|

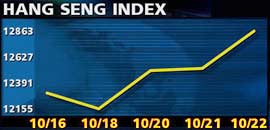

HK rallies 340 points

|

|

October 22, 1999: 6:20 a.m. ET

HK sees late buying spree ahead of government IPO; firm yen erodes Nikkei

|

LONDON (CNNfn) - Hong Kong stocks finished sharply higher Friday, propelled by a late buying surge as investors took a more optimistic view of next week's launch of a giant public offering by the territory's government. Tokyo shares ended flat as a weakening yen weighed on Japan's export-reliant global manufacturers.

Other bourses were mixed following Wall Street's overnight rebound from a sharp nose-dive Thursday that had been prompted by IBM's (IBM) previous profit warning. The Dow Jones industrial average rebounded from a loss of more than 200 points to close down 94.67 points; the tech-laced Nasdaq Composite squeezed out a slightly higher close.

Japan's benchmark Nikkei 225 average ended down 9.47 points, or 0.05 percent lower, at 17,438.80, with traders expressing little interest in a series of corporate earnings announcements. The dollar weakened against the yen, pressured by robust Japanese economic data, released early Friday, showing a 1.2 percent rise in Japan's overall business activity in August.

Hong Kong's Hang Seng - which had been up less than 1 percent in early afternoon trade - rallied in the final 45 minutes of the session to finish up 340.08 points, or 2.72 percent, at 12,863.08. Local traders said the gains were encouraged by bargain hunters dipping their toes back into the market as they took a less skeptical view of the upcoming launch of the government's so-called Tracker Fund.

The trust represents a portion of the equity portfolio amassed by the Hong Kong government during a controversial market intervention last year at the height of the territory's financial crisis.

Hutchison Whampoa and its parent Cheung Kong holdings scored impressive gains for the second day running. Hutchison said Thursday it expects to reap HK$113 billion ($14.55 billion) from its sale of U.K. mobile phone subsidiary Orange (ORA) to Germany's Mannesmann (FMMN) . Hutchison Whampoa, which owns a 44.8 percent stake in Orange, soared 3.6 percent to close at HK$79.25, while Cheung Kong shot up 4.07 percent to HK$70.25.

The most actively traded stock, HSBC Holdings, gained 1.75 percent to HK$87.25, while property conglomerate New World Development catapulted 10.83 percent to HK$15.35 in what traders told Reuters was a technical rebound.

A report that France's Renault (PRNO) intends to raise its stake in partner Nissan to 44 percent from 36 percent if the Japanese automaker's massive restructuring is successful boosted Nissan shares 3.25 percent to close at 604 yen.

Ichikoh Industries, which had surged Thursday amid speculation of a possible tie-up with French auto-parts maker Valeo (PFR) , ended nearly 11 percent higher after an earlier sharp dip.

The dollar was quoted at 105.51 yen late Friday in Tokyo, down 0.35 yen from a level of 105.86 Thursday evening in New York. The euro was quoted at 113.93 yen late in Tokyo.

Singapore's Straits Times index ended virtually unchanged at 2,017.38 amid a subsiding of political tensions in neighboring Indonesia, where popular opposition figure Megawati Sukarnoputri's election as vice-president Thursday was seen as reducing the risks of civic unrest. Jakarta stocks, which posted sharp gains Thursday, closed down 2 percent at 604.18 as the enthusiasm over Megawati's election waned.

Australia's All Ordinaries posted a modest 0.33 percent gain, to end at 2,837.3, as investors looked nervously towards U.S. markets and any signs of the next direction in U.S. interest rates. Gold stocks continued to post a healthy performance.

Malaysia finished minimally higher at 739.00 as institutional investors kept to the sidelines and amid uncertainty over the timing of the country's next general election. South Korean stocks closed a touch higher, at 819.52 as late-hour program-related buying offset earlier losses on the back of the Wall Street decline.

But Taiwan and Manila both took a hit Friday as local factors drowned out buying enthusiasm. Manila slumped almost 2 percent to end at 1,946.68 amid fears that slower growth in the farm sector could drag on the broader economy. Taiwan traders were unnerved by another strong earthquake and several aftershocks which collapsed several buildings in the south-central part of the country. Taiwan closed down 1.24 percent at 7,559.63.

Thai stocks surged 2.7 percent amid heavy buying of banking and financial stocks.

--from staff and wire reports

|

|

|

|

|

|

|