|

MCI buys Sprint for $129B

|

|

October 5, 1999: 6:11 p.m. ET

Deal ends brief MCI-BellSouth bidding war, creates top AT&T long-distance rival

By Staff Writers Martha Slud and Tom Johnson

|

NEW YORK (CNNfn) - MCI WorldCom Inc. sealed a $129 billion deal to acquire Sprint Corp. Tuesday in the most expensive corporate takeover in history, creating a powerful rival to long-distance leader AT&T Corp. and quickening the telecom sector's already frenetic pace of consolidation.

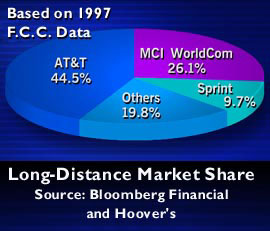

The all-stock transaction, which would easily top Exxon Corp.'s (XON) planned $80 billion purchase of Mobil Corp. (MOB), links the nation's second- and third-largest long-distance carriers. The new company, to be called WorldCom, would control about 32 percent of the estimated $90 billion U.S. long-distance market.

The deal also would fill a glaring hole in MCI's business line: the lack of a significant wireless service. The Westwood, Kan.-based Sprint's PCS cellular business, which trades as a separate tracking stock, is the nation's largest 100 percent digital nationwide wireless service, covering more than 4,000 cities and communities.

"MCI WorldCom is clearly a winner here," said Michael Balhoff, telecom analyst at Legg Mason Wood Walker Inc. in Baltimore, citing the addition of Sprint's "high-class business operations" with MCI's "international assets."

In this story:

The much rumored deal comes after several days of frenzied negotiations, which heated up after a surprise, last-minute offer from BellSouth Corp. (BLS) late Sunday.

BellSouth's 11th-hour offer -- reportedly for $72 per share in cash and stock for Sprint, excluding the PCS tracking stock -- forced MCI to substantially raise its bid, which initially totaled about $65 per share.

BellSouth confirmed Tuesday that it had been in discussion with Sprint, but "an agreement was not reached and those talks have concluded," the company said in a statement. The Atlanta-based Baby Bell wanted Sprint's long-distance business to complement its local telephone service.

But MCI Chief Executive Officer Bernard Ebbers -- one of the industry's top dealmakers who just two years ago led Worldcom's $41.9 billion takeover of MCI Communications Corp. -- refused to back down, knowing he couldn't pass up the opportunity to nab both Sprint's long distance might and its formidable cellular service.

"The combination of MCI WorldCom and Sprint creates nothing less than the most dynamic, most capable, most growth-oriented, most fully integrated communication company in the world," Ebbers said.

But the combination is hardly a done deal. The two parties face intense regulatory scrutiny, particularly at the Justice Department, where they must explain why they should be permitted to exceed current market concentration levels.

The head of the Federal Communications Commission said he too had concerns about the merger.

"American consumers are enjoying the lowest long distance rates in history, and the lowest Internet rates in the world for one reason: competition," FCC chairman William Kennard said in a statement. "This merger appears to be a surrender. How can this be good for consumers? The parties will bear a heavy burden to show how consumers would be better off."

But the companies played down the potential regulatory roadblocks at a news conference in New York announcing the deal. Ebbers said he and Sprint chief William Esrey had talked with Kennard about the deal and "the chairman told us he would keep an open mind."

"We understood from day one it's our burden of proof to show this is pro-competitive," he said.

Still, analysts believe there is a good chance the companies will have to sell off all or part of their Internet backbones, or the systems that move information around the world from one computer network to another. Without any divestiture, WorldCom would control two-thirds of the backbone market following the merger.

"The short answer is yes, they are going to have to sell off their backbone," said Erik Schneider, a telecom analyst at PaineWebber. "But that won't create too much of a problem. They will still be the market leader among Internet providers."

Wall Street's tepid reaction

Many investors initially reacted coolly to the news. MCI WorldCom (WCOM) shares shed 3-11/16 to 67-15/16 in trading Tuesday, while Sprint (FON) stock lost 2 to finish at 58-7/8. Stock in Sprint's cellular unit, Sprint PCS (PCS), tumbled 4-11/16 to 74.

AT&T, meanwhile, rose 1-1/4 to 45.

But analysts blamed the sagging stock prices on arbitrage trading and initial concern about regulatory approval.

"There's an arbitrage going on now so MCI is a little weak and Sprint is strong," said Martin Sass, chief executive officer at money management firm M.D. Sass. "But I think once this sorts out, you're going to get a big move up in MCI. It's No. 2 to AT&T and I like AT&T as well. These are going to be the two big players in that field."

"I think investors have a pretty short memory," said Mel Marten, a telecom analyst at Edward Jones. "If they think back to every big telecom merger that has [taken place] the FCC has always made [cautious] comments at first."

Instead, analysts and company officials predicted the deal ultimately would help consumers since the company would be able to offer flat-fee pricing packages that included long distance, cellular and Internet service.

Ebbers said the deal marked his company's shift from a "voice communications business to a data communications business," saying the new entity should not be thought of as only a "long-distance company."

"You cannot look at just long-distance," he said. "That is a very foolish way to look at our industry."

MCI WorldCom's entry into the cellular business comes after much waiting on Wall Street. The Clinton, Miss.-based company has no wireless unit of its own and has been looking to work its way into the quickly consolidating cellular business.

It tried and failed to strike a deal with the two-way radio and cellular telephone company Nextel (NXTL) earlier this year while its competitors continued to move ahead with their plans, including a recent major wireless telephone joint venture between Bell Atlantic (BEL) and Vodafone Airtouch Plc (VOD).

"I guess the one question I will not get today is: When are you going to do anything about cellular?" Ebbers joked at the press conference.

"Sprint PCS' wireless network is one of the last keys filling one of the last holes in MCI's network," Marten said.

Terms of the deal

Under the deal, each Sprint share will be exchanged for $76 of MCI WorldCom stock, subject to a "collar" that protects the value of the Sprint offer from volatility in MCI's stock price. The deal represented a 27 percent premium over Sprint's closing stock price Monday and includes a $2.5 billion break-up fee.

In addition to BellSouth bowing out of the bidding war, Deutsche Telekom AG (FDTE) said Tuesday that it does not plan any counteroffer for Sprint and would sell its 10 percent stake in the company.

A Telekom spokesman said the firm is expected to sell its stake for $9.2 billion, pocketing a $7.7 billion profit. France Telecom (PFTE), which also holds a 10 percent stake in Sprint, said it too would sell its shares.

The MCI WorldCom deal is made up of $115 billion in equity for Sprint and the Sprint PCS (PCS) wireless unit, plus the assumption of $14 billion in Sprint's debt and preferred stock. Besides the $76 per share offer for regular Sprint shares, each share of Sprint PCS will be exchanged for one share of a new WorldCom PCS tracking stock and 0.1547 share of MCI WorldCom stock.

No layoffs are planned, the companies said.

For Sprint, the deal brings the company a wider customer base plus the opportunity to take advantage of MCI's international assets, analysts said.

Michael Farr, president of Farr, Miller and Washington, said WorldCom is well positioned to integrate Sprint's businesses.

"WorldCom is a proven manager of larger companies, of being able to integrate these things," he said. "We like this merger and we think that the ramifications in the marketplace, certainly in the short term, is there will be a sympathetic rise probably in a lot of the telecom stocks."

Hurdles ahead

Like the Exxon-Mobil deal and a planned $72 billion deal between Baby Bells SBC Communications Inc. (SBC) and Ameritech Corp. (AIT), this merger is expected to be subject to intense regulatory review, said Tom Burnett of Merger Insight.

"You're going to have Justice Department, FCC (Federal Communications Commission) and states' commissions looking into this," he said. "It's going to be a very long ordeal."

The deal is not expected to close until late 2000, the companies said.

In addition to the FCC's initial comments, the Communications Workers of America -- which represents several thousand workers at Sprint facilities -- announced their opposition to the merger Tuesday, citing concerns over antitrust issues, local service and labor relations problems.

The merger "fails any common sense test for what would be considered healthy competition," the union said.

Consumer advocates also oppose the deal.

"We wish this merger would not happen, but the simple fact is a whole bunch of them should not happen," said Mark Cooper, research director at the Consumer Federation of America. "In the end the consumers end up with fewer and fewer competitors."

He said his group also has opposed AT&T's planned $60.5 billion takeover of cable company MediaOne Group (UMG) and SBC Communications' (SBC) proposed $62.6 billion buyout of Ameritech Corp. (AIT) "If they can swallow those two, this one will go down real easily," he said of the government regulators.

Recently, AT&T cut its long-distance rates to compete with nickel-a-minute calling plans from both Sprint and MCI WorldCom. But Cooper says that studies of consumer long-distance rates show that two-thirds of residential customers have not seen a rate cut because they don't make enough calls to make participation in such a calling plan worthwhile.

"For the average consumer, their rates have not gone down," he said.

Ebbers said that customers are not likely to see a change in long-distance rates under the combined company because the profit margin in long-distance already is low.

|

|

|

|

|

|

|