coming to an end. While inflation in of itself has not risen substantially - prices this year are up 2.3 percent this year - job creation hasn't quit, prompting concern among Fed officials and Chairman Alan Greenspan in particular that wages will have to rise substantially to lure workers into positions.

That could prompt prices to rise as people have more disposable income to spend, Hatzius said.

A few more to go?

"The Fed's chief worry is still the labor market," said Ian Shepherdson, senior U.S. economist at High Frequency Economics in Valhalla, New York. "So long as the unemployment rate does not fall further, and clear signs of consumer slowed own emerge, the Fed will be able to leave rates on hold."

Indeed, investors will be watching September's employment numbers, to be released Friday, for evidence that pace of job growth is beginning to ebb, reducing the risk of rising wages and faster inflation. Analysts polled by Reuters expect that 218,000 new jobs were created last month, and the jobless rate held steady at 4.2 percent. The report will be released at 8:30 a.m. Eastern time.

To be sure, few analysts are convinced that the Fed has taken its foot off the brakes for good. Many are still anticipating a third quarter-point rate increase as soon as November - one that would "take back" the three rate cuts made last year in the wake of the financial market crisis brought on by a Russian default on its debt.

When that might happen is another story.

But when?

For the Nov. 16 meeting investors will focus on more economic numbers, particularly September's employment and inflation reports. For the Dec. 21 meeting, though, most analysts agree that the Fed won't do anything - partly because it typically refrains from raising rates during the holiday season and partly because it doesn't want to exacerbate any problems caused by the computer glitch Y2K.

January, though, tells a different tale. The rate on the January fed funds futures contract, which indicates where investors expect the fed funds target to be early in the new year, now rests at 5.46 percent, suggesting rates will rise at least another quarter point before the winter is over.

And many economists expect one or two additional quarter-point rate increases in 2000 "to really slow things down," Hatzius said. "The Fed will have to raise rates again," he said. "What will be nice, though it's unimaginable right now, is to start forecasting when they might be able to cut rates."

|

|

|

|

|

|

Federal Reserve

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|