|

Europe fund ignores euro

|

|

October 8, 1999: 4:05 p.m. ET

Some funds got stung by euro woes, but Franklin Mutual European is winning

By Staff Writer Martine Costello

|

NEW YORK (CNNfn) - The euro may be in a terrible funk, but Europe fund manager David Marcus is having the time of his life.

Marcus, of the Franklin Mutual European Shares, can barely contain his enthusiasm about the great bargains he's finding in France, the United Kingdom and other parts of the region.

"I'm more excited about the opportunities than ever before," Marcus said. "I love the portfolio. It's just perfect."

The fund is up 17.91 percent year to date as of Thursday, making it the third-best performer in a category of 95 funds, according to Morningstar.

While other Europe funds are suffering because of a weak euro, Marcus has avoided getting stung in part by hedging his currency.

"What happened to Europe funds this year is the euro happened, and it hasn't been good for them," said Kunal Kapoor, an analyst at Morningstar.

The problem is even if Europe stocks are doing well, U.S. funds suffer because their profits are in euros, Kapoor said. Funds like Marcus's that buy futures contracts to hedge against a weak euro will act as if they invest in dollar-denominated stocks.

Few fund managers hedged the euro because they thought it would be so strong, Kapoor said.

Marcus said the strategy has added a few percentage points to his returns. But he attributes most of the fund's success to great stocks. The main benefit of hedging the euro has allowed him to focus on his portfolio.

"The euro was heralded as the most significant event since World War II, and so far it's not working out the way they intended," Marcus said. "I'd rather not make a bet on what the euro will do. I'd rather focus on the companies."

Marcus said the corporate landscape is at the start of a massive transformation. Governments are getting out of the utility business. There are widespread mergers and companies are cutting costs, doing stock buybacks and whatever else it takes to be competitive and profitable.

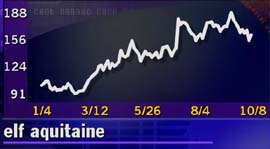

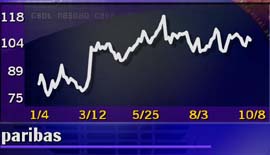

The fund made big profits when a number of holdings announced mergers, including French oil giant Elf Aquitaine, French bank Paribas, and Pathe, France's largest film producer.

The fund's top holding, representing 6 percent of the portfolio, is French pharmaceutical company Rhone-Poulenc (RP). The company is merging with German conglomerate Hoechst and is spinning off everything but its drug and agribusiness units. The combined company, called Aventis, will be the largest pharmaceutical stock with the smallest valuation, Marcus said.

"Aventis is what we're betting on," Marcus said. "Aventis is where the talent is. It's going through significant changes."

Another top investment is Lagardere, a French conglomerate that makes missiles. Most people don't know that the company also publishes magazines and operates France's largest Internet service provider, Marcus said.

Ashley Lagardere, whose family founded the business, is a 30-something chief executive with a lot of big ideas, Marcus said.

"He wants to prove he can create value," Marcus said. "They're all thinking like Capitalists, not the old French way of thinking."

Marcus isn't making any predictions on the euro, but he is optimistic about the outlook for stocks across Europe. His goal is to find great companies that are set to soar - before anybody notices.

"The secret is getting in early," Marcus said. "You want to get in when it's a ripple, before the wave hits. Then you ride the wave."

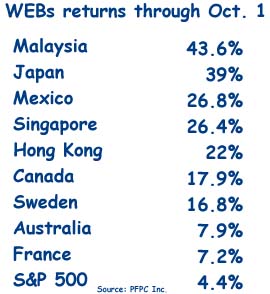

Speaking of international investing, interest has soared this year in World Equity Benchmark Shares. WEBs are index funds that invest in a single country and trade like stocks on the American Stock Exchange.

The number of outstanding shares in WEBs has doubled to about $1.7 billion, said Mike Crinieri, vice president and head of exchange trade funds at Morgan Stanley Dean Witter.

"These are a good proxy to see where there's investor interest," Crinieri said. "We've seen growth across the board."

The WEB with the most shares outstanding is Japan (EWJ), up 39 percent year to date through Oct. 1, followed by the United Kingdom (EWU), up 4.14 percent; and Germany (EWG), down 3.83 percent. France (EWQ), up 7.2 percent, is also popular.

Shares sell anywhere from $5.50 for Malaysia to $26.50 for Spain, he said.

"It gives institutions and individual investors equal access to these markets for the first time," Crinieri said.

Part of the interest in WEBs is from market timers who capitalize on breaking news that affects a country's market. For example, if Germany's market is closed but there is an announcement that may affect it the next day, an investor can buy the WEB and realize the gain when Frankfurt's Xetra Dax reopens.

Another advantage for investors is they have more control than with a traditional mutual fund, Crinieri said.

"One of the reasons is trading flexibility," he said.

Lastly, Japan and Europe may be doing well in fund performance data, but Latin American stock funds got hammered in the second quarter. Here are some results for the category compiled by Lipper Analytical Services.

At the top of the list is Nicholas Applegate Institutional Latin America, up 2.09 percent for the week Sept. 30 through Oct. 7 and up 24.05 percent year to date; followed by Chasevista Latin America Equity Fund, class A shares, up 1.38 percent for the week and up 7.10 percent year to date; and WEBS Mexico, up 1.36 percent for the week and up 31.33 percent year to date through Oct. 7.

At the bottom of the list is Scudder Latin America Fund, down 0.67 percent for the week but up 9.02 percent year to date; followed by INVESCO Latin America Growth Fund, down 0.60 percent for the week and up 13.16 percent year to date. Ivy South America Fund's class B and C shares are tied for third place, both down 0.50 percent for the week. But the B shares are up 9.12 percent year to date and the C shares are up 8.88 percent in the same time.

-- Staff Writer Martine Costello covers mutual funds for CNNfn.com. If you have any comments about mutual funds, you can contact her at cnnfn.interact@turner.com

|

|

|

|

|

|

|