|

Dow gets a big facelift

|

|

October 26, 1999: 4:10 p.m. ET

Small investors will notice, but pros say they'll keep tracking S&P 500

By Staff Writer Martine Costello

|

NEW YORK (CNNfn) - The Dow got a makeover on Tuesday that will make Main Street's most recognizable benchmark more hip, more tech-heavy and more volatile.

While most fund managers said they'll keep using the S&P 500 as a comparison to their portfolios, the addition of Microsoft, Intel and two other hot stocks to the stodgy Dow will be a symbolic change for small investors.

"It's making the Dow more meaningful, more representative of the stock market," said Spiros Segalas, manager of the large-cap Harbor Capital Appreciation Fund.

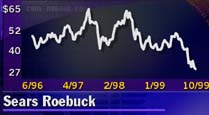

Dow Jones & Co. on Tuesday said it was changing the composition of its famed Dow Jones industrial average, adding Microsoft, Intel, Home Depot and SBC Communications in the place of Chevron, Goodyear Tire, Union Carbide and Sears Roebuck.

A growth injection

Since the Dow is price-weighted, rather than weighted according to market capitalization like the S&P 500, the four new stocks would have made a big difference in performance this year if the change had occurred on January 1, said Chuck Carlson, manager of the Strong Dow 30 Value Fund.

The four new stocks are up an average of 13 percent year-to-date as of Monday, compared with 1.5 percent for the four old stocks, Carlson said. And 13 percent is a conservative estimate, since pricier Microsoft is up 33 percent in that time.

Compare a new Dow 30 stock…

…With an old Dow 30 stock.

"The Dow would be trading noticeably higher," Carlson said, adding the "new Dow" would be trading around at roughly 10,700. The Dow closed Tuesday at 10,302.

The new stocks have an average market capitalization of $225 billion, compared with $21 billion for the old stocks, Carlson said.

Changing times

Carlson disputed some claims on Wall Street that the 103-year-old index has been behind the times. He pointed out that the Dow in 1997 changed four other stocks - meaning it has changed one-third of its components in the less than three years.

"You're looking at more high-octane stocks that can produce strong gains," Carlson said. At the same time, the Dow will see more volatility, he said.

Click here to see how the old four Dow stocks performed over the last three years.

Carlson, who has one of the few index funds that mirrors the Dow, could barely contain his glee at the change.

"It's beyond my wildest dreams," Carlson said. "It's a long-standing recognition that the Dow was lacking in representation of the 'new economy.' "

But elsewhere on Wall Street, the reaction among money managers to the change was muted. Many funds that invest in U.S. stocks track the S&P 500 or the Wilshire 5000 Index.

"We've never been compared to the Dow," said Segalas, of the Harbor Capital Appreciation Fund. "No managers use the Dow as a benchmark."

Segalas questioned whether the Dow changes would really mean much at all, beyond the symbolism.

"It's getting closer to the S&P 500," Segalas said of the Dow. "It's a sign that in this economy, you can't ignore technology."

What should you do?

William Fries, managing director of the Thornburg Funds, said individual investors don't need to make any portfolio changes.

"It (the Dow change) is an acknowledgment that our economy continues to change, and technology is a whole lot more important than it was in the past," Fries said. "It shows that most portfolios should have some technology."

Gus Sauter, a managing director at fund giant Vanguard Group, said the Dow change also wouldn't mean much difference for index funds.

"It's just 30 stocks," Sauter said. "It is generally positive, but overall it doesn't change the position of institutional investors or individual investors for that matter."

Sauter said he doubts the new stocks will deliver better returns for the Dow in the rest of 1999.

"If that were the case that you could predict it, then every manager would have dumped Chevron and Union Carbide in favor of Microsoft and Intel."

Dick McCabe, chief market analyst at Merrill Lynch, said the new stocks don't change his forecast that the Dow will move lower, below 10,000.

And it's unlikely that mutual fund investors will see much changes in their holdings, said Scott Cooley, an analyst at Morningstar.

"For most fund managers and fund investors it's not a big deal," Cooley said. "It's a lot less dramatic than a change in the S&P 500."

Cooley recalled that when the S&P 500 added America Online in December, hundreds of mutual-fund managers had to rush out and buy the stock for their portfolios.

But Cooley did say it's possible some small fund shops may introduce more products pegged to the Dow 30 stocks. They may not be able to compete with the low costs of an S&P 500 index fund at Vanguard, for example, but a Dow 30 fund might be offer something different.

"I wouldn't expect a big wholesale movement in that direction," Cooley said. "But (the Dow) has a little more sex appeal now."

|

|

|

|

|

|

|