|

Job growth rebounds

|

|

November 5, 1999: 1:58 p.m. ET

October employment rises by 310,000; wages up 0.1%, jobless rate at 4.1%

By Staff Writer M. Corey Goldman

|

NEW YORK (CNNfn) - U.S. employment growth resumed its robust pace in October but wages barely budged, the government reported Friday, a sign that inflation remains tame enough to allow the Federal Reserve to hold the line on interest rates.

The economy generated 310,000 new jobs in October, the Labor Department said, in line with analysts' expectations. September's employment growth was revised upward to 41,000 jobs from an initially reported decline of 8,000 positions.

Average hourly wages, closely watched on Wall Street as a harbinger of inflation pressures, rose 1 cent to $13.37 an hour, a smaller-than-expected increase of 0.1 percent. The jobless rate edged down to 4.1 percent, the lowest since January 1970, from 4.2 percent in September.

For financial markets, the message was unambiguous: Strong job growth isn't spurring higher wages and accelerating inflation, leaving the Fed arguably little reason to raise rates at its policy meeting a week on Nov. 16. Higher rates tend to slow economic growth by making borrowing for consumers and business more expensive.

"Throw away the old economic textbooks that say a falling unemployment rate creates inflation," said Melanie Hardy, an economist with Bear Stearns Inc. "The absence of a smoking gun on wages takes the Fed out of play for the rest of the year."

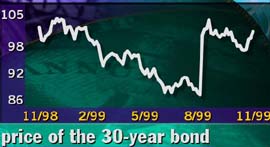

Stocks, bonds rejoice

Both bonds and stocks celebrated the report. The benchmark 30-year Treasury bond jumped almost a full point in price, pushing its yield down to 6.03 percent. The Dow Jones industrial average surged almost 100 points; at the opening bell the benchmark index surged more than 150 points.

The Fed has raised rates twice this year to stave off inflation, lifting its benchmark target interest rate to 5.25 percent from 4.75 percent. At the Nov. 16 meeting, policy makers will discuss the progress of the economy and whether rates need to be nudged up a third time to keep inflation at bay.

Bonds are taking to the idea of the New Economy

The most anticipated and best received piece of news in the report was the smaller-than-expected rise in hourly wages. Of concern to Fed policy makers and financial markets has been the lack of available workers and the pressure on employers to pay more to attract and retain them.

Wage pressures aren't building, though. While wages rose significantly in September -- a 7-cent rise in hourly earnings -- they barely moved in October, suggesting companies are keeping their employment costs low while maintaining profits.

Slowing growth?

"The inflation threat has receded yet again," said Bill Cheney, chief economist with John Hancock Securities in Boston. "I can't see the Fed moving now at least until early next year. They have almost no evidence of inflationary pressures and there are hints that the economy finally is slowing."

Indeed, recent reports have suggested both slowing economic activity and tame inflation.

Last week the government reported that companies' third-quarter costs for wages, salaries and benefits rose a modest 0.8 percent, while the gross domestic product price deflator -- a key measure of inflation -- came in at a low 0.9 percent annual rate.

In addition, separate reports showing declining new home sales, tame income and spending levels and falling factory orders -- among other indicators -- all hit the markets, pointing to slower growth in the final three months of the year. Third-quarter growth rang in at 4.8 percent.

What's more, the Fed's own "Beige Book" report on the performance of the economy, released Wednesday, indicated that, while growth appears to be strong in many regions of the country, it's tapering off. Fed officials will use the report as a guideline for discussions at their policy meeting.

A productive society

The reason, according to a growing number of economists and even Fed Chairman Alan Greenspan, is that computers and the Internet are making people more productive at their jobs, which means companies can boost sales and profits without being forced to raise wages too much.

"The fact of the matter is, the increasing impact of technology is fueling productivity," said Secretary of Labor Alexis Herman.

"Productivity is crucial," said Ben Burdetsky, a labor professor at George Washington University and former deputy commissioner of the Bureau of Labor Statistics. "There are so many new forms of technology now that the labor market can continue expanding without triggering a boost to wages, which is what we're seeing."

That's why the next big number for financial markets -- the last significant piece of data before Fed policy makers meet -- will be the third-quarter productivity report, due out Nov. 12. Analysts polled by Reuters expect productivity rose 2.6 percent in the third quarter after gaining a scant 0.6 percent in the second.

Hurricane Floyd effect

September's upward revision for job growth and October's rebound were partially a result of Hurricane Floyd, which displaced thousands of workers along the East Coast and doused hiring activity for almost two weeks in total. Companies reporting their hiring activity after the hurricane led to the revisions, the Labor Department said.

Even so, the report was enough to convince the market that the Fed probably will hold off raising rates this month. That can be seen in the fed funds futures contract, which indicates where investors think the central bank's benchmark rate will be.

The yield on the November contract is now 5.29 percent, just a smidgen above the current 5.25-percent Fed funds rate, indicating investors are pricing in only a slight chance of a rate hike. That's in stark contrast to early last week, when the futures rate was as high as 5.42 percent.

Service-related employment rose by 293,000 in October, with about one-third of that coming from gains in business services, the Labor Department said. Construction employment rose by 28,000 and manufacturing positions declined by 15,000. Government positions gained by 53,000 last month.

|

|

|

|

|

|

Labor Department

|

Note: Pages will open in a new browser window

External sites are not endorsed by CNNmoney

|

|

|

|

|

|