|

A wired world of medicine

|

|

November 1, 1999: 3:56 p.m. ET

The Internet is making its mark on the American health-care system

By Staff Writer Martha Slud

|

NEW YORK (CNNfn) - The Internet is changing the way we go shopping, handle our finances and get the news. Now, Web pioneers are trying to conquer what's perhaps the most complex, and potentially the most lucrative, industry yet to shift online en masse: the trillion-dollar-a-year U.S. healthcare system.

Walk into a typical doctor's office and you'll likely find harried employees trying to accommodate crowds of patients while phones ring incessantly. Workers enter data into clunky computer programs amid stacks of manila folders crammed with medical files, lab reports, insurance forms and bills while scribbling down appointments on a crowded calendar. Patients emerge clutching a prescription slip or referral written in that famously cryptic doctor's scrawl.

And that's just your lone family doctor. Add the pharmacy, the claims offices, the suppliers and the hospitals, and this is an industry whose information technology, experts universally agree, is inefficient, outdated and costly. An estimated one-quarter of the $1.1 trillion in annual U.S. health care spending goes toward administrative costs.

"Health care has fundamentally and historically always under-invested in technology," notes Caren Taylor, an analyst at E-Offering who covers the burgeoning "e-health" industry. Now, "for the first time there really is an opportunity in health care to take advantage of technology and leverage it across the industry."

Health information ranks as one of the most popular subjects researched on the Internet

The Net, advocates say, has the potential to link up health-care providers, pharmacies, labs and patients like never before, streamlining time-consuming paperwork and freeing up doctors to spend more time with patients. But it's an overhaul that requires massive cooperation from a plethora of interests, and raises many questions about ethics, security, cost, patient access and where the doctor-patient relationship is headed in a new age of techno-medicine. Some observers fear that the millions of people already on the fringes of the health care system could be left further behind by the Internet's "digital divide."

"It's beyond doubt that some services will be exclusively on the Web," said Nicolas Terry, a professor at the Saint Louis University School of Law who has studied cybermedicine issues. For the underclass, "in fact it will become much more difficult to get access to health care."

An information explosion

Already, the Web is peppered with health-oriented Web sites offering information about diseases, diet and exercise, such as the popular drkoop.com (KOOP), headed by former U.S. Surgeon General C. Everett Koop, and Medscape (MSCP), a medical journal and companion consumer network that is 35 percent owned by CBS (CBS). Meanwhile, many companies are pushing business-to-business applications aimed at putting medical records online and helping doctors manage their mountains of paperwork and order supplies.

And patient care is moving online too, with specialized disease management sites allowing diabetics or cardiac patients to enter vital signs into personal Web pages and troubleshoot with nurses via e-mail. Proponents say this type of service can boost patient compliance with disease regimens and reduce costly and unnecessary emergency room visits.

This push toward the Web is in large part consumer driven, and reflects as much about social attitudes as it does about technological innovation, experts say. Many Americans are dissatisfied with managed care, making the Internet a desirable place to seek out supplementary information.

"Your doctor has less time to spend with you," said Robert Cramer, CEO of adam.com (ADAM), a health data and information Web site that provides content to many other Web companies. The attitude among many people now is, "'I'm going to take charge of my finances -- I'm going to take care of my own health."

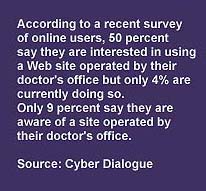

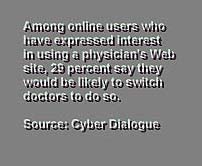

But doctors have marched slowly toward the Web, frustrating many people accustomed to instant stock quotes and rapid-fire e-mail who want the same quick access to their doctors. According to research firm Cyber Dialogue, only 4 percent of patients are using a doctor's office Web site while 50 percent say they are interested in doing so.

Whether the Web can truly transform health care will depend on the participation of doctors, and this is a group that is notoriously techno-phobic, notes Dr. Ivor Benjamin, a professor of obstetrics and gynecology at the University of Pennsylvania School of Medicine and the head of his own Web design company, Digital Ingenuity.

"You get so sheltered for the years you're in training, physicians lose touch with a lot of things going on in society," he said.

Rushing to the Web

An estimated 16,000 health-oriented Web sites currently are fighting for space on the Internet. Companies are rushing to stake claim to e-health turf amid a flurry of deal-making and complex strategic partnerships linking health-care companies, the online media and technology superpowers.

"The Internet is new, and on top of that, health-related issues and ventures online are very new," said David Restrepo, a health-care analyst at Internet research firm Jupiter Communications. "The whole industry is all of nine months old."

Besides start-up Web companies, the e-health industry also has caught the attention of managed- care organizations that see better patient communication plus potential cost savings and efficiencies of putting services online.

Kaiser Permanente, for example, recently launched an online consultation, scheduling and chat service available to its approximately 8 million members. The HMO estimates that about 61 percent of its members currently have Internet access. Aetna US Healthcare allows new members to enroll over the Internet, offers a "DocFind" service, and is moving toward processing more of its 200 million annual claims online. Aetna also runs one of the most commonly visited health information sites, Intelihealth.com, a joint venture with Johns Hopkins University that provides content to many other Web sites.

The nascent e-health industry has also attracted some of the biggest names in technology - Microsoft (MSFT), America Online (AOL), Yahoo! (YHOO) and Intel (INTC) - all of which have e-health related ventures and see a bright future ahead in a wired world of medicine.

"Health care is the largest sector of the economy," said Stephen DeNelsky, an online health-care analyst at Credit Suisse First Boston, "They want, in one fashion or another, to be part of that. Microsoft would like the desktop to be Windows. Intel wants an Intel-based processing chip."

Overall U.S. health-care spending accounts for about 13 percent of U.S. GDP. While Amazon.com (AMZN) made a splash by selling books online, the retail prescription drug industry rakes in four times as much money as books. The overall consumer market for health-related goods is expected to jump from $2.4 million in 1998 to $1.7 billion in 2003, according to Jupiter Communications.

"For the companies that ultimately win, the payoff is going to be huge," DeNelsky said.

The players

Analysts say that with thousands of health- oriented Web sites out there, and only a few companies that have firmly established themselves in the marketplace, the industry is primed for consolidation.

Among the biggest names in the sector are two so-called "connectivity" companies, Santa Clara, Calif.-based medical billing and claims processing company Healtheon (HLTH), founded by Netscape co-founder Jim Clark, and CareInsite (CARI), an Elmwood Park, N.J.-based network headed by deal maker Martin J. Wygod, who ran the Medco pharmacy benefits service now owned by Merck & Co (MRK). Other high-profile e-health companies include drkoop.com, Medscape and online drugstores drugstore.com (DSCM) and PlanetRX (PLRX). All of these companies went public this year.

Taylor said, however, that Wall Street is becoming tougher on prospective IPOs, especially toward startup health content sites that hope to survive on advertising and sponsorship revenue alone. Of the estimated 16,000 health content Web sites, she's dubious about the survival of many of these ventures. Unlike finance, news or other types of Web sites that are visited daily, many people only look at health sites when they're sick - limiting traffic growth and creating sustainability problems.

"There are more content sites chasing fewer advertising dollars," she said. "The advertising is really going to those that have the brand names. The other 15,950 health content sites that don't have a brand name are going to have a hard time surviving."

Already, the biggest deal in the sector so far has been Healtheon's pending merger with privately held doctor-and-consumer portal WebMD, a stock swap worth an estimated $7.9 billion that's designed to create a "one-stop" health site. (CNN.com has a content partnership and a small equity stake in WebMD). CareInsite, meanwhile, struck a deal in September to link its network of doctors, insurers, pharmacies and labs with America Online's (AOL) estimated 18 million members.

To track this burgeoning industry, Credit Suisse First Boston has compiled an index of 10 e-health companies, including Healtheon, adam.com, CareInsite (CARI), drkoop.com and Drugstore.com, that together have a total equity market value of about $10.6 billion.

Click here for a list of the top 10 companies in the CSFB e-health index

Like all Internet stocks, these are volatile investments and most are losing money as they try to grow and build their brands. But they tend to be better bets than some other Internet investments because the payoff potential is so great, DeNelsky said.

"When you look at these e-health companies vs. other Internet companies, I think you'll find better valuations," he said. "The pot of gold at the end of the rainbow here is much better."

But Taylor also said investors should take note that while e-health has caught Wall Street's attention, health care is among the most conservative of industries and sweeping change is going to take time.

"For investors, they should know that this is not going to happen as quickly as everyone thinks it's going to happen," she said. "This is going to be a gradual change, probably over the next 10 to 20 years."

|

|

|

|

|

|

|